Government watchdog finds 'strong indicators of widespread fraud' in the $60 billion small business bailout program

Reuters

The Small Business Administration's watchdog said widespread instances of possible fraud were discovered in the agency's Paycheck Protection Program.

The inspector general found about $300 million that went to ineligible recipients or was double disbursed.

The agency says its internal controls caught most of the nefarious applications and is working to augment those tools.

PPP funding remains available for small businesses, and many may soon be able to take a second loan as the first round dries up amid ever-growing coronavirus cases.

The Small Business Administration's Inspector General said Tuesday the office found likely examples of pervasive fraud in the Paycheck Protection Program, which provided more than $500 billion in mostly forgivable loans to small businesses affected by the coronavirus pandemic.

The watchdog office said its preliminary review found "strong indicators of widespread fraud." Specifically, its investigation into hundreds of hotline complaints found $250 million in loans and grants to "potentially ineligible recipients" and another $45.6 million in potential double payments. In total, the potential wrongdoing totals less than 1% of the program's total $520 billion in loans provided to about 5.03 million businesses since March.

Among those cases include a Florida man accused of spending part of a $3.9 million PPP loan on a $318,000 Lamborghini Huracan supercar.

Related: 6 months of coronavirus in the USA, reviewed in 6 minutes

"Swift management action could reduce or prevent additional losses to the taxpayer, because the associated economic injury loan applications may still be unapproved or undisbursed," the report suggests to the SBA. "Management should engage financial institutions immediately to identify disbursements that may have been obtained fraudulently and recover disbursed funds."

In response to the findings, the SBA's administrator, Jovita Carranza, acknowledged the small number of potentially fraudulent applications and said the agency was working on technology to augment its internal controls.

"Because of the EIDL Program's robust internal controls, the concerns raised by OIG in the Draft Management Alert were unexpected," Carranza said, adding that the inspector general had rejected agency requests for more details of the investigation ahead of its response.

"SBA has imposed rigorous system rules and controls to mitigate the risk of fraud," it continued. "Despite the lowered guardrails required by Congress with respect to fraud prevention (e.g., applicant self-certification of eligibility), and contrary to OIG's assertions, SBA's efforts have in fact saved taxpayers billions of dollars."

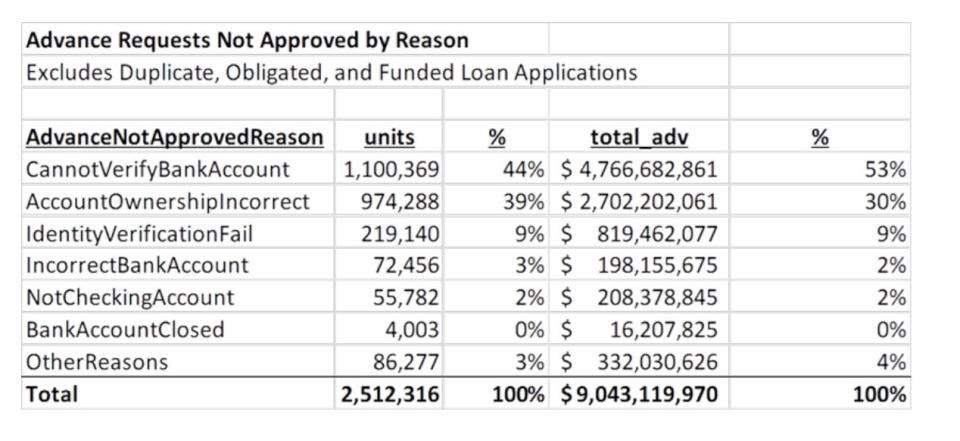

Here's a breakdown of the suspected fraud the SBA says it caught before disbursement:

SBA IG

In July, following pressure from republicans in Congress, the SBA released some data on loan recipients who received funding above $150,000.

Some of same conservatives who championed the transparency praised the inspector general report.

"The purpose of COVID-19 EIDL loans and advances are to aid eligible, legitimate American small entities with both a quick injection of capital and long-term financing for working capital needs brought on by the pandemic," Sen. Marco Rubio said in a statement, according to the Washington Post.

"I'm proud to have worked to secure language in the CARES Act to ensure the federal government has the tools to identify and go after fraudulent activity while protecting taxpayer dollars."

Republican senators' proposed "Heals Act," another economic relief measure to follow on those passed in the Spring, many of which are expiring this month, includes provisions for a second round of loans to embattled businesses, many of which have said they will have to lay off staff when funds dry up.

Read the original article on Business Insider