GrubMarket buys Butter to give its food distribution tech an AI boost

Much of how people buy food has moved online — restaurants often replace menus with QR codes that let you order with your smartphones, and grocery shopping has been revolutionized with delivery services like Instacart. But until recently, the other side of the food supply chain — how small restaurants and neighborhood groceries procured food — depended largely on physical media, pen and paper.

Now, GrubMarket, which provides software and services that help link up and manage relationships between food suppliers and their customers, is hoping to make the distribution process more digital and efficient via a new acquisition.

California-based GrubMarket recently acquired Butter, a SaaS platform that aims to digitize the traditionally manual food distribution process with AI, the companies exclusively told TechCrunch. Founded in 2020, Butter's eight-person team will join GrubMarket, and its software suite will be integrated with GrubMarket's own slate of offerings.

Mike Xu, founder and CEO of GrubMarket, declined to disclose the price of the deal, but Winston Chi, Butter's co-founder, told TechCrunch that "most parties, including our investors and us, are making money" from the exit.

Butter's post-money valuation was $39 million when it raised a $9 million Series A in November 2022, per PitchBook (the company confirmed with TechCrunch the reported valuation is roughly correct). Backed by investors, including Google’s AI-focused Gradient Ventures, Uncommon Capital, Notation Capital, Collide Capital, and angel investor Jack Altman, the startup has raised $12.3 million in total.

GrubMarket has been on a buying spree over the past few years and has acquired over 100 companies to date. Most of these deals focus on supply chain consolidation, as the company operates a B2B e-commerce business. On one hand, GrubMarket directly sources produce and ingredients from growers and supplies to buyers like supermarkets. On the other, it sells distributors the software needed to run their businesses. It's not unlike Amazon's positioning as both a marketplace and SaaS provider.

Butter, alongside Farmigo and IOT Pay, remains one of the few venture-backed startups in GrubMarket's portfolio that are aimed at bolstering its tech stack.

It's unclear whether GrubMarket used capital from its balance sheet for the acquisition. Given its profitability and funding history, it wouldn't be surprising if the money came out of its pocket — Xu told TechCrunch the company has been profitable on an EBITDA-basis for three consecutive years, and its annual revenue run rate is on track to surpass $2 billion in 2024.

Xu declined to comment on GrubMarket's fundraising plans, only saying that it has raised "hundreds of millions of dollars" to date. GrubMarket's last publicly announced investment happened in 2022, a $120 million round that valued it at more than $2 billion. In late 2021, Bloomberg reported that the company was "interviewing banks" for a potential IPO in 2022.

Scooping up Butter

GrubMarket is effectively buying out a smaller competitor. At the height of the coronavirus pandemic in 2020, Chi and his co-founder, Shangyan Li, launched Butter as an end-to-end vertical SaaS solution to help small and medium-sized food wholesalers manage everything from inventory and customer relationships to ordering.

These aren't necessarily unique features — GrubMarket itself provides many of them — but like many SaaS startups, Butter quickly jumped on the generative AI bandwagon, developing tools to improve its users' workflow.

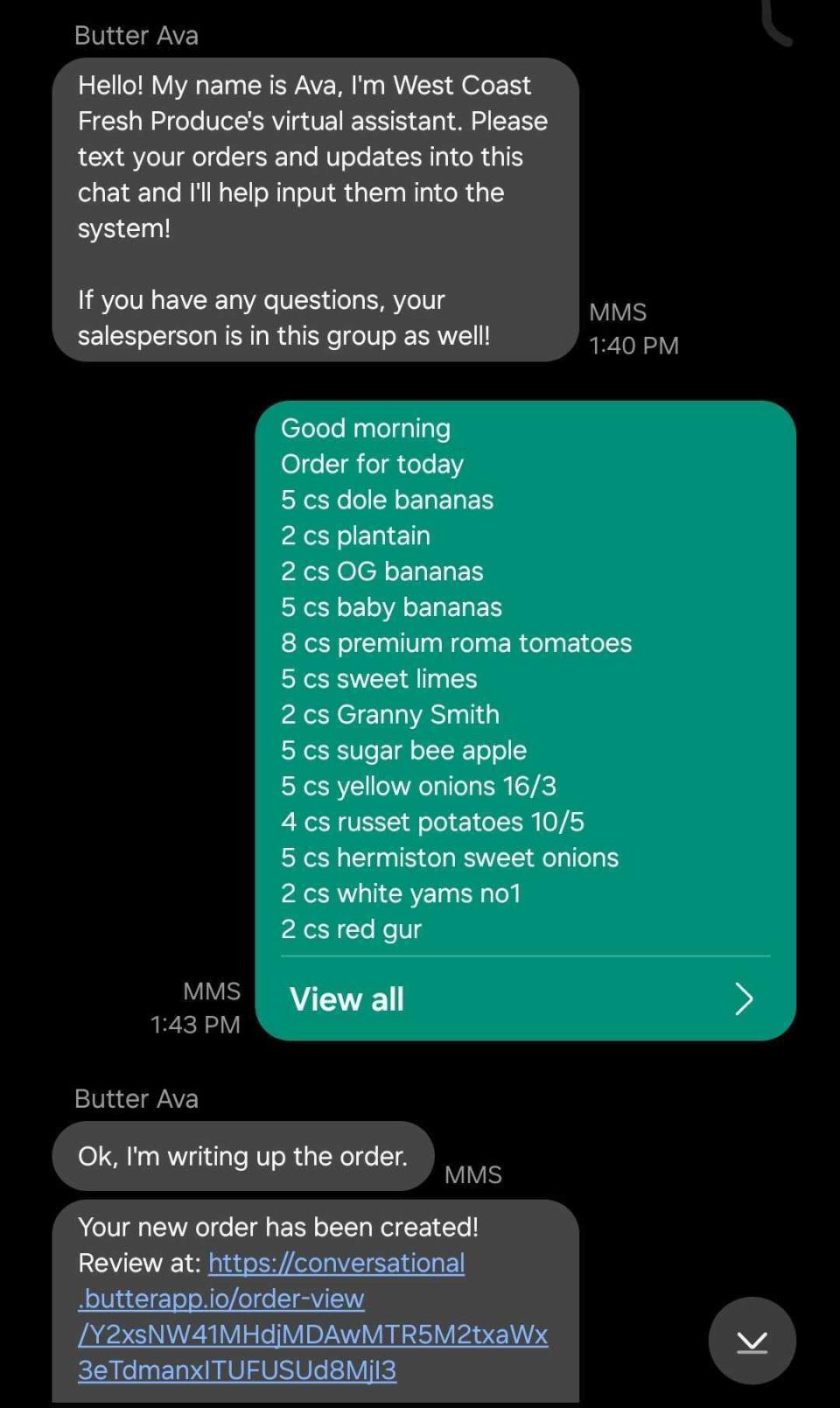

The ordering process in the wholesale food industry was particularly ripe for a change. Food suppliers would often scribble orders down as they listened to voicemails from their customers — like a chef calling from a restaurant at the end of the day after counting inventory — or scroll through text messages of orders. This haphazard process often led to wrong orders or missing items. Analyzing sales and performance remained a dream.

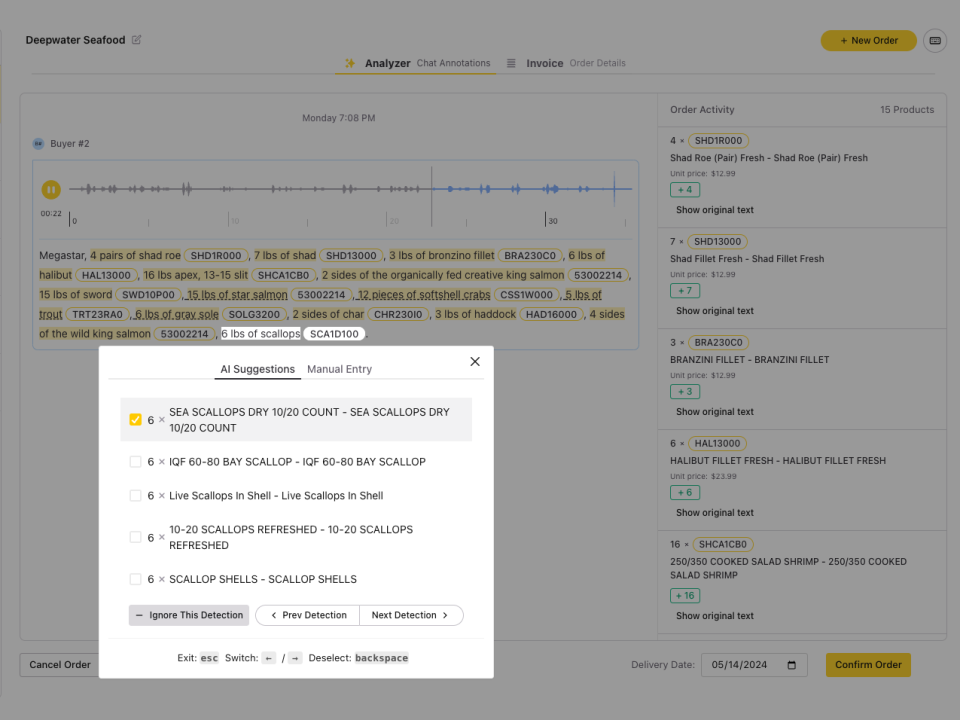

Using AI, Butter built features to help distributors turn that type of unstructured data into information that can be viewed, tracked and analyzed easily. It uses a mix of third-party AI models and its proprietary AI to convert voice notes into lists of items that restaurants and supermarkets order. Before the AI-generated information goes into Butter's system, users get a chance to review it for accuracy. And because the information is now digital, distributors can analyze sales and optimize their inventory and pricing.

"Every sales rep on the distributor side literally spends five hours a day transcribing text messages and voicemail orders, so it’s a huge amount of productivity boost and manual process cut-down," Li said.

More importantly, Butter doesn't ask its customers to learn a completely new workflow. "Neither distributors nor restaurants want to change how they communicate. We aren't changing their workflow, but we are helping them centralize sales knowledge," said Chi.

"Every single step [of food distribution] can be boosted by AI. Even if we aren't replacing humans, AI can easily help 10x sales. We start with ordering because this is clearly the biggest pain point," added Chi.

As it turned out, Butter's AI capability was the impetus GrubMarket needed to buy and merge with its young rival.

Fast dealmaking is the order of the day

Four years into building Butter, Chi and Li had a sticky product, but they found themselves struggling to scale their customer base without a strong distribution channel.

Looking across the industry, they realized their most formidable competitor, GrubMarket, had the customer reach they needed. They also recognized that Butter could play a complementary role to GrubMarket. Chi and Li decided to propose a merger to Xu.

"The moat is not the tech but the data, and we thought, 'Wow, GrubMarket has all the data,'" Chi reflected on his decision to sell the company.

Xu had already heard of Butter at the time because the startup had won over a customer from GrubMarket. "[Butter] works harder with the customer … [T]hey even had a team sleeping in the customer's warehouse to get the job done," said Xu. "But we all know building an ERP system needs a lot of investment. Winston's team only raised about $12 million, so it was hard to continue to build a sophisticated ERP system."

GrubMarket had plans to automate order management, but its development resources were "fully loaded" and focused on other features, like using AI to derive customer intelligence from raw data, according to Xu. So when Butter proposed the deal, the technological synergies were immediately obvious. Furthermore, the startup had a stronghold in a segment that GrubMarket had coveted -- seafood distributors. Butter reached out in March, and by the end of April, GrubMarket had already completed the deal to acquire it.

Once the companies have been integrated, GrubMarket will leverage Butter's products, which include AI-augmented chat commerce, to strengthen GrubAssist, its enterprise AI assistant. GrubMarket is also slated to add an AI-enabled prospecting and digital ordering module to its ERP system, which will let food wholesalers automatically generate digital sales orders regardless of the original medium the orders were taken on — be it text, paper, voicemails, or emails.

"Our style is very direct and fast-moving," said Xu, commenting on the speed of the dealmaking. "It's great that [Butter] joins us so we don't need to build it from scratch, and that's a great addition to our software product family."

https://techcrunch.com/2022/11/14/gradient-backs-butters-operating-system-for-food-distribution-businesses