Gold Price Futures (GC) Technical Analysis – August 8, 2017 Forecast

December Comex Gold futures are trading higher early Tuesday. The weaker dollar helped underpin the market, but geopolitical concerns over North Korea and Venezuela may be the catalyst behind the price surge.

Speculators may also be taking advantage of thin trading conditions. Many of the major players are sitting on the sidelines ahead of Friday’s major U.S. consumer inflation report. Lower equity prices may also be helping to drive up demand for lower-yielding assets.

Technical Analysis

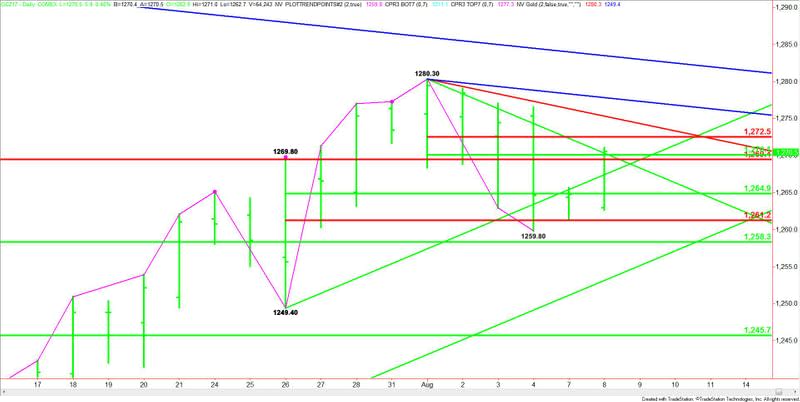

The main trend is up according to the daily swing chart. A trade through $1280.30 will signal a resumption of the uptrend. A trade through $1249.40 will change the main trend to down.

A trade through last week’s low at $1259.80 will signal a shift in momentum to down.

The market is also stuck between a series of retracement levels. This could lead to a range bound, two-sided trade. On the upside, potential resistance levels are $1269.40, $1270.10 and $1272.50. On the downside, retracement zone support levels come in at $1264.90, $1261.20 and $1258.30.

Forecast

Based on the current price at $1269.50 and the earlier price action, the direction of the gold market today is likely to be determined by trader reaction to a downtrending Gann angle at $1270.30.

A sustained move over $1270.30 will indicate the presence of buyers. This could create enough upside momentum to trigger a move into $1272.50, followed by another downtrending angle at $1275.30.

The inability to overcome $1270.30 will signal the presence of sellers. This could trigger a labored break with targets at $1269.40 and an uptrending angle at $1267.40. The daily chart will open up to the downside under this angle with $1264.90 the next target, followed by $1261.20.

Continue to look for a choppy, two-sided trade as long as gold remains inside the Fibonacci level at $1272.50 and the 50% level at $1258.30.

This article was originally posted on FX Empire