Railroad Companies Offer High Margin Potential

- By James Li

As of Sept. 21, several companies in the railroad industry have an efficient business operation. Two companies, Canada Pacific Railway Ltd. (CP) and Union Pacific Corp. (UNP), have a selling, general & administrative expense to gross profit ratio of about 30%, which suggests durable competitive advantage. With low SGA expenses, these companies have potential for high profit margins.

The efficiency ratio

Unofficially known as the "efficiency ratio," the SGA expense to gross profit ratio can measure the efficiency of a company's business. Warren Buffett (Trades, Portfolio) prefers companies that have consistent efficiency ratios as these companies likely have durable competitive advantage. As discussed in a research article, durable competitive advantage and earnings predictability form the basis of the Buffett-Munger investment strategy, which looks for undervalued company stocks using a four-criterion approach.

The distribution of efficiency ratios for companies trading on the New York Stock Exchange and Nasdaq is roughly symmetric with a median of 48.6% and a standard deviation of 22.4%. About 32.8% of the industries have an efficiency ratio less than the average ratio for all NYSE and Nasdaq companies.

Average Efficiency Ratios for NYSE and Nasdaq Companies | |

Mean | 46.56% |

Standard Error | 1.87% |

Median | 48.61% |

Standard Deviation | 22.43% |

Sample Variance | 5.03% |

Kurtosis | 300.80% |

Skewness | 51.18% |

Range | 166.02% |

Minimum | -8.95% |

Maximum | 157.07% |

Count | 144 |

Railroad companies have decreasing efficiency ratios, resulting in expanding margins

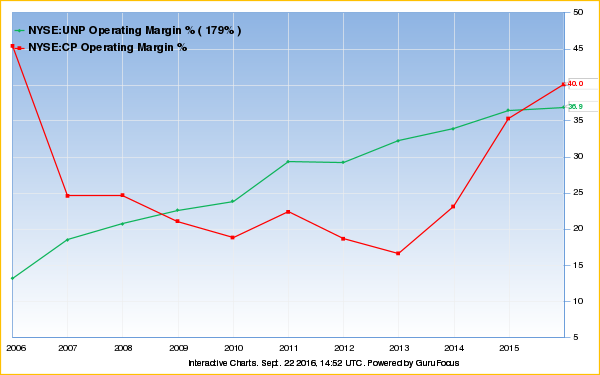

With an average efficiency ratio of 34%, the railroad industry has a lower efficiency ratio than 74% of industries. This suggests that railroad companies generally have efficient business operations, which can lead to high profit margins. Both Canada Pacific and Union Pacific currently have expanding operating margins, which usually imply high growth potential.

Even though Canada Pacific's operating margin sharply decreased in 2006, the Canadian railroad company had increasing operating margins during the past three years. Union Pacific, on the other hand, generally had steady operating margin growth since 2006. The Utah based railroad company's operating margin outperforms 89% of global railroad companies, and its five-year operating margin growth rate is 5.5% per year. With high profitability margins and returns on equity, Union Pacific has a profitability rank of 8.

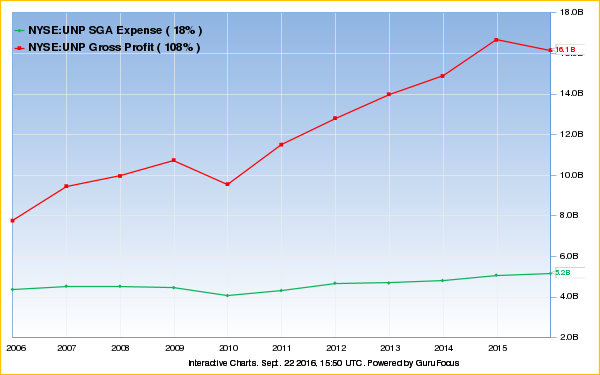

During 2010-2015, Union Pacific increased gross profit by about $6 billion while maintaining a steady SGA expense level. This led to a constant decrease in the company's efficiency ratio, suggesting that Union Pacific established durable competitive advantage.

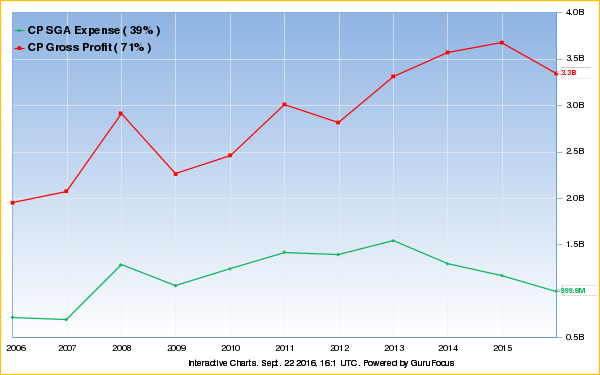

Despite having increasing efficiency ratios from 2007-2010, Canada Pacific currently has a slightly lower efficiency ratio than does Union Pacific. Since 2013, the Canadian railroad company lowered its SGA expenses and increased its gross profits, reducing its efficiency ratio from its 2010 high of about 50% to its current efficiency ratio of 29.9%.

As the Utah based railroad company experiences durable competitive advantage, Dodge & Cox increased its Union Pacific position by 23.96% during the second quarter. The San Francisco based fund management company currently owns 15,188,949 shares, the highest number of shares among all gurus who own UNP. Additionally, Daniel Loeb (Trades, Portfolio) purchased 1.35 billion new shares of Union Pacific at an average price of $84.56 per share.

Conclusions and see also

As mentioned earlier, the co-managers of Berkshire Hathaway Inc. (BRK-A) (BRK-B) invest in companies that have high earnings predictability and durable competitive advantage. You can find these companies in the Buffett-Munger Screener, one of GuruFocus's most popular value screeners. During the backtesting period from 2009-2016, the Buffett-Munger strategy generally outperformed the Standard & Poor's 500 index. As the U.S. stock market is significantly overvalued, the Buffett-Munger strategy allows you to invest defensively.

Premium members have access to all the value screeners, including the All-in-One Guru Screener that allows you to choose from over 150 financial filters. Additionally, the premium membership includes a subscription to our monthly Buffett-Munger Newsletter, which details five undervalued companies that Buffett and Munger prefers. The premium plus membership gives further access: seven additional years of backtesting within the All-in-one Screener (10 years compared to just 3 for premium members) and the Manual of Stocks for all U.S. companies. (Premium membership only includes the S&P 500 companies.) Please sign up for a free seven-day trial.

Disclosure: The author has no position in any stock discussed in this article.

Start a free 7-day trial of Premium Membership to GuruFocus.

This article first appeared on GuruFocus.