Home Depot Authorizes Additional $15 Billion in Share Buybacks

- By Sangara Narayanan

Home Depot (HD) announced a massive $15 billion share buyback program last week, which further bolsters an investment case for dividend investors. The world"s largest home improvement retailer has been on a roll this year, consistently beating its own expectations and delivering strong comparable store sales numbers.

Home Depot is no stranger to share buybacks. Since it started repurchasing its shares in 2002, the company has bought back nearly $73 billion worth of its common shares, reducing its number of shares outstanding by 1.3 billion.

Warning! GuruFocus has detected 4 Warning Signs with ORCL. Click here to check it out.

The intrinsic value of HD

The company has picked up its pace of buybacks in the last five years, spending nearly $33.410 billion between 2012 and 2016, giving them an average spending of around $6.6 billion every year for the last five years.

So it"s not really a surprise that the company has now announced a $15 billion share buyback program. The company said that it will be buying back $12.5 billion worth of shares over the next three years, which is proportionately lower than the $8 billion the company is on course to spend in 2017.

The steady rise in Home Depot"s stock price may have lowered the company"s outlay for share buybacks for next year. In addition, with the current authorization not clearly specifying a time limit, Home Depot may increase or decrease its spending on share buybacks depending on market conditions and the price point at which its stock is trading.

But the good news for investors is that the company is clearly taking a buyback-plus-dividends approach for enhancing shareholder returns. The dividend per share has increased by 237% in the last five years, to $2.76 in 2016 from $1.16 in 2012, while the cash paid for dividends also doubled, to $3.4 billion from $1.7 billion during the same period. The massive share buyback program has kept its dividend bill under control, and the sustained buybacks will help Home Depot to keep increasing its dividends over the next five to 10 years.

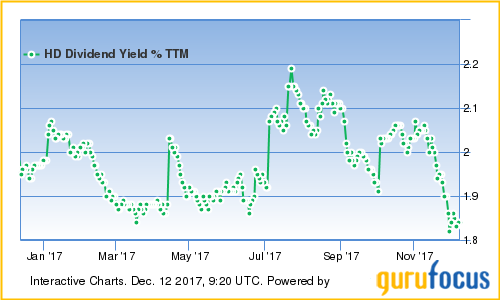

During the recently concluded investor conference, Home Depot revealed that it is targeting a 55% payout ratio, which is a little higher than the current 48% but still not too high to be worried about. Though the nearly 2% yield may not look attractive to some, dividend investors need to consider Home Depot, as the company certainly has a lot of strength to keep increasing its dividends over the next several years.

Disclosure: I have no positions in the stock mentioned above and no intention to initiate a position in the next 72 hours.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 4 Warning Signs with ORCL. Click here to check it out.

The intrinsic value of HD