Why Goldman Sachs pays such a high savings account rate

Americans will have a hard time finding a bank that pays a higher savings account interest rate than Wall Street giant Goldman Sachs (GS).

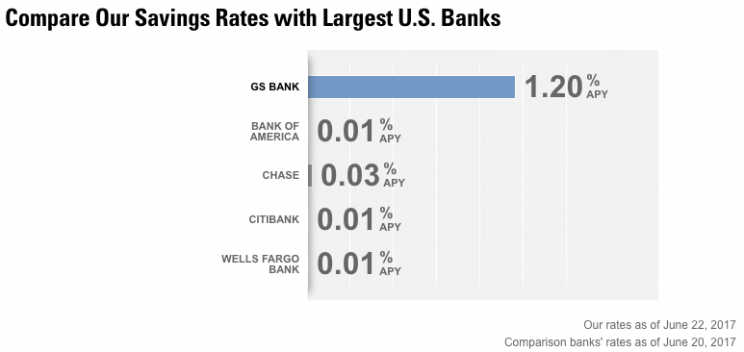

GS Bank, the firm’s online bank, recently made headlines when it raised its savings rate to 1.2% from 1.05% earlier this month. At 1.2%, GS Bank surpasses the large consumer banks, where most households keep their money.

One of the reasons Goldman can offer better rates is it doesn’t have the major expenses associated with operating a consumer banking business.

“[We] are able to give good value to customers on the interest rate because we don’t have the expenses of all the branches and all that infrastructure,” said Harit Talwar, head of Digital Finance at Goldman. “It’s very economical for us to give consumers high interest rate on their savings accounts.”

This explanation is well known among savers. It’s a business model that has made household names out of the likes of online entities like Synchrony and Ally.

But GS Bank’s rate is higher than its online competitors

GS Bank‘s rate is significantly higher than other online deposit competitors. Synchrony High Yield Savings and Barclays Online Savings offer their customers a 1.15% rate, while Discover Bank and Ally Online Savings offer 1.1% and 1.05%, respectively, according to data NerdWallet.

The national average is 0.6%, according to the FDIC.

In its efforts to attract business, GS Bank also has just a $1 minimum deposit requirement and it charges no transaction fees.

“They’re new,” said banking analyst Marty Mosby, the director of bank and equity strategies at Vining Sparks.

“This is their first year and they want to make a splash,” he added. “They’re going to be rounding up, trying to be on the high end of the market to get peoples attention.”

This implies that GS may not forever be the highest payer in the business.

But for now, the strategy appears to be working. Currently, Goldman has around 300,000 retail customers between its loans and online deposits, according to Talwar.

Among those customers, there are large numbers of both Millennials and Baby Boomers.

“I think Millennials are coming because they like online offerings and I think the Baby Boomers get attracted by the value,” Talwar said.

Unfortunately for those seeking convenience, GS does not offer debit or credit cards or ATMs, which helps control costs.

There’s still demand for brick-and-mortar banks

According to Mosby, not having traditional retail branches can have its drawbacks.

“People still like having traditional banking. They like having branches. They like the convenience of knowing their bankers,” he said. “Online strategies will have to entice them with higher rates. They’ll need higher rates for it to make a difference. We’re just not there yet.”

While Goldman doesn’t have branches or ATMs, they do have a call center where someone answers the phone within 10 seconds. (This reporter tested this out and it appears to be an accurate statement.)

Goldman wasn’t always in the consumer banking business. Traditionally, Goldman’s clients have included corporations, financial institutions, governments, and high-net-worth individuals. During the 2008 financial crisis, Goldman was required to convert from a broker-dealer to a bank holding company to gain access to the Federal Reserve’s discount window, a source of liquidity. In that time, there were internal discussions on how to grow the consumer side of the business. Last year, the bank made the first move in that direction when Goldman’s GS Bank acquired GE Capital’s online deposit platform and assumed approximately $16 billion in deposits.

Goldman also built out its online lending platform “Marcus: By Goldman Sachs” as part of that effort. Marcus, which gives out personal loans up to $30,000 for credit-worth borrowers, recently surpassed the $1 billion milestone in loans. Having deposits on hand at GS Bank helps fund those loans that Marcus makes. This gives the firm a lower cost and more stable source of funding compared to borrowing money in the market.

—

Julia La Roche is a finance reporter at Yahoo Finance. Follow her on Twitter.