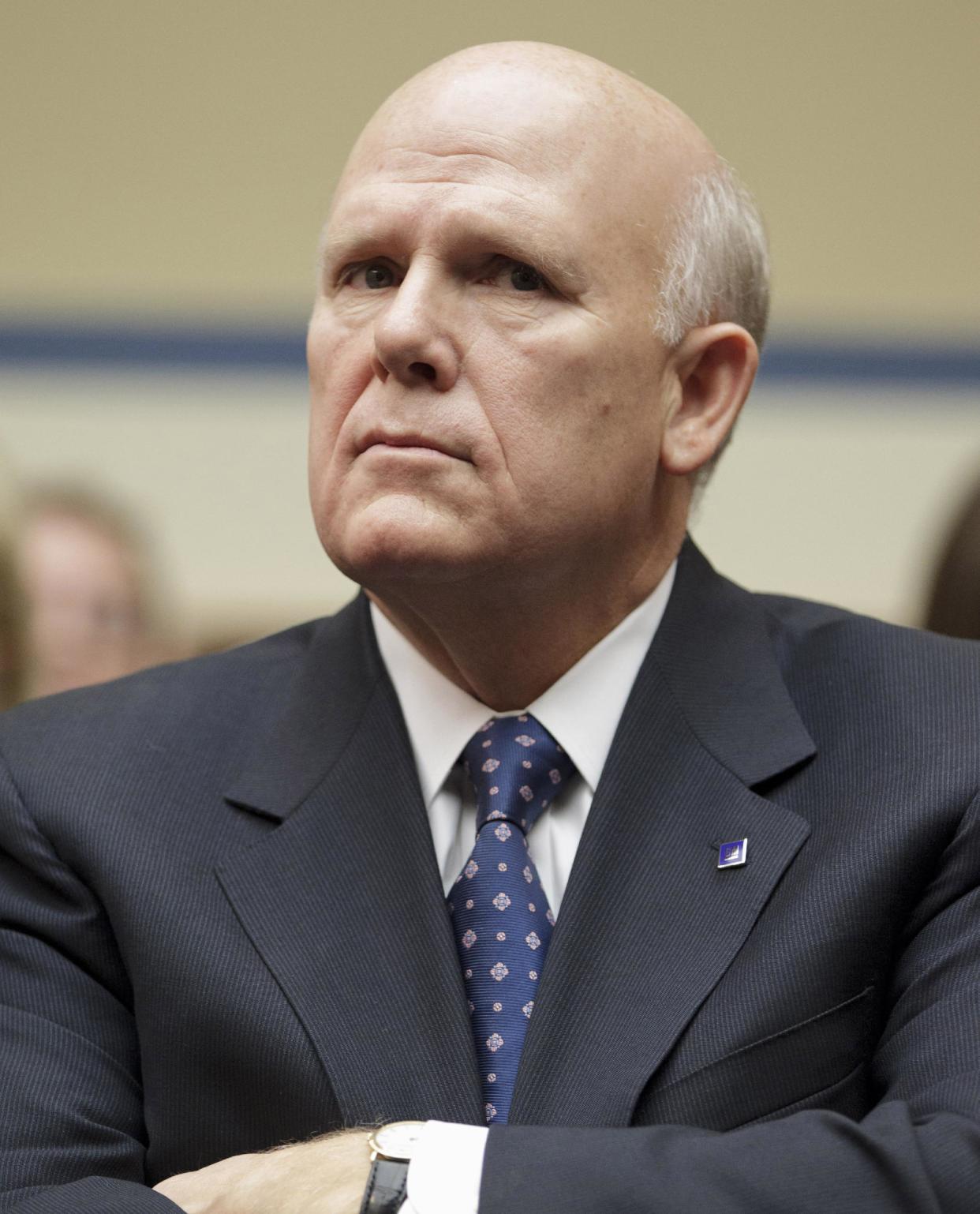

GM CEO gets $7.7 million pay package for 2011

DETROIT (AP) — General Motors CEO Dan Akerson's compensation tripled in 2011 to $7.7 million as the company posted the biggest profit in its history.

But the automaker complained in its annual proxy statement on Thursday that pay for Akerson and other executives isn't competitive with similar companies because of government-imposed limits. The lower pay, GM said, limits its ability to attract and keep top talent.

Akerson earned $1.7 million in salary, up from $566,667 in 2010. He got stock awards valued at $5.95 million for 2011, his first full year as CEO. Stock awards in 2010, when he was CEO for only three months, were $1.77 million.

Akerson, 63, a former private equity and telecommunications executive, also got $55,000 in other benefits including use of GM company cars and contributions to savings accounts. He joined GM's board after the company emerged from bankruptcy protection in 2009, became CEO in September of 2010 and chairman in January of last year.

Top executive pay at GM is controlled by the U.S. Treasury Department, since the government still owns about 30 percent of GM's stock. The government got the stock in exchange for a $49.5 billion bailout that saved GM from financial ruin in 2008 and 2009.

The automaker said in the filing with the Securities and Exchange Commission that government pay limits forced it to pay Akerson and others less than their counterparts at peer companies. GM made a record $7.6 billion last year on strong sales in North America and Asia. The government restrictions, which affect six current and former senior executives and 100 more of GM's top earners, limit cash payments and shift compensation to long-term stock.

"These constraints do not permit us to reward our senior executives in a manner reflecting the level of achievement of our business plan," GM said in its filing. "Appropriately recognizing and rewarding these key contributors and competing with other large, multinational employers to attract and retain fresh talent with critical skill sets is extremely difficult within the compensation constraints."

Because of the pay constraints, Akerson's package is in the bottom 25 percent of CEO compensation for comparable companies, GM said. Akerson made a little more than one-fourth of what Ford paid CEO Alan Mulally last year. Mulally's compensation rose 11 percent to $29.5 million. He got more than $5 for every vehicle Ford sold, while Akerson was paid roughly 85 cents per car and truck sold.

GM's stock price fell more than $16 during 2011, costing Akerson roughly $1.3 million. GM said in the documents that Akerson's pay package was targeted to be $9 million, but fell because of the stock decline. GM shares closed 2010 at $36.86 and ended 2011 at $20.27.

Earlier this month the Treasury Department announced that it would cut by 10 percent the compensation of nearly 70 executives at companies that still have not repaid government bailouts; including GM, American International Group Inc. and Ally Financial Inc. The CEOs of each company had their pay frozen at 2011 levels. GM spokesman Jim Cain says the formula used to figure Akerson's compensation was unchanged from 2010.

The Associated Press formula calculates an executive's total compensation during the last fiscal year by adding salary, bonuses, perks, above-market interest the company pays on deferred compensation and the estimated value of stock and stock options awarded during the year. The AP formula does not count changes in the present value of pension benefits. That makes the AP total slightly different in most cases from the total reported by companies to the Securities and Exchange Commission.

The value that a company assigned to an executive's stock and option awards for 2010 was the present value of what the company expected the awards to be worth to the executive over time. Companies use one of several formulas to calculate that value. However, the number is just an estimate, and what an executive ultimately receives will depend on the performance of the company's stock in the years after the awards are granted. Most stock compensation programs require an executive to wait a specified amount of time to receive shares or exercise options.

GM also said Thursday that it nominated two candidates to expand its board from 12 to 14 members. ConocoPhillips Chairman and CEO James Mulva and Theodore "Tim" Solso, former chairman and CEO of diesel engine maker Cummins Inc. will stand for election at GM's annual stockholders meeting on June 12 at the corporate headquarters in Detroit. Stockholders also will vote on an advisory resolution to approve compensation of company executives.