Here's what economists are saying about Hurricane Harvey's impact

Tropical Storm Harvey, which made landfall in Texas as a Category 4 hurricane, is set to rank as one of the costliest natural disasters on record. But while economists highlight temporary disruptions, there is more of a mixed view about the long-term impact on the broader economy.

Here’s a rundown of what some analysts are saying:

Jan Hatzius, Goldman Sachs: The GDP impact is ambiguous

Hatzius, who noted that preliminary estimates suggest property damages in the $30 billion range, said the effect on GDP long-term is unclear despite a temporary slowdown.

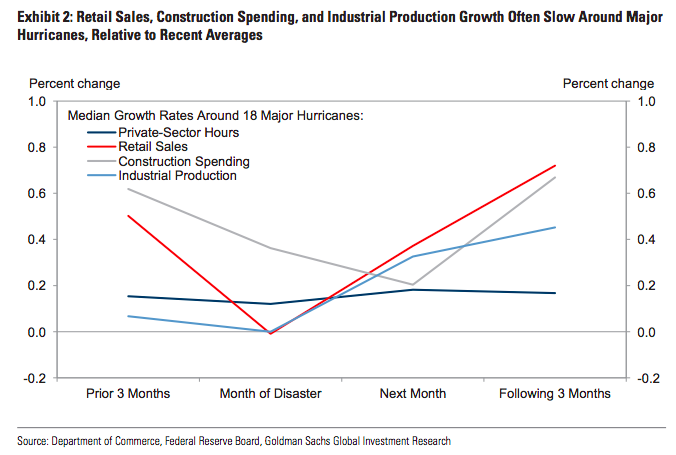

“Property losses will not be directly visible in most economic indicators, but major hurricanes in the past have been associated with a temporary slowdown in retail sales, construction spending, and industrial production, as well as a pickup in jobless claims,” he wrote. “However, GDP effects are ambiguous, as the level of economic activity typically returns to its previous trend—ore even somewhat above—reflecting a boost from rebuilding efforts and a catch-up in economic activity displaced during the hurricane.”

Hatzius did highlight the importance of the energy sector in the regions affected.

“Our commodities team estimates that Harvey has already shut down over 16.5% of US refining capacity, and we estimate that disruptions in the energy sector could directly reduce Q3 GDP growth by as much as 0.2pp. However, we stress that the overall impact of the hurricane on second-half growth is uncertain, as the negative effects are likely to be offset by an increase in business investment and construction activity once the storm has passed.”

Don Rissmiller, Strategas: GDP impact could be positive

Rissmiller noted rebuilding would give the economy a boost, but that the spending could cause strain on individual pocket books:

“Flood insurance is unlikely to provide much of a cushion for individuals. The business situation could be more nuanced—increased spending on essentials is set to crowd out other purchases (eating out, etc). Rebuilding will be a significant story, though monthly data (especially durables) will likely be volatile. Replacement spending will boost economic growth, though it’s not good for wealth.”

Brett Ryan, Deutsche Bank: The GDP impact could be negative

Ryan highlighted estimated the disaster would be a drag on GDP growth, but that it would have little impact on what’s expected to be strong growth.

“Harvey could potentially drag on H2 real GDP growth by as much as -20 basis points (bps)—mainly through disruptions to exports. This is not much in the context of our 2.7% growth forecast—the economy would still be growing noticeably above trend.”

“To be sure some of the negative hit to growth will likely be offset by a boost to construction spending as rebuilding efforts get under way. Hence, this unfortunate event will not likely affect the overall trajectory of the economy or monetary policy.”

Michael Feroli, JPMorgan: Jobless claims should spike

Feroli, who cited a $10 billion to $20 billion estimate for Harvey’s physical damage, also highlighted that the hurricane could strengthen economic activity.

“Any assessment of the economic impact of Hurricane Harvey will be inherently subject to a fair degree of uncertainty, given the recency of the event. As a general rule, hurricanes tend to be a short-run depressant and a medium-run boost to economic activity. (Here we should pause to emphasize the usual disclaimer: economic growth does not always correspond with economic well-being).

Other storms reflected medium-term growth, he noted, as shown below.

Feroli added that, nonetheless, we will see some temporary disruptions in data points and energy prices:

“While Harvey may not be a game-changer for the expansion, it may leave its market on the high-frequency economic data … Jobless claims—which are counted at a weekly frequency—are a prime candidate to show effects of Hurricane Harvey, especially in the state-level data.”

“Gasoline prices, and to a lesser degree, natural gas prices have already moved higher. This could crimp consumer spending power in the near term. However, if the past is any guide the impact on energy prices should be short-lived as refineries come back on line in the coming days and weeks.”

Ellen Zentner, Morgan Stanley: Gas prices will tax households

Zentner highlighted the potential positive impact to 4Q GDP, but was wary of quantifying her expectations.

“Natural disasters are never good for the economy, but they can cause a temporary increase to GDP … We have over a full month left in the third quarter, which means the economic effects of Harvey may be fairly neutral on 3Q as a whole, but the lagged effects of rebuilding homes and replacing motor vehicles can last longer, providing a lift go GDP in 4Q and beyond.”

She did note, though, the offsetting negative impact on gasoline prices.

“We would be remiss if we did not acknowledge the effect of rising gasoline prices on the pocketbooks of all Americans … We estimate that every sustained 10-cent rise in the price per gallon of gasoline acts as a $10bn tax on US households.”

And Zentner did add the looming debt ceiling deadline as something to watch.

“Our current estimate of the debt ceiling deadline is mid-October. This estimate could be affected by cash transfers from the Treasury in response to Hurricane Harvey,” she wrote. But she added that this will likely be handled: “Ultimately we expect funds from the FEMA Disaster Relief Fund will be enough to cover near-term disaster response needs, and additional appropriations can be made in the 2018 budget and/or after the debt ceiling is resolved.”

Michael Cohen, Barclays: The last major hurricane to hit Texas was pre-shale boom

Cohen, who pointed out that Harvey is the first major Hurricane to hit the US Gulf Coast since the shale booms started, emphasized the threat to infrastructure and production.

“Its market impact from a trade, refining and petroleum perspective should not be underestimated,” Cohen wrote. “The US Gulf Coast is now exporting twice as much petroleum from the area as it did in 2012 … We think the flooding impact of Hurricane Harvey could make it more destructive to US crude and product supplies as well as port facilities than the market is currently assuming.”

Nicole Sinclair is markets correspondent at Yahoo Finance

Please also see:

The shift from brick-and-mortar to online may be a hopeless strategy

Digital ads aren’t working for big consumer brands

Why Home Depot is leaving Lowe’s in the dust quarter after quarter

Walmart’s sales numbers make Amazon look small