Here's the strategy behind Trump's dangerous trade war with China

If you look at the trade numbers with China, you can discern what President Trump might be thinking as he drags the United States into an escalating trade war.

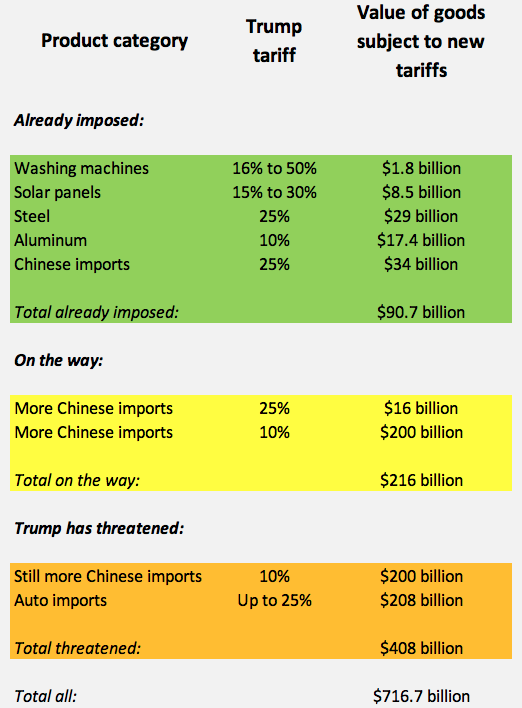

Trump has upped the ante yet again, beginning the process to slap tariffs on $200 billion worth of Chinese imports, in addition to $34 billion already subject to new tariffs and $16 billion that’s about to be. Since there have been many volleys in this competition so far, let’s first review the Trump trade war scorecard. Here are the tariffs Trump has actually imposed (in green), along with those he seems likely to impose (in yellow) and others he has merely suggested (in orange):

The Trump tariffs on solar panels, washing machines, steel and aluminum apply to imports from many countries, including China. But those apply to just $57 billion of goods.

Trump is targeting China in particular much more aggressively. If we add up the tariffs already imposed with those in the process of being imposed, Trump could hit $250 billion worth of Chinese imports with new tariffs by the fall.

That number matters—to Trump, at least. He has long complained about the U.S. trade deficit with China, which was $336 billion in 2017. Let’s look at a breakdown of the 2017 numbers:

U.S. imports of Chinese goods and services: $524 billion

US exports of goods and services to China: $188 billion

Overall trade deficit with China: $336 billion

At the beginning of his trade war, Trump seemed to think China wouldn’t dare impose retaliatory tariffs on U.S. imports if he did the same to Chinese imports, even though most trade experts predicted that would happen. They were right and Trump was wrong. China has imposed its own tariffs on U.S. imports almost dollar-for-dollar, to match those Trump has imposed. There’s every reason it will continue to do so.

But China only imports $188 billion worth of U.S. goods and services per year. Ah ha! Once both countries have imposed tariffs on $188 billion worth of imports from the other, then China starts to run short of ammunition, according to the Trump playbook. At that point, Trump can keep imposing tariffs on Chinese imports, all the way up to $524 billion worth, while China will run out of imports to tax at a paltry $188 billion.

How China can retaliate

Maybe that explains why Trump has mentioned adding yet another $200 billion in Chinese imports to his tariff list, if his new tax on the first $250 billion worth of Chinese imports doesn’t get the job done. That would push the total of newly tariffed Chinese imports to $450 billion, which is getting close to all of them.

The problem with Trump’s logic is his flawed concept of leverage. Trump seems to think that once China hits all $188 billion worth of U.S. imports with new tariffs, it will do nothing as Trump keeps ratcheting up the pain. Then, they’ll buckle. But there’s plenty that China could do if the trade war really gets to this foolish level of mutually assured destruction.

China could raise the tariff on U.S. imports, and it could go as high as it wants. A 20% tariff could go to 40%, 80%, or 400%. So while there might not be additional imports to tax, the tax could go higher and higher on the imports that exist (until they don’t exist anymore).

China could also begin to harass the hundreds of U.S. companies already doing business in China, to the extent they are effectively shut down in the world second-largest economy. China has become a key market for many American businesses, and losing this business would be a big hit to corporate profits.

China could become more aggressive militarily in the South China Sea and other areas that are important to trade. It could torpedo Trump’s effort to negotiate the denuclearization of the Korean peninsula. It could pull out of business deals in the United States, which total $140 billion. It could sell off some of the $1.2 trillion in U.S. government debt it owns, which would probably send the value of the dollar lower and interest rates higher. It could exploit Trump’s alienation of traditional U.S. allies in Europe and elsewhere by offering sweetheart deals not available to U.S. firms.

Sure, this would hurt China in many ways. But Trump’s trade crusade is becoming a war of attrition in which neither side is a winner and the only way to win is to lose less. So both sides are going to get hurt.

If Trump ramps all the way up to a 10% tariff on all Chinese imports, it would modestly raise prices on many products American consumers buy, and probably shift U.S. imports away from China toward other countries that can supply similar stuff. So the U.S. trade deficit with China might improve, as Trump desires, but our trade deficits with other countries would worsen by a like amount, on net.

Here in the U.S., the pain would be concentrated among American farmers and others who export to China, who already face new barriers to selling there. Those barriers would get much higher. The stock market would probably wobble and perhaps decline, especially if the trade war actually begins to impede corporate profits. If Trump taxed all Chinese imports, it would amount to an added tax on American consumers of about $60 billion. That’s not huge in a $20 trillion economy, but plenty of Americans would still feel it.

Few economists think more U.S. production would materialize as Chinese imports got more expensive. In fact, some companies that produce stuff here for export to China and other markets would move that production out of the United States, as BMW recently said it plans to do. It might even compel more companies to set up shop in China, where they’d face no tariffs selling into the Chinese market. That’s obviously the opposite of Trump’s goal, which is why just about nobody who has studied trade agrees with him that they are “easy to win.” They’re easy to lose, though.

Confidential tip line: rickjnewman@yahoo.com. Click here to get Rick’s stories by email.

Read more:

Rick Newman is the author of four books, including “Rebounders: How Winners Pivot from Setback to Success.” Follow him on Twitter: @rickjnewman

Follow Yahoo Finance on Facebook, Twitter, Instagram, and LinkedIn