Headline CPI Surges On Rising Energy Prices, Fueling Fed Debate

DailyFX.com -

Talking Points:

- September US Headline Consumer Price Index matched high expectations.

- Federal Reserve officials have debated openly pros and cons of tolerating higher inflation.

- US Dollar falls slightly in limited market reaction.

US inflation rose more than expected in September, with the headline reading of the Consumper Price Index rising to an annualized 1.5% from 1.1% the month prior, and matching expectations of 1.5%. The core reading, which excludes food and energy prices, grew an annualized 2.2%, compared to expectations of 2.3% and a previous reading of 2.3%. The surge in headline prices was driven primarily by oil prices, which rose 2.9% in the month. Apparel prices were the largest drag as seasonal sales and discounting begins to occur, as apparel prices fell by -0.7%.

This CPI report comes during a divisive time for the Federal Reserve. Several Bank Presidents have openly called for rate hikes in recent days, citing a tightening in labor markets and impending breakout in inflation. On the other hand, last Friday, Chair Yellen spoke at the Boston Fed conference and struck a dovish tone. Chair Yellen mentioned a weakening belief in the Phillips Curve, the idea that a tightening labor market would drive up inflation, and mentioned that the best way to recover from the Great Recession was to allow the economy and inflation to overheat.

The Fed meets next in November but are highly unlikely to raise rates. Fed Funds markets are pricing in only a 7% chance for a rate hike in November as of this morning. December, however, is showing 70% chances for at least one rate hike, well above the historical 60% threshold.

Here are the data lifting theUS Dollar this morning:

- USD Consumer Price Index (AUG): +1.5% versus +1.5% expected, from +1.1% (y/y).

- USD Core Consumer Price Index (AUG): +2.2% versus +2.3% expected, from +2.3% (y/y).

- USD Real Average Weekly Earnings (AUG): +0.8%, from +0.4% (y/y).

See the DailyFX economic calendar for Tuesday, October 18, 2016

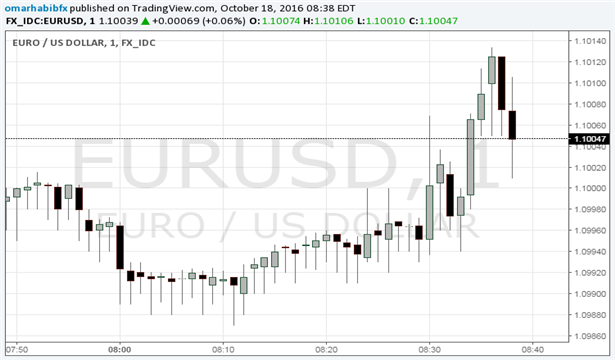

Chart 1: EUR/USD 1-minute Chart (October 18, 2016 Intraday)

In the immediate wake of the data, the US Dollar fell slightly against the Euro. The pair rose from $1.09948 to $1.10134 immediately and then continued to fall. By the time this report was written, the pair had settled near 1.10050. With FX volatility edging higher again, it’s the right time to review risk management principles to protect your capital.

--- Written by Omar Habib, DailyFX Research

For comments or feedback, e-mail feedback@dailyfx.com

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.