Good times keep rolling for the state treasury … for one last year

The Louisiana State Capitol (Wesley Muller/Louisiana Illuminator)

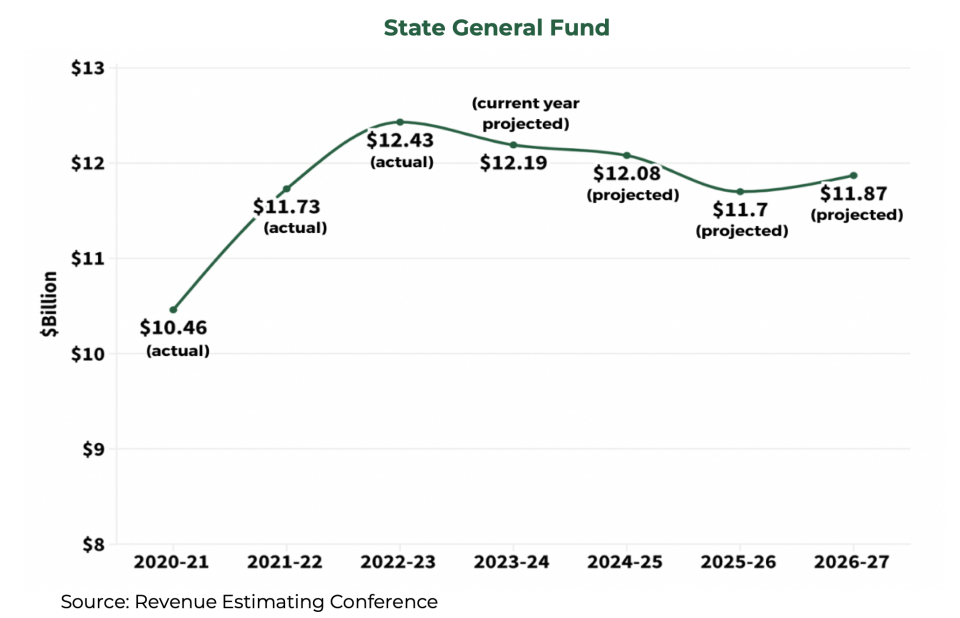

A boost to Louisiana’s state income projections will give lawmakers more money to spend over the next 14 months, even as the post-pandemic financial surge continues to taper off and a fiscal downturn edges ever closer.

The state’s forecasting panel, called the Revenue Estimating Conference, increased its predictions for Louisiana’s tax and fee collections for the 2023-24 budget year that ends June 30 and the upcoming budget year that starts July 1.

The adjustments will give the Louisiana Legislature $197 million more in state general fund money for this year and another $89 million in the upcoming 2024-25 year. The general fund contains the flexible, unearmarked dollars that lawmakers can spend on any area they’d like to prioritize.

While those aren’t the kind of huge increases seen last term in the immediate recovery from the COVID-19 outbreak, the brightened financial picture should give lawmakers enough money to avoid backpedaling on education investments and other state priorities.

With Thursday’s forecasting action, legislators have $920 million in short-term cash they can spend on infrastructure projects, debt payments or other items – or deposit into savings accounts for use in later years. That includes surplus money from last year, previous forecasting adjustments and state general fund dollars that agencies won’t need because they found other funding sources or had fewer expenses than expected.

In addition, dollars available for drawing up next year’s budget have grown larger.

The Public Affairs Research Council of Louisiana hopes senators, who currently have control of the budget bills, prioritize early childhood education and coastal restoration work with some of the money newly available. They also should continue a focus on paying down debts, such as retirement debt, to lessen the fiscal cliff on the horizon when a temporary 0.45% state sales tax expires on July 1, 2025. Anything lawmakers can do now to shrink the shortfall will lessen the pain of next year’s budget negotiations.

The House-crafted version of the budget cut $24 million from a program that provides quality child care and education for children from birth to age 3. House lawmakers used that money to instead pay for an increase in the K-12 public school financing formula sought by the state Board of Elementary and Secondary Education for tutoring, student apprenticeship programs and targeted stipends for teachers in high-need areas.

PAR would like senators to use the extra dollars available for next year’s budget to reverse that House-proposed cut to an early learning program that helps parents stay in the workforce and children become better prepared to enter school.

Senators also will consider undoing a House reduction to public school teacher and support worker stipends. The Legislature provided $198 million for those stipends in the current school year, but the House proposed shrinking that amount to $166 million next year. That’s an unnecessary cut that could weaken teacher recruitment and retention.

GET THE MORNING HEADLINES DELIVERED TO YOUR INBOX

Meanwhile, Gov. Jeff Landry’s administration is suggesting steering some of the new money available for next year’s budget to the Department of Children and Family Services to combat staffing shortages.

For the short-term money available, PAR would like to see legislators allocate some of the new money to the state’s vital coastal restoration and protection work. A trust fund for those efforts currently has significant sums, with some additional dollars annually flowing into the account. But that money is nowhere near the amount needed to fulfill the state’s coastal master plan.

Lawmakers face a complication if they want to spend all the new money recognized by the Revenue Estimating Conference.

The nonpartisan Legislative Fiscal Office said lawmakers would need a two-thirds vote in the House and Senate to breach a constitutionally set cap limiting annual growth in government spending if they want to spend more than $86 million of the $197 million added to this year’s general fund forecast. Such a vote caused angry debate and legislative infighting last year and nearly kept the budget from being passed in the regular session.

So far, the Landry administration and legislative leaders are showing little interest in breaching the cap, preferring to stockpile some of the largesse for lawmakers to spend in future years when they face tighter budgets. Following PAR’s recommendation, they could steer dollars to the coastal fund for use in later years without exceeding the spending limit.

If lawmakers decide to set aside money in various accounts for the future, they should only withdraw the cash later to pay for one-time expenses – not to fill gaps in ongoing programs and services. It’s never advisable to pay for recurring expenses with short-term dollars because that simply continues the budget problems rather than fixing them.

The expenditure limit, however, won’t cause problems for using the $89 million in general fund money newly recognized for the budget that begins July 1 because lawmakers have more wiggle room under the cap next year.

The four-member estimating conference increased this year’s forecast because the state is collecting more than expected from corporate, personal income, sales and severance taxes and from interest earnings on sizable sums Louisiana has locked up in savings accounts. Next year’s forecast increase was driven largely by those better-than-expected interest earnings.

The conference bumped up its projections by even larger amounts than the state general fund numbers suggest, but much of the money is earmarked to trust funds and dedications. For example, the $2.3 billion Revenue Stabilization Trust Fund, created to lessen Louisiana’s reliance on volatile tax collections tied to corporate activity and oil and gas drilling, is projected to get another $1.1 billion in deposits over the next 14 months.

As lawmakers decide how to use all the newly recognized money, PAR urges the House and Senate to keep their focus on priorities that will improve the long-term trajectory of the state while acknowledging the fiscal headwinds they will soon face.

The post Good times keep rolling for the state treasury … for one last year appeared first on Louisiana Illuminator.