High inflation is the bill coming due for Trump and Biden's stimulus that kept us out of a Great Depression

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

Inflation is the highest since 1990, but remember: That's the price of huge stimulus and a booming recovery.

The $5 trillion in stimulus passed by Trump and Biden powered spending so strong that supply hasn't caught up.

The economy is also much stronger than it was one year ago. Prices are higher, but Americans are doing better.

There's one thing being largely left out of the inflation debate.

Yes, Americans are dealing with the worst inflation since 1990. But that's the price to pay for historic stimulus and a thriving recovery, and it's a price well worth paying.

The Consumer Price Index shot 0.9% higher in October, exceeding the 0.6% forecast and fueling the largest year-over-year jump in 31 years. It's bad news for your wallet today, but it's good news if you zoom out and consider what it says about the economy: Americans have more money to spend and want to spend it.

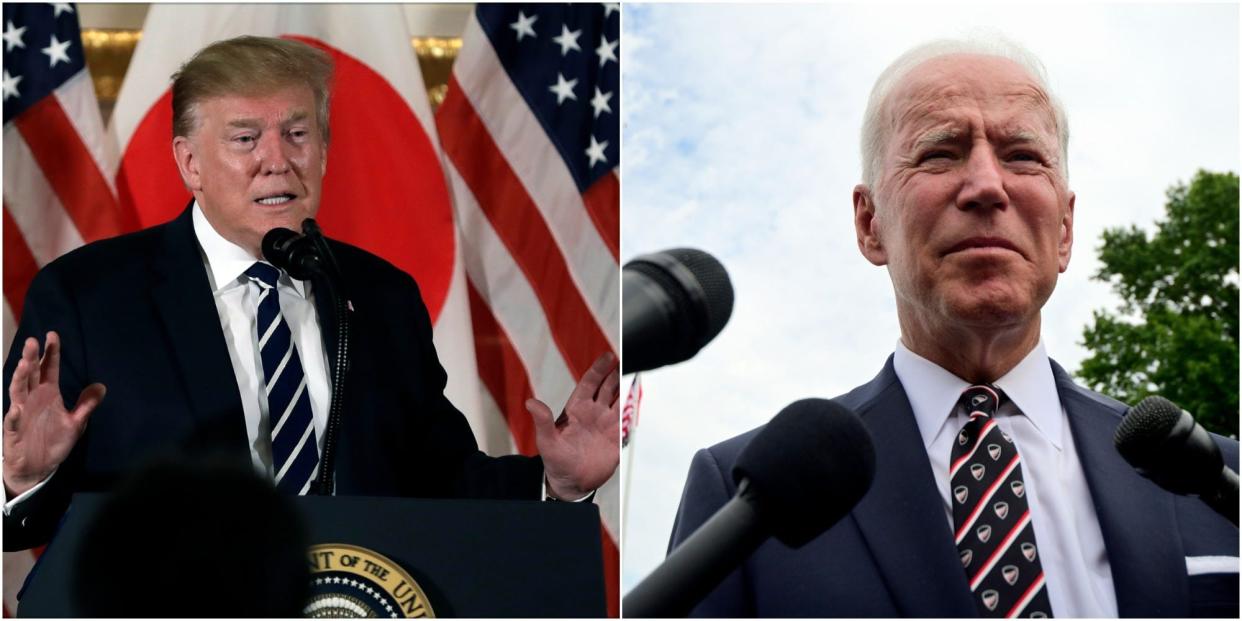

Where the cash came from is obvious, as President Donald Trump and President Joe Biden collectively passed $5 trillion in pandemic stimulus, and much of the aid arrived as direct payments and enhanced unemployment benefits. This stimulus didn't just make Americans whole again; it fueled an unprecedented economic boom.

Consumer spending counts for about 70% of economic activity, and preserving those levels was key to bringing the US back online. Trump and Biden did better than that.

Americans saved a lot during lockdowns and mostly spent on durable goods. When they started leaving the house again in 2021, spending on goods stayed strong while spending on services soared. It means Americans are buying more stuff overall than they have in decades, but the supply chain to provide that stuff is buckling under the pressure. That's a telltale recipe for inflation, but it's a lot better than mediocre spending and a lingering recession.

For the first time since the 1970s, the American shopper wanted to buy stuff and was told "no," or at least "not right now." That pain has manifested as higher inflation, but consider the alternative.

The 2020 and 2021 economies are starkly different

More than half of the government's $5 trillion in stimulus was approved after October 2020. That means the year-over-year inflation reading captures this massive policy support - and its effects on the recovery.

What all that money accomplished: Way more people are working now. Stimulus juiced the labor market recovery, leading firms to quickly rehire, with the economy adding nearly 6 million jobs from October 2020 to October 2021.

Year-over-year inflation continues to outpace average wage growth, but the wage comparison ignores all the jobs added over the last year. Aggregate private payrolls - which count hours worked with average earnings - have handily outpaced inflation, Bloomberg editor Joe Weisenthal highlighted in a Wednesday newsletter.

Put simply, Americans are collectively earning much more than they did one year ago. It only makes sense prices would rise faster than before.

"Inflation is definitely a reflection of our economy's reviving," Labor Secretary Marty Walsh told Insider on Friday. "I wish we could just flip a switch and have that, you know, automatically just level itself off ... We still have work to do there."

The virus situation itself also separates October 2021 from October 2020. Late last year, the US was just entering the worst stage of the pandemic. Case counts ripped higher into the winter, leaving Americans stuck at home and sparking an unexpected plunge in jobs. Compared to the current economy, last year's was a ghost town.

And as for how much inflation has picked up, the economic doctrines of the 20th century state that such a huge increase of the money supply should lead to inflation even worse than Americans have seen this year, but even October's huge jump is trailing behind the amount of cash pumped into the economy. The country's money supply has ballooned by roughly 15% in the past year and has nearly quintupled from pre-pandemic levels.

Now what the economy really needs is for the slow healing of the supply chain to speed up a little bit. This inflationary tab is one worth paying to prevent a catastrophe.

Read the original article on Business Insider