Healey bill would allow municipalities to hike taxes on eating, sleeping out

- Oops!Something went wrong.Please try again later.

BOSTON – It is arguably the "most hated tax in Massachusetts," the excise tax on passenger vehicles, and it could be going up in the near future.

The tax increase is part of the Municipal Empowerment Act, a package of bills filed by Gov. Maura Healey in January that would allow municipalities to crank up taxes on prepared meals, lodging and on car ownership as a way to add cash to increasingly skinny budgets.

While the tax increases were touted as “modest” by municipal officials who spoke in favor of the measure at two joint committee hearings held during the past week, they would still pump up the cost of that getaway weekend at a boutique hotel or that weeklong stay at an in-state seaside or ski resort.

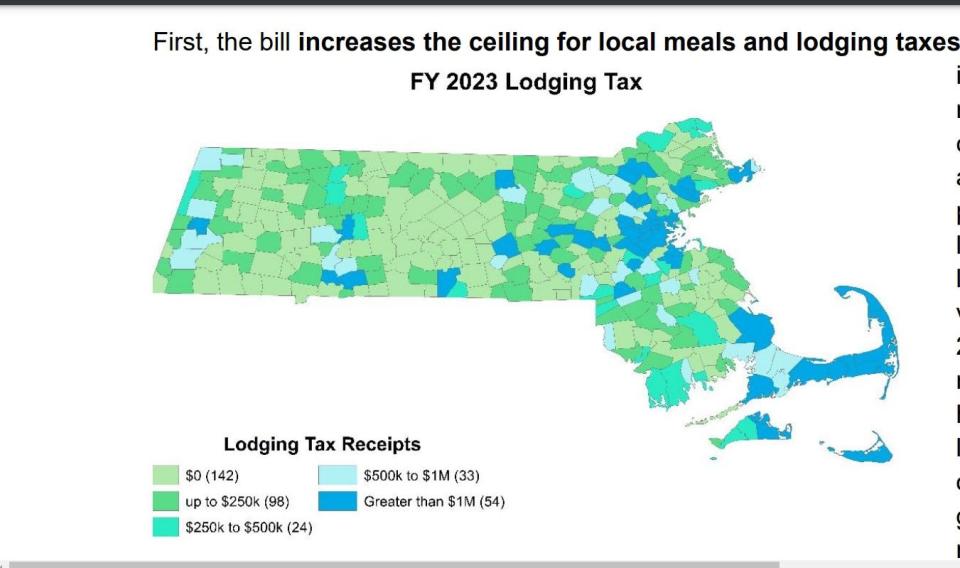

Of Massachusetts’ 351 municipalities, 216 charge a 6% lodging tax. If enacted, the bill would allow communities to increase the tax to 7% throughout the state, except in Boston. The capital city charges 6.5% and the new bite would increase to 7.5% under the proposal.

Added expected revenue would be $49 million across the state. Local communities now rake in $317 million a year in lodging taxes.

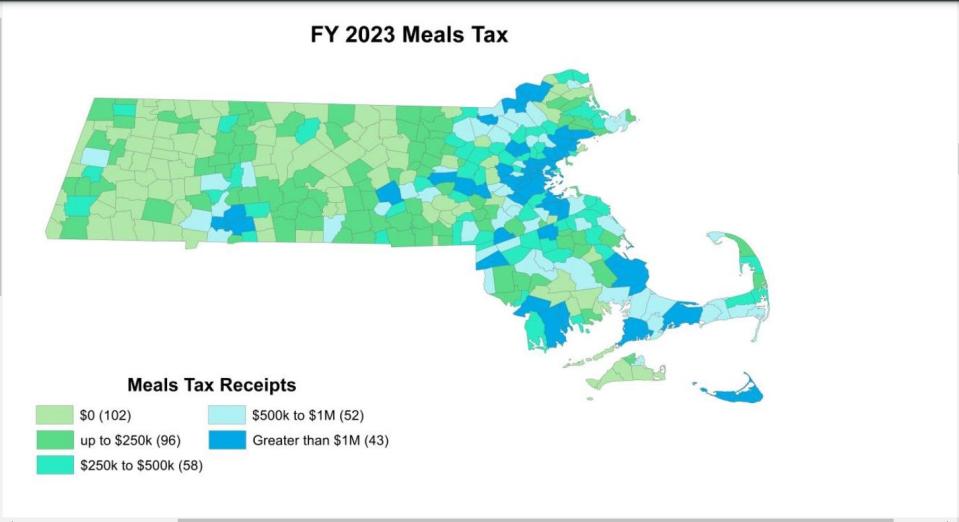

The 251 Bay State communities that add a surcharge to prepared meals would be allowed to up that tax by .25%, from .75% of the total cost to 1%. Added expected revenue: $58 million. They now collect $175 million in taxes on meals.

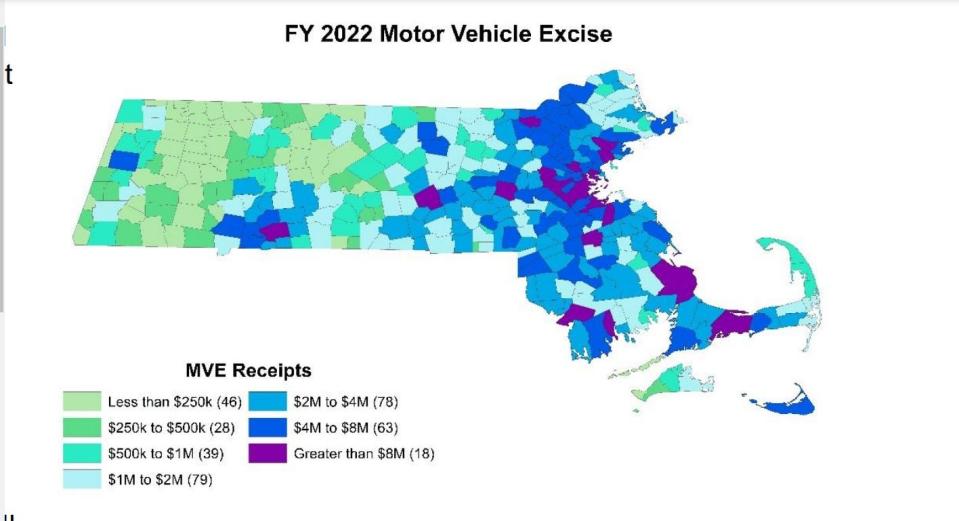

And what Rep. David Linsky, D-Natick, called the “most hated tax in Massachusetts,” now at $25 per $1,000 of declining valuation, would be allowed to increase by 5%. The valuation is based on the MSRP in the year it was produced. According to the calculations in the proposal, the increase would add about $7.70 to an average bill of $154. Expected increased revenue: $48 million. The tax now generates $950 million for municipalities that charge an excise tax.

Somerville Mayor Katjana Ballantyne, one of several who spoke in favor of the measure, said the greater good accomplished by the measure outweighs the cost to local residents.

“This is a tool,” Ballantyne said, adding the measure would be welcomed by every municipality in the commonwealth, especially in light of the Healey/Driscoll administration’s quest to make Massachusetts more affordable, competitive and equitable.

“Municipalities are not exempt from the same challenges faced by working families,” said Lt. Gov. Kimberly Driscoll as she presented the financial aspects of the bill to the Joint Committee on Finance. She presented other aspects of the bill to the Joint Committee on Municipalities and Regional Government.

Local governments have to educate children, fix the roads and sidewalks, buy school buses, and fund police and fire departments. The bill, Driscoll said, empowers local governments to maintain their communities and invest in the resources that communities rely on on a daily basis.

Luxury tax shifts part of burden to diners, lodgers and car owners

The luxury taxes levied on prepared food and lodging options ease the local burden on property taxes to level out municipal budgets, allowing municipal cost sharing and regionalization of services that go beyond dispatching first responders.

Easthampton Mayor Nicole LaChapelle said her municipality collected $311,000 from the local meal tax in 2022, enough to pay her assessors and tax collector. That tax funded two necessary departments, freeing up funds for other measures and services.

“It’s a modest proposal, but it can make a sizable difference for municipalities,” LaChapelle said.

Senior citizens, however, would get a break on their property taxes. The measure allows for a means-tested reapportioning of a tax bill for older residents who meet income restrictions.

In the give-and-take between committee members and Driscoll’s team, Rep. Erika Uyterhoeven, D-Somerville, asked whether the writers of the bill had looked at the possibility of taxing the state’s nonprofit organizations, commenting that many had “deep pockets” as well as extensive real estate holdings. Somerville is the partial home to Tufts University, which also owns land in Medford. Cambridge and Boston. Other Greater Boston communities are home to wealthy private secondary schools such as Harvard, Radcliffe, Boston University and Boston College.

The legislator has filed a bill that would allow municipalities to tax institutions.

“We focused on what was in the Legislature's ability,” Driscoll said, adding the team was reluctant to damage locally important institutions, naming the Peabody-Salem Museum and Salem State University, that were in her district, by imposing a tax.

The Somerville legislator suggested the state tackle school-related measures next as pressures mount, as evidenced by strikes across Massachusetts, to set a base wage for educators and in some districts to pay support staff a living wage.

This article originally appeared on Telegram & Gazette: Increasing local taxes to free up budget for other needs: road repairs