'Haves and the have nots': Williamson gets more growth taxes than Maury, Rutherford

New state legislation may help Maury, Rutherford and other fast-growing counties pay for needed schools.

The Tennessee General Assembly bill that amended the County Powers Relief Act would allow qualifying counties with 20% growth based on U.S. Census 10-year counts to charge a $1.50 per square foot school facilities tax for all new housing and commercial projects up to 150,000 square feet.

State officials estimate that annual revenues from development could increase by $4 million for Maury and $7 million for Rutherford if both counties adopt the proposed school facilities tax rates on development. To accept these added revenues, the Maury and Rutherford county commissions each must agree by a two-thirds vote at two meetings to adopt the revised County Powers Relief Act.

The added revenues, for example, will help Maury pay the 20 years of debt service payments Battle Creek High School project initially estimated to cost in the $90 million range, Mayor Shelia Butt said.

"There's no other way to fund that now except property taxes," said Butt, adding that 80% to 85% of Maury County's budget goes to schools.

Battle Creek High that's scheduled to open next school year with room for 2,000 students is now expected to cost at least $112 million but could grow to $124 million when final project amendments are made, Maury County Commission Chairman Eric Previti said. The county also faces paying for an estimated $63 million elementary school on the northern side of Columbia, he said.

Previti, Butt and other Maury and Rutherford leaders have been seeking more revenues from development for a few years to pay for needed schools for two of the fastest growing counties in the state.

Proposed taxes on development: Rutherford County mayor launches online petition supporting impact fees to fund growth

Many leaders of the fast-growing counties envy the way Williamson County has been able to collect in annual taxes on development, such as nearly $30.9 million in fiscal year 2021-22 compared to Rutherford's $5.5 million and Maury's $3.7 million, according to a November 2023 study from the Tennessee Advisory Commission on Intergovernmental Relations.

"It’s almost like the haves and the have nots," Previti said. "Williamson County is part of the haves, and Maury County is part of the have nots. It's not fair."

Williamson is also known for being an affluent county that had an estimated median owner occupied home value measured from 2018 to 2022 of $611,100 to top Rutherford's $305,100 and Maury's $273,400, according to the U.S. Census Bureau.

'It's the opportunities': Rutherford, Maury counties rank in Top 10 in Tennessee for prosperous counties

How does Williamson County collect more from development taxes

Williamson County collects more because of a grandfathered adequate facilities tax and impact fee on development on a per square foot basis first adopted in 1988, which predate the Tennessee General Assembly approving the County Powers Relief Act in 2006.

Rutherford and Maury are limited to using the amended legislation to seek more revenues from development to help pay for school projects.

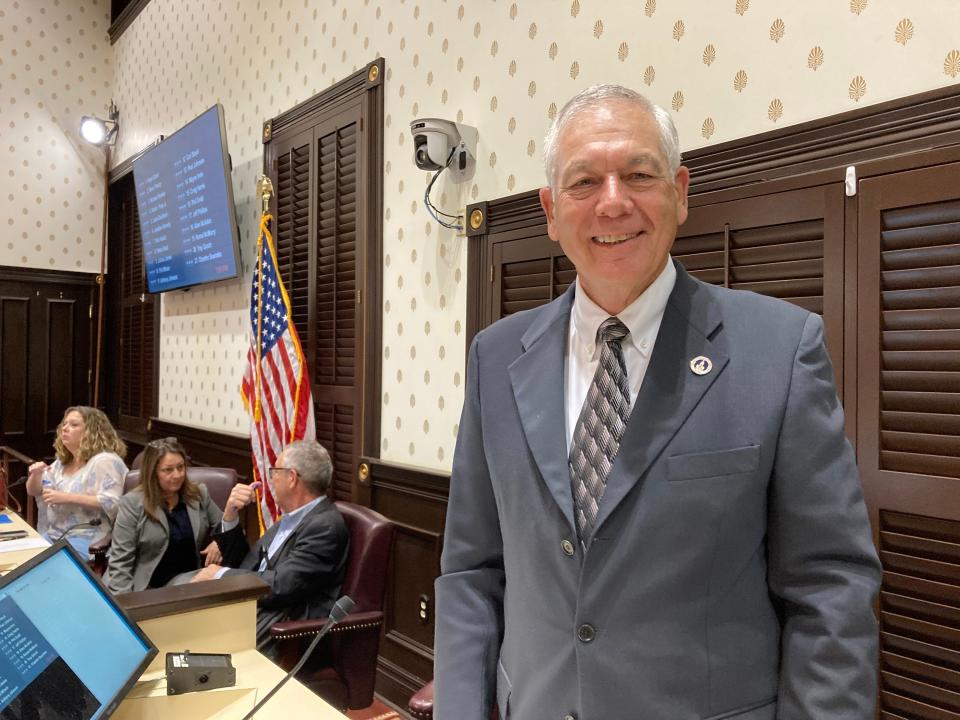

Williamson County 22-year Mayor Rogers Anderson said the impact fee and adequate facilities tax have helped pay for schools and other needs and "offset having to raise property taxes as people move in."

"It’s not slowing down growth," Anderson said.

Anderson has witnessed the growth since moving to Williamson in 1980. He served first as a 16-year Williamson County Commission member prior to becoming mayor.

Williamson County Schools, for example, saw past increases of over 1,000 students each year for about 20 years, including one year with a gain of about 1,700. So the county responded about six years ago by adding more revenues from an education impact fee on new homes. Williamson faced a lawsuit from home builders but won the litigation by 2020, said the mayor, whose county has 52 schools.

Williamson County Schools in more recent years have added about 600 to 650 students annually. Williamson has also responded to growth through zoning in the unincorporated areas by requiring new homes be on 5 acres.

"It gives you some breathing room and drives your growth into your cities," Mayor Anderson said.

Paying for schools: Williamson County prevails in lawsuit with homebuilders over educational impact fee

Rutherford County officials wanted more growth taxes

About 75% of Rutherford County's budget is for schools, including operations, new projects and renovations.

Rutherford charges a school facilities tax of $1 per square foot on new housing to generate nearly $6 million at this time, County Mayor Joe Carr said.

Carr expects the revised County Powers Relief Act that would allow the county to increase the school facilities tax to $1.50 per square foot on residential and commercial to generate about $5 million to $6 million more based on data from the Rutherford County Building Codes Department.

Carr had wanted state lawmakers to allow Rutherford to have the same authority as Williamson County and other city and county governments have through development taxes and impact fees to help pay for growth needs for schools, fire and ambulance stations, other public buildings and roads.

The legislation, however, would allow Rutherford to collect only the school facilities tax that Carr estimates will generate a new total in the $11 million to $12 million range.

"It's not what the county needs," Carr said. "It's not what the county wants. It's not what the county asked for, but it's a small step in the right direction."

Rutherford County Commission Chairman Jeff Phillips said also suggested during a recent meeting that he was disappointed that state lawmakers would not allow his government to have greater authority to collect alternative revenues to help pay for growth. Phillips, however, said he accepts the county being able to collect more revenues from the revised County Powers Relief Act.

"The end result is financially beneficial to us," Phillips said.

The Rutherford County Commission accepted Carr's recommendation in 2023 to raise property taxes by about 16.1% to eliminate a $64 million budget deficit.

The mayor contends the deficit was caused by Rutherford funding for the needs of growth, such as paying $156.3 million to expand Riverdale, Smyrna and Oakland high schools.

Future tax hikes? 'If we don't fix growth paying for itself, we will be in same situation'

That added revenue can help pay for the annual debt service on the school expansion projects as well as for payments to help fund $280 million in plans for Rutherford County to build an elementary school, middle school and high school over the next three years.

'You got to pay the bills': Rutherford County commission adopts 16.1% property tax hike

The fast-growing Rutherford County Schools typically adds over 1,000 students annually and depends on 179 portable classrooms spread among the overcrowded campuses. The district this year has served about 52,000 students at 50 schools.

The plans for the three schools include the $59.9 million Poplar Hill Elementary School expected to open on the westside by August 2025. The yet-funded middle school will open by August 2026 on adjacent property and is estimated to cost $71 million. Both westside schools are expected to relieve overcrowding at Blackman Elementary, Blackman Middle, Stewarts Creek Elementary and Stewarts Creek Middle.

The Rutherford County Board of Education is searching for land to build a high school by August 2027 that's estimated to cost $137 million on the northwest side to relieve overcrowding at La Vergne High and Stewarts Creek High.

Costs of growth: Rutherford County wants state law to stop 'burden of paying for new development'

Maury County can add revenue for schools but not other projects

Maury at this time collects 50 cents per square foot on residential development and 30 cents per square foot on commercial. These revenues can be spent on various public needs, including roads, fire stations, courthouse and schools. The amended County Powers Relief Act, however, only allows the revenues to be spent on school projects, said Previti, chairman of the Maury County Commission.

"Money that has been going to roads and other buildings projects will cease, and we’ll have to find other ways to fund those projects," said Previti, who's served on the Maury County Commission since 2014. "So I’m not 100% sure that what we’re going to get is going to be the cat’s meow."

Maury County officials have been struggling with how to fund projects needed for growth and get relief from the state, Previti said.

"The state tied our hands with the County Powers Relief Act in 2006," Previti said.

Although Maury has wanted more authority on raising revenues to help pay for growth, Mayor Butt said she accepts the amended County Powers Relief Act to increase revenues through the proposed school facilities tax.

Butt praised the efforts of lawmakers such as state Rep. Scott Cepicky, a Republican from Maury's Culleoka community, in crafting a bill with input from home builders and realtors to help pay for schools.

"We have spent hours at the table together working this through because they understand that we don't want the quality of life and our schools to suffer in Maury County because of all the development," said Butt, a former Republican state representative. "They get that."

Change in government leadership: Sheila Butt sworn in as Maury County's new county mayor

Cepicky said he's worked on legislation for three years so Maury can generate more revenues from growth to help pay for schools.

"We’re getting inundated with this growth," Cepicky said.

The revised County Powers Relief Act will increase the Maury County Commission's revenues from development by $4 million "to prevent from raising property taxes."

"The people of Maury County have made it perfectly clear that they want this help," Cepicky said. "My job is to put the people of Maury County first."

Lawmakers negotiate compromise on bill

The revised County Powers Relief Act primary sponsors are state Rep. Tim Hicks, a Republican from the Gray community in East Tennessee's Washington County on the northeast side of the state; and state Sen. Shane Reeves, a Republican from Murfreesboro, the county seat of Rutherford.

Hicks also is a home builder who worked with professional peers on crafting a tax on their own industry, Cepicky said.

Hicks had strong support from state Reps. Tim Rudd, R-Murfreesboro, and Robert Stevens, R-Smyrna, and others to move forward with the legislation.

"We brought everybody together at the state and local level, and negotiated a compromise," said Rudd, who's also a real estate agent.

Sen. Reeves also sought to bring local and state government officials, home builders, realtors and Rutherford County Chamber of Commerce leaders together to discuss the growth funding issue prior to the legislation to amend the County Powers Relief Act.

"Hopefully, this gives Rutherford County a little bit of relief," said Reeves, who praised home builders for coming up with the idea for the legislation. "I’m not sure it solves all the county's problem. It’s certainly a step in the right direction."

How much does school growth cost? Rutherford County Board of Education pursues a $744.7 million five-year building plan

Builders, realtors tout efforts crafting bill

Among those who worked on the legislation is Chris Jensen, who lives in Coffee County and operates a Jensen Quality Homes business with an office in downtown Murfreesboro. Jensen is also the past president of the Home Builders Association of Central Tennessee.

"The home builders association authored the bill and have been lobbying for it," Jensen said. "We are part of our community. And we understand that the county is struggling, and we're willing to do our part and try to help."

The home builders association backed the $1.50 school facilities tax but opposed excessive impact fees adding cost concerns to "housing affordability" on new homes "that we think would be detrimental to growth," Jensen said.

The Middle Tennessee Association of Realtors, including past president Christopher Wilson, also backed the revised County Powers Relief Act to generate more revenues for school projects.

"If there’s a need, we’re trying to help," said Wilson, who's both a realtor and a builder.

Wilson also opposes excessive impact fees on housing.

"You can only take so much from one industry before you break that industry's back," said Wilson, who's one of the partners of Exit Realty, Bob Lamb & Associates in Murfreesboro.

Middle Tennessee Association of Realtors Vice President Hunter McDonald agreed. He contends elected officials seeking excessive impact fees on homes are pushing a "false narrative" by saying growth is causing property tax increases.

"We feel strongly there’s a spending issue," said McDonald, who's also president-elect of the regional real estate association.

The realtors want all the added revenues to go toward school projects, McDonald suggested.

"For each $1,000 you add to the price, you are pricing out more and more people," said McDonald, who's also a vice president with Red Realty, a Middle Tennessee agency that's based in Murfreesboro.

More home buyers are having to move farther from Nashville to cities such as Shelbyville in Bedford County to find affordable housing, said McDonald, who's seeing his blue collar Murfreesboro community where he grew up attract families wanting expensive homes.

"We are becoming a more affluent town, and I’m happy to see that," McDonald said.

'Our values are still going up': Affordable homes drive buyers outside Rutherford County

Reach reporter Scott Broden with news tips or questions by emailing him at sbroden@dnj.com. To support his work with The Daily News Journal, sign up for a digital subscription.

This article originally appeared on Murfreesboro Daily News Journal: 'The haves and the have nots': Maury, Rutherford envy Williamson taxes