Gun company investors push for change after Florida school shooting

Socially responsible investors and asset management giant BlackRock plan to use their stakes to ask weapons manufacturers some hard questions

What if the answer to America’s guns crisis lies not with its government but with its gun companies? It’s a question that some investors are now asking and after the recent mass shooting in Florida, some see a path to change.

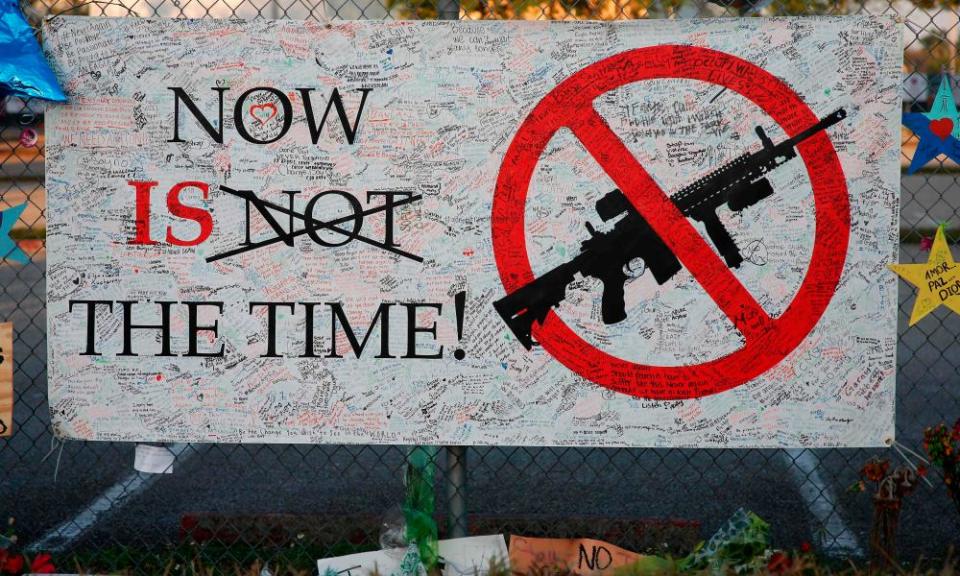

While the deadly massacre at Marjory Stoneman Douglas high school in Parkland, Florida, this month sparked a national debate and made its survivors a powerful voice for a new generation of gun-control activists, there are no guarantees of meaningful change. America’s mass shootings can seem like a grim repetitive cycle of “thoughts and prayers” followed by political inaction, a brief pause, and then another mass shooting.

But this time, Judy Byron, coordinator of the Northwest Coalition for Responsible Investment at the Interfaith Center on Corporate Responsibility (ICCR) is hopeful something has changed.

“These high school kids are really changing the debate. I really see some hope this time,” she said. She aims to back their powerful rhetoric with money.

The ICCR is a coalition of 300 global institutional investors which control $400bn in managed assets for faith-based groups, academics, unions and others interested in socially responsible investment.

Normally, guns would not be on their list of good investments, but two years ago, outraged by the seemingly unending gun death toll in the US, the ICCR started encouraging its members to buy gun shares so that they would have a voice as shareholders. The campaign appears to be taking off.

ICCR members have filed motions with the two largest listed US gun companies, Sturm Ruger and American Outdoor Brands (formerly Smith & Wesson) requesting reports detailing the companies’ efforts to make their products safer. It’s a move that could bring pressure to bear on gun companies to do more to make their products safer and harder to buy, even if Florida’s tragedy fails to move Washington to action.

“We are not going to do away with guns but what are they [the gun companies] going to do to make them safer?” asked Byron. Technology allows us to lock up our phones when they are not in our possession, she said. “But if I left my gun out on the desk, you could use it. Why is that?” she said.

Until recently shareholder activists have tended to focus on “divestment” as their tactic to put pressure on gun companies. Many ethical funds refuse to hold shares in gun companies at all and following Florida’s shooting there have again been campaigns to press pension funds to drop their holdings.

But those campaigns have been complicated in recent years by the rise of index funds – lower-cost funds that track the performance of various stock market indexes and hold shares in all their components.

BlackRock, the world’s largest asset manager with assets of $6tn, is a major player in index funds. As a result it owns significant chunks of gun companies Smith & Wesson and Sturm Ruger – not because it sees guns as a great investment but because they are constituents of major indexes like the Russell 2000 index for smaller companies.

Last week, BlackRock said it too intends to speak to weapons manufacturers and distributors “to understand their response” to the Florida high school shooting. It hasn’t yet said what it will do if it doesn’t like their replies but the company has form for effecting real change.

BlackRock’s founder, Larry Fink, warned company executives in January he expected them to behave as good citizens. “Society is demanding that companies, both public and private, serve a social purpose,” Fink wrote to CEOs. “To prosper over time, every company must not only deliver financial performance, but also show how it makes a positive contribution to society.”

The letter followed BlackRock’s decision last May to back a shareholder resolution to force energy giant Exxon to be more open about the impact of climate change on its business.

That resolution had long been championed by ICCR members including the pension funds of the Church of England but with BlackRock’s support it was passed by 62% of shareholders. “When we do not see progress despite ongoing engagement, or companies are insufficiently responsive to our efforts to protect the long-term economic interests of our clients, we will not hesitate to exercise our right to vote,” BlackRock said a statement.

The Exxon victory could provide a model for change, said Byron. With BlackRock’s support, change is also possible at the gun companies, she said.

She also pointed to the success of campaigners against apartheid in South Africa who targeted companies investing in the country until it scrapped racial segregation.

“It took 20 years but it happened,” she said. “But this time we cannot take 20 years. I was a teacher and I just cannot imagine teaching in this environment.”

Adam Kanzer, managing director of corporate engagement at Domini Impact Investments, which manages socially responsible mutual funds, said BlackRock’s involvement was a significant early victory for the campaign,

“They are going to take that meeting,” said Kanzer. “I am very, very pleased to see that big investors are starting to wake up.”

He also said that pressure for change was likely to come from below. “If you manage a teachers’ pension fund, you have got to be hearing from your investors about this,” he said. “That feels like a real problem to me.”

But he worries that, as has so often been the case, attention spans are short and pressure for change could fizzle out. And that, in the end, America’s gun problem is an issue that needs “a public sector response. It is not going to be solved by the private sector alone.”

The first test will come in May when Sturm Ruger holds its annual shareholder meeting and shareholders will be asked to force the company to account for its “activities related to gun safety measures and the mitigation of harm associated with gun products”.

Even if they are not successful this time, the campaign will continue. “Something has to change,” said Byron.