Hedge Your Bet With These Real Estate Dividend Payers

The real estate sector performs relatively in-line with the wider economy. Prosperous periods bring about high growth and inflation, leading to strong returns in real estate investments. These factors drive the profitability and cash flows of real estate companies, which in turn steer the dividend payout and yield for investors. During economic growth, these companies provide an opportune time to increase your portfolio income through dividends. Today I will share with you my list of high-dividend real estate stocks you should consider for your portfolio.

The Becker Milk Company Limited (TSX:BEK.B)

BEK.B has a substantial dividend yield of 4.97% and the company currently pays out 82.53% of its profits as dividends . BEK.B’s DPS have risen to $0.8 from $0.6 over a 10 year period. They have been consistent too, not missing a payment during this 10 year period. With a debt to equity ratio of zero, I’m optimistic on the company’s health if a downturn is to occur in the future. More on Becker Milk here.

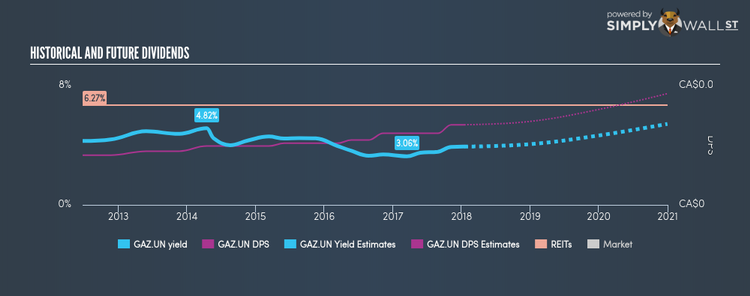

Fronsac Real Estate Investment Trust (TSXV:GAZ.UN)

GAZ.UN has a wholesome dividend yield of 3.67% and pays 32.85% of it’s earnings as dividends , with the expected payout in three years hitting 56.85%. The company’s yield puts it among good company – the top 25% of the market. Fronsac Real Estate Investment Trust’s earnings per share growth of 31.91% outpaced the ca equity real estate investment trusts (reits) industry’s 24.63% average growth rate over the last year. More detail on Fronsac Real Estate Investment Trust here.

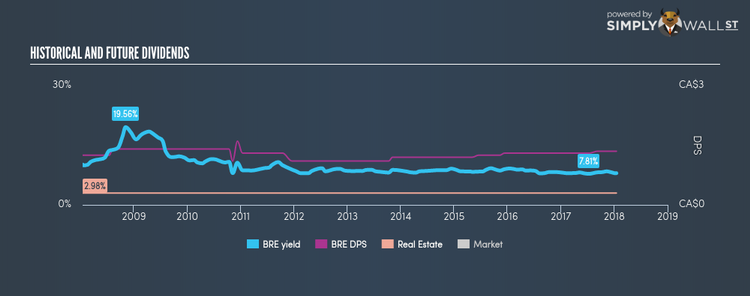

Brookfield Real Estate Services Inc. (TSX:BRE)

BRE has a great dividend yield of 7.98% and is paying out 83.27% of profits as dividends . While there’s been some fluctuation in the yield over the last 10 years, the dividends per share have increased in this time. Brookfield Real Estate Services has been a strong performer over the last five years, with the company averaging double digit earnings growth of 45.87% during this time. More detail on Brookfield Real Estate Services here.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.