FTSE heads for worst week in years after disastrous global services data and Brexit pound boost

SERVICES SHOCK: String of dire service sector activity sends shockwaves through global markets

Surprise services slowdown suggests UK economy underwent contraction during September, signalling possible recession

US services slump registers second major activity gauge miss of the week

German business activity stumbles and Eurozone stagnates

STERLING SURGES: Pound leads major currency gains as Boris Johnson unveils Brexit plans

But rising currency adds to pressure on FTSE 100, with more than 100bn wiped off blue-chip index so far this week

PLUS: Imperial Brands boss Alison Cooper heads for the exit

Ted Baker shares plummet after profit warning

Ambrose Evans-Pritchard: Europe is defenceless against an economic crisis but will it force a no-deal Brexit anyway?

Markets wrap

Well, it has been another tough day for the FTSE after yesterday's bloodbath.

A string of poor service sector activity sent shockwaves through global markets today and major declines in commodity stocks weighed on London's benchmark index. It closed 0.63pc lower.

IG analyst Joshua Mahony said, "The FTSE 100 is back in the red... as fears over the global growth picture and a tit-for-tit trade war between the US and EU continue to dent sentiment."

Let's hope tomorrow will be a cheerier day!

Thank you for following along, and as always, Louis Ashworth will be back tomorrow with all the latest.

Boiler room scammers ordered to repay 1.5m after conning investors

Convicted fraudsters who lost investors more than 1m have been ordered by the City watchdog to repay the victims of their illegal investment scam.

The Financial Conduct Authority (FCA) has told Aleem Mirza and Samrat Bhandari to hand over 1.2m and 376,604 respectively, to help compensate hundreds of investors who were mis-sold shares in Mirza's "healthcare solutions" business Symbiosis Healthcare between 2009 and 2014.

Elderly victims looking to invest their savings were cold-called and urged to pour money into a network of medical clinics in Dubai, despite the fact that Symbiosis shares were largely worthless.

Read Harriet Russell's full article here

European stocks close...

London's benchmark FTSE 100 ended the day 0.63pc lower to 7077.64 as global economic growth concerns were compounded by worries Britain could be heading into recession.

The stock market decline added to yesterday's plunge of more than 3pc.

The German market is closed today as the country celebrates Unity Day. The CAC 40, IBEX 35 in addition to the FTSEMIB held up well considering the turmoil in the UK market.

The CAC closed 0.30pc lower to 5,438.77.

Oil prices slide

Oil has fallen below $58 a barrel amid concerns about global economic growth, oil demand and signs of excess supply despite Opec-led cuts.

Saudi Arabia said it has fully restored oil output following the attacks on its facilities last month.

Brent crude is currently trading at $57.04 a barrel, 0.87pc lower.

Meanwhile, gold has been given a boost by the decline in the greenback in addition to the uncertainty in stock markets.

Diamond sales lose more lustre for De Beers

De Beers has suffered another slump in diamond sales, prompting fears the sector is in the grip of more prolonged slump.

The industry giant sells diamonds to selected buyers 10 times a year at events called sights at its base in Botswana. Sightholders, or customers, are allocated boxes of gemstones that roughly match the quantity and quality they bought the previous year.

Sales in the eighth sight this year mustered just $295m (239m), a near-40pc tumble compared with the same period a year ago, when it fetched $482m. This was on a par with the result in August's sight, which raised $287m.

Read Jon Yeomans' full article here

Another day, another sell-off

Alan Custis of Lazard Asset Management says:

"Economic data remains weak, US employment data did markets no favours this afternoon.

"What may be different today is that Sterling is appreciating by nearly 1pc versus the US dollar and this has up until now, been the litmus test for how Brexit negotiations are progressing, with a strong pound signalling that a deal may be forthcoming.

From a market standpoint another FTSE100 CEO has resigned making it three in two days.

"The message from UK PLC is one of complete inertia at present, as they wait to see what happens, and this is now affecting investor sentiment, which had overlooked such weakness as temporary, but now becoming more ingrained."

No long until London close...

Good afternoon!

I'll be with you for the final hour of the live blog and we'll be keeping a sharp eye on what happens with the FTSE very shortly.

Handover

With things starting to flatten out a bit, we might not be in for quite the afternoon of US carnage that followed Wednesdays London session. My colleague LaToya Harding is going to take over from here, and steer things through the London close. Ill be back tomorrow morning! Louis

FTSE starts to pull back losses

Slowly but surely, the FTSE is pulling back its losses for the day, now down just 0.5pc, despite sterling remaining high against the dollar.

European stocks swing back as FTSEs losses for week pass 100bn

Several European stock indices have now swung back into the green, with Frances CAC 40 now up 0.4pc. No such luck for the FTSE, which has been wobbling between 1pc and 1.2pc down.

That brings the amount of market value wiped of the indexs firms for the week so far to more than 100bn.

Reaction: Any optimism has been snuffed out

Heres Markets.coms Neil Wilson on those ISM numbers, and the ensuing stock market chaos:

Completing the services PMIs today, the US ISM reading missed expectations at 52.6 against 55 expected. The slowdown in manufacturing is spreading to services. We flagged that this print would be critical to market sentiment today and its clear that any optimism has been snuffed out...

...The question now is whether and when the Fed steps in. Or more importantly, how big goes the Fed? We know they are prepared to ease, these PMIs give them added justification. I think we can anticipate expectations for more aggressive stimulus to increase.

Two-day wipeout touches 83bn

European shares have all flipped red after that reading, though the FTSE 100 has pulled back slightly to just 1.02pc down. By my quick calculations, that puts the total market cap losses for Londons biggest listed firms over the last two sessions at 83bn.

Round-up: Fifties women lose appeal over state pensions, Microsoft announces Android phone, Netflix gets Treasury tax rebate

It looks like we might have another day of big stock market losses on our plate, so lets do a quick corporate round-up:

Fifties women were not discriminated against over state pension age increase: Campaigners who took the Government to court over its handling of increases to the state pension age for women have been told by judges that they were not discriminated against.

Hell freezes over as Microsoft unveils a phone running Android: Microsoft made a shock return to the smartphone market with a dual-screened handset that runs Googles Android software, a tie-up between the two tech giants that would have been unthinkable just a few years ago.

Netflix gets another tax rebate from the Treasury: Netflix was handed a 57,000 (51,000) tax rebate last year despite the Government's plan to make US tech giants pay more to the Exchequer.

Reaction from Twitter

Weakest #ISM growth signal since 2010 (except for a short period in 2016 after Brexit)

US growth now around ~1% q/q AR, according to ISM

This doesn't make tomorrow's jobs report less interesting

Supports our call that the #Fed will cut again later this month! pic.twitter.com/bhFdZWGRSYDanske Bank Research (@Danske_Research) October 3, 2019

While most #ISM Non-Manufacturing indices remain in a range of 52-56, the Employment index at 50.4, down from 53.1 looks somewhat worrisome. #Fed to the rescue? pic.twitter.com/dcGSJEmZhx

jeroen blokland (@jsblokland) October 3, 2019

US ISM Non-Manufacturing joins the malaise of PMI disappointments.

Drops alarmingly to 52.6 (55.0 exp, 56.4 last).

That's a 3 year low folks...#EURUSD spiking through $1.0965 resistance as USD weakens. #Forexpic.twitter.com/2KKv8HD9qKRichard Perry (@HantecRich) October 3, 2019

FTSE 100 losses pass 1.5pc after US survey shiffs

A one-two punch for the FTSE 100: the pound is spiking even higher as the dollar drops, up nearly 0.8pc on yesterdays close, putting pressure on exporters, and further indications of a US slowdown will have rattled investors.

The blue-chip index is down about 1.55pc currently.

Wall Street stocks drop following miss

The aftershocks on US stock markets have been immediate, with the Dow now down over 1pc, and the S&P 500 and Nasdaq both dropping. The ISM says of that PMI activity data:

The non-manufacturing sector pulled back after reflecting strong growth in August. The respondents are mostly concerned about tariffs, labor resources and the direction of the economy.

This miss, of course, raises the possibility of further interest rate cuts from the US Federal Reserve, to try and stop this slowdown becoming a contraction.

Gauge gives lowest reading since mid-2016

That miss is going to sting the purchasing managers index reading hitting a three-year low. That is the second big miss this week, and is likely to further spook investors. In brief:

New orders fell

Business activity fell

Employment fell

After Tuesdays manufacturing disappointment....comes non-manufacturing disappointment

Slowdown clearly spilling over outside of just production$USDhttps://t.co/fpMl8fpyqVMichael Brown (@MrMBrown) October 3, 2019

The reaction on the bond markets has been immediate:

US 2-year Treasury sinks to 1.38%, lowest level in two years! pic.twitter.com/jOiWJaCht5

jeroen blokland (@jsblokland) October 3, 2019

Break: US non-manufacturing activity growth slows in September

Just in: the ISM non-manufacturing PMI figure is 52.6 another big miss against expectations of 55, showing a slowdown in the services sector. A reminder that a score above 50 indicates growth.

More follows...

US firms reduce job numbers for first time since early 2010

IHS Markit says:

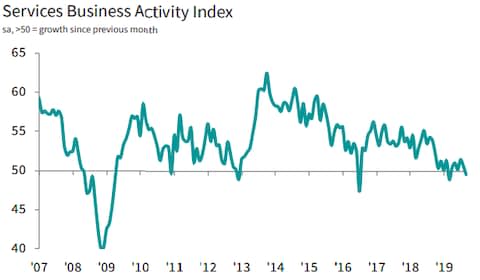

September data indicated only a slight increase in business activity across the U.S. service sector, with the expansion constrained by the slowest monthly rise in new business recorded since data collection began in October 2009. Subsequently, firms reduced their workforce numbers for the first time since early-2010. Business confidence also remained subdued amid ongoing economic uncertainty.

US Service Business Activity Index picks up slightly to 50.9 in September (50.7 - Aug) but output growth remains historically subdued amid weakest rise in new orders in the survey's history. Employment fell for the first time since early-2010. More: https://t.co/IXiSLGpWovpic.twitter.com/TPeFj7WTh6

IHS Markit PMI (@IHSMarkitPMI) October 3, 2019

Its chief economist Chris Williamson added:

A disappointing service sector PMI follows news of lacklustre manufacturing and means the past two months have seen one of the weakest backto-back expansions of business activity since 2009, sending a signal of slower GDP growth in the third quarter.

The surveys are consistent with the economy growing at a 1.5pc annualised rate in the third quarter, with forward-looking indicators suggesting further momentum could be lost in the fourth quarter.

...however, IHSs jobs gauge is in contraction for the first time since 2010

Somewhat of a tail sting, however. Adding to a sense of worry ahead of tomorrows closely-watched jobs report, IHS Markits measure of employment in the US services industry swung into contraction territory for the first time since 2010, dropping 1.8 points to 48.6.

Markit releases final US services and composite PMIs, data unchanged

Research group IHS Markit just released its final figures for US services activity in September. Its unchanged, as is the overall figure (50.9 and 51 respectively). A score above 50 indicates growth.

More, importantly, the ISM non-manufacturing PMI is coming up in 15 minutes. It is broadly seen as the more closely-watched measure, so results could impact the mood either way. Wall Street has opened slightly down.

Pound advance stalls, relieving pressure on FTSE 100

The pounds advance has stalled in the last few minutes, as traders digest some less-than-enthusiast comments from the Irish PM. That has relieved pressure on the FTSE 100, which has pulled back to about 0.95pc down.

Everything you need to know about the looming US/EU tariff war

How did a row about Airbus and Boeing planes end with a tax on cheese?

Thats the question you might be asking after yesterdays World Trade Organisation ruling, which decided that the US can slap tariffs on $7.5bn of EU goods in revenge for illegal EU subsidies to plane-maker Airbus.

Luckily, Tim Wallace is here with the answers. Hes unpacked the who, what, why, when and how of the burgeoning tariffs clash, which will hit products such as welding gear, shears and biscuits from Germany. Olives and oil from Spain. Italian liqueurs, French wine, Austrian pork.

In chase you want to check out the full list of tariffed goods yourself, it can be found here.

Could the FTSE breach 7,000?

If the fall across Londons blue-chips continues, the FTSE 100 might breach 7,000 points for the first time since February.

As a reminder, the index spent most of January in recovery mode after Decembers major sell-offs, so this would put Londons top index back to where it stood around last November which, incidentally, was roughly when Theresa May unveiled her Brexit deal.

Miners and energy stocks drag as FTSE fall continues

Mining and energy firms, some of the most internationally-exposed companies on the FTSE 100, are providing some of the biggest drag on the blue-chip index.

BP and Shell are both down more than a percent, while Rio Tinto and BHP are off 1.7pc and 2pc respectively. The index is down about 1.2pc.

Irish PM: Johnsons words dont match his proposals

Irish Taoiseach Leo Varadkar is currently speaking at a press conference with the Swedish Prime Minister.

He praised Boris Johnsons proposals for there to be no infrastructure on the Irish border, but said the British PMs words in Parliament dont reflect the proposals unveiled yesterday.

He emphasised that the land border is the main sticking point, as Ireland (and, by extension, the EU), want to maintain the integrity Single Market. Mr Varadkar told reporters:

I think there are two major obstacles. I think the first is on customs, I dont fully understand how we could have Ireland and Northern Ireland in separate customs unions and not have checks...

He added that a system based on consent would need to find a way of reflecting will of all Northern Irish people.

Sterling is holding its ground at around 0.6pc up well have to wait and see where it goes from here.

Taoiseach Leo Varadkar: the proposals are welcome in the sense that we have written proposals, they do fall short. Any consent mechanism wd have to be reflective of the views of all the population of NI, not just one party, need to explore in more detail the customs proposals

Tony Connelly (@tconnellyRTE) October 3, 2019

FTSEs losses pass 1pc

A strengthening pound and several heavyweight drops are doing no favours to the FTSE, which just passed 1pc off. It is down more than 5pc this week, on course for its biggest weekly drop since early 2016.

US jobless claims slightly higher than expected

US jobless claims figures have come in, the first of several bits of US data due this afternoon. There were 219,000 claims, against Bloomberg estimates of 215,000. That is definitely towards the higher end of estimates, but isnt a dramatic miss. Last weeks number was 213,000.

US initial claims totaled 219K in the week up to September 28th. Technically claims gave a #recession signal in April this year when they hit a bottom of 193K. pic.twitter.com/pl05BmCTXF

jeroen blokland (@jsblokland) October 3, 2019

FTSEs losses accelerate as pound climbs on Brexit talks

The FTSEs losses have deepened somewhat over the past half hour the blue-chip index is now off nearly 1pc. That flop comes as the pound strengthens against the euro and dollar, putting pressure on the exporter-heavy index.

To glimpse where things currently stand:

Self-styled Brexit hardliner Steve Baker (chair of the European Research Group) says he may be able to accept Boris Johnsons proposals

Irish Deputy PM says that if the proposals from the PM are final, there will be no deal

Of course, there being no deal now doesnt necessarily mean there will be a no-deal Brexit at the end of the month.

Follow the latest politic updates here: Brexit latest news: Boris Johnson addresses Commons on his Brexit plans

Sterling holds flat as US econ data nears

As we head into the afternoon, things are fairly calm. A slew of US economic data is likely to set the tone for trading, with jobless claims and services activity data both due to arrive.

The pound is almost totally flat against the dollar and euro, with little of substance to trade on on the Brexit front (in a line: Ireland has, as expected, rejected Boris Johnsons proposals).

The FTSE 100 has dug in its heels at around 0.5pc down, with gloomy services data not putting much more of a knock on the blue-chip index.

UBS economist Dean Turner says:

This gloomy set of PMIs for September shows an economy stuck under the cloud of Brexit uncertainty. The service sector contraction indicated in this survey, the first since March when the previous Brexit deadline was looming, is a concerning development. However, PMIs have had a tendency to overreact relative to reality. It is too early to conclude that the UK is heading for a recession on these numbers alone.

For the markets, the greater concern is on the success or otherwise of the Brexit negotiations. Although the mood has improved somewhat, the chances of an actual breakthrough remain slim, in our view. We still expect the Government to be forced into seeking an extension, which will be followed by a General Election before the year is out.

If, as we expect, it becomes apparent that the most likely path ahead for Brexit is an extension, we expect the pound to recover some of its recent weakness against the US dollar. If a deal emerges, then the rally could be relatively meaningful.

Analyst: Ted Baker needs to get costs under control

Shares in stricken retailer Ted Baker are now down more than 35pc, after it warned on earnings and conditions this morning.

You can read more here: Ted Baker shares tumble after retailer swings to a loss

Hargreaves Lansdowns Sophie Lund-Yates says the company is suffering from wider sector issues, as well as its own idiosyncratic headaches. She writes:

Ted says unprecedented levels of discounting across retail, and the continued shift to online shopping is to blame for poor performance. These have definitely proved significant challenges for the group, as knocking down prices has caused gross margins to shrink.

Ted Baker is causing some of its own problems too. There were issues with the Spring/Summer collection, and thats not really the kind of mistake retailers can afford at the moment. And the biggest hammer to profits has been increasing costs, with restructuring and distribution spending ramping up as Ted tries to turn itself into something more lucrative.

Teds future fortunes lie in its ability to get its cost base under control. Sales performance hasnt been too bad, so theres clearly demand for what Ted is selling, just not necessarily at the price it needs them to be. Only time will tell if Ted can find a way to rejig its offering in a profitable way, at the moment that looks to be some way off.

FTSE misses out as European bourses bounce back

How Germanys might have reacted to those PMI numbers this morning will remain unknown as the bourse stays shut for a national holiday.

The FTSE 100 is definitely suffering however, down about 0.5pc currently, as most of Londons blue-chip shares notch up losses. Elsewhere in Europe, other countries top indices are looking a bit more healthy, posting moderate gains, though the continent-wide STOXX 600 is down about 0.2pc.

Heres how the FTSE 100 has compared to Frances CAC and Germanys DAX over the past month:

Full report: Recession warnings grow as services sector wanes

Economics Editor Russell Lynch has a full report on those shock PMI numbers. He writes:

The CIPS survey data excludes government services as well as the retail sector, which has been more resilient. But survey respondents reported tumbling sales, investment and job losses as Brexit worries dominated the agenda.

Read more here: Recession warning as services sector slides into reverse gear

Questor drops Woodford Patient Capital

Heres a big one from Questor, the Telegraphs investment advice service: theyve dropped shares in Woodford Patient Capital. Editor Richard Evans explains:

The time has come: we are pulling the plug on Woodford Patient Capital.

Why have we run out of, well, patience? Its quite a list but the first reason is simply that we think the shares have further to fall.

Read more here: Questor: why we are selling Woodford Patient Capital and what we are buying instead

And read Questors rules of investment before you follow its tips

Dont forget to subscribe to our investor newsletter as well:

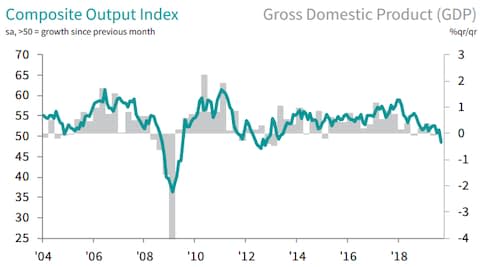

Reaction: Services growth all-but fizzled out

Todays PMI data shows growth in the UK services industry may have evaporated, writes Capital Economics Ruth Gregory. She says:

The drop in the IHS/Markit services PMI to a six-month low of 49.5 in September means that all three sector PMIs are now below the 50-mark which theoretically separates expansion from contraction, reigniting concerns that the economy is in recession...

...As a result, the services PMI suggests that after rising by 0.1pc q/q in Q2, growth in the biggest part of the economy has now all-but fizzled out.

Ms Gregory adds, however, that the surveys are not a perfect guide to GDP moves:

Admittedly, we can take some comfort from the fact that the surveys have not been a foolproof guide to the official data recently. They did not pick up the impact of Brexit preparations ahead of the 29thMarch Brexit deadline and will probably fail to do so again. That could add an extra 0.1ppt to quarterly GDP growth in Q3. And the PMIs exclude the recent resilience in the retail and government sectors. In addition, Julys surprisingly strong rise in GDP of 0.3% m/m suggest that the economy did at least start the quarter on a solid footing.

Capital Economics has stuck to an estimate of 0.3pc growth for the third quarter overall: that would clearly avoid a recession.

Centamin is FTSE 250s biggest faller

Egypt-focused mining firm Centamin is the biggest faller on the FTSE 250 currently, with its shares off around 12pc. Its the sharpest drop in seven months for the company, and comes following a production warning and the announcement of its long-term bosss retirement.

Centamin announced a search had begun to replace Andrew Pardey, who joined the company nearly 12 nearly ago and is now retiring. Mr Pardey said:

It has been a privilege to be involved with Centamin and grow with it, from General Manager to Chief Operating Officer and ultimately serving the last four years as Chief Executive Officer. I would like to thank the Board, all my colleagues and the shareholders for their dedication, loyalty and support transforming this business and building an exceptional mine.

Production during the last quarter was 17pc less than in the three months before, the company warned. It said it still expects to hit the lower end of its full-year targets, but RBC analyst James Bell warned those numbers looked to be a stretch.

Heres footage of the whole Treasury incident...

Extinction Rebellion activists failed in a plan to spray HM Treasury with thousands of litres of fake blood this morning after their high-pressure hose pipe became too much to handle.

What is your response? pic.twitter.com/EpfqWefcKmtalkRADIO (@talkRADIO) October 3, 2019

Extinction Rebellion protesters spray fake blood onto the Treasury

In what is likely to be the days strangest story, climate change protesters from Extinction Rebellion have sprayed 1,800 litres of fake blood onto the Treasury. A banner carried on top of the fire engine used for the student bore the banner stop funding climate death. It appears they lost control of the hose at one point.

Extinction Rebellion have sprayed 1,800 litres of fake blood on the Treasury using an old fire engine pic.twitter.com/COVQX6oHfS

Sam Francis (@DavidSamFrancis) October 3, 2019

Here are some photos from the event:

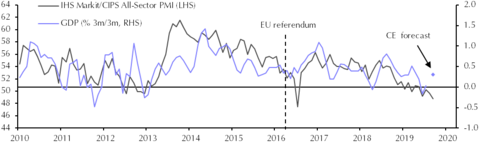

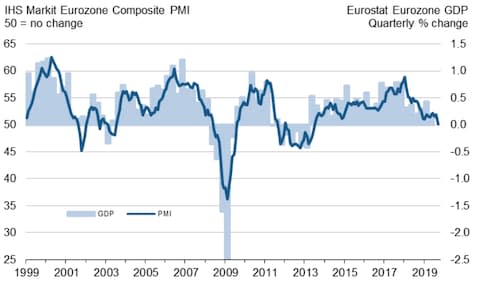

Heres how composite PMI has compared to monthly GDP change in recent months

As you can (hopefully) see, the signs arent looking great, but Julys healthy figure could indicate the third quarter managed to eke out growth.

Services slowdown reaction: The Bank of England cannot play the Canute on rates

Reacting to those UK PMI figures, Markets.coms Neil Wilson says:

Its not too extreme to suggest the recession warning light is flashing red following the 0.2pc drop in Q2 GDP.

The services PMI printed 49.5, signalling contraction for the largest area of the economy. Employment cuts are at their worst levels in nine years and business confidence has slumped. Input costs continue to rise. These are not great readings at all and certainly indicate the kind of weakness that could signal recession.

For sure the next move for the Bank of England is to cut rates, as IHS Markit suggest. This has been the case for some time, although the MPC has retained its tightening bias in the face of a global slowdown and collapse in government bond yields. Against the tide of global easing from central banks, the Bank of England simply cannot play the Canute here; cutting is the next step unless we see a miraculous bounce back in activity.

The Think Tank: Will Sajid Javids pay rise put part-time women out of a job?

Heres the latest edition of The Think Tank, the Telegraph economics teams daily shot of analysis and insight. Today, theyve focused on Chancellor Sajid Javids plans to raise the minimum wage. Russell Lynch writes:

The Saj has decided that nothing is too good for the workers so long as businesses have to foot the bill so hes upping the ante on Labours 10 an hour pledge.

Ending low pay is a laudable (and vote-winning) ambition, even though hes not being quite as ambitious as he seems. Trace back the history of the minimum wage and then National Living Wage (NLW) to 1998, and then plot the Chancellors 10.50 target.

Were not talking about a step change here, rather the continuation of a trend. Its also of course subject to economic conditions, which may or may not include a no-deal Brexit.

Read more here: Will Sajid Javids pay rise put part-time women out of a job?

Analysis: Could stockpiling prevent a contraction?

Although activity data looks pretty dire, its worth remembering that GDP growth in July was healthy at 0.3pc.

Steady Lads ( and Lasses)! Some seem to have forgotten that the UK Q3 GDP data started with July at 0.3% https://t.co/rW6uAULHMD

Shaun Richards (@notayesmansecon) October 3, 2019

Lets quickly recap the theory about what happened earlier this year:

The UK economy grew strongly in the first quarter as companies built up stockpiles in anticipation of Britains March exit date...

...and then shrank in the second quarter as companies burned through those stockpiles.

There have been suggestions that the pattern could repeat itself: weve certainly heard a lot of chatter about individual companies stockpiling.

There could be doubts, however: despite Boris Johnsons do or die Brexit pledge, the PM is tied by legislation to seek an extension from the EU if he cannot get a deal. Companies may be gambling that another delay is likely.

Its also worth noting that (as some analysts have pointed out), GDP gains from stockpiling are slightly illusory: increased spending to refrigerate a lot of food or stack materials isnt good for the companies, it is just an extra cost.

We wont know the final outcome until we get Septembers GDP change figures in November, but figures for August (out next week) should give us a clearer sense of where things are headed.

Brexit: Heres what you need to know right now

As that big miss for the services sector raises the possibility of a Brexit recession, heres what you should read to understand where things stand over the crucial negatitations:

Tweet: Heres how those employment figures look...

IHS Markit economist Chris Williamson tweets:

Sep also saw the steepest drop in employment since Dec 2009. Job losses were seen in all 3 sectors, with services reporting largest drop in headcounts for 9 years, while manufacturing and construction jobs were shed at rates not seen since Feb 2013 and Dec 2010 respectively 3/ pic.twitter.com/PmAYRLjHHd

Chris Williamson (@WilliamsonChris) October 3, 2019

UK recession risk rises

Those number round out a difficult third quarter for the UK. The services sector, which is the dominant portion of the UK economy, contracted for the first time since after the Brexit referendum (July 2016).

The UK economy shrank by 0.2pc in the second quarter, so a slip in the three months to the end of September would put the Britain into an official Brexit recession.

Duncan Brook, director of the Chartered Institute of Procurement & Supply, said of the services-sector slump:

An exhausted sectors optimism faded away to July 2016 levels and new export orders fell at their fastest rate since March. Some respondents mentioned overseas customers were putting spending decisions on hold or choosing other European suppliers instead. In this last month before the Brexit deadline, there is little time or vision for a major turnaround in fortunes before the end of the year

Fastest job shedding in nine years as Brexit concerns dominate

Lets get more detail on those numbers.

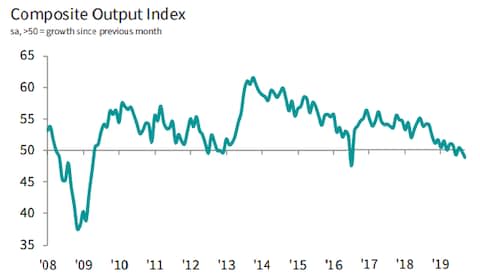

Heres how the services PMI looks:

And here is the overall picture:

IHS Markit/CIPS say:

The latest IHS Markit / CIPS PMI data for the UK service sector signalled a contraction in activity in September, and the biggest cut in employment in over nine years. With both new and outstanding business declining at the end of the third quarter, companies were the least optimistic of future growth of activity since July 2016 following the EU referendum.

All three sectors services, manufacturing and construction registered lower output in September.

IHS economist Chris Williamson said:

A trio of grim reports on the economy means that the vast service sector has now joined manufacturing and construction in decline. Only the collapse in confidence immediately following the 2016 referendum has seen a steeper overall deterioration in the economy during the past decade, but Septembers decline is all the more ominous, being the result of an insidious weakening of demand over the past year rather than a sudden shock.

At current levels the surveys point to GDP falling by 0.1pc in the third quarter which, coming on the heels of a decline in the second quarter, would mean the UK is facing a heightened risk of recession.

Brexit-related concerns dominated the September survey responses, linked by companies to falling sales, cancelled and postponed projects, a lack of investment and job losses.

Are UK businesses starting to layoff employees?

Yes, according to the Markit PMI composite employment subindex. Yet to be seen in the official employment data! pic.twitter.com/jE2tj85ScpDanske Bank Research (@Danske_Research) October 3, 2019

Following the 0.2% fall in GDP in Q2, the fall in the all sector PMI from 49.7 in August to 48.8 in September leaves it consistent with another fall in GDP Q3. That would leave the economy in recession. (1/2) pic.twitter.com/gc6MXS9fPs

Capital Economics UK (@CapEconUK) October 3, 2019

Break: UK economic activity contracted in September, services sector shrinks

A MISS: services comes in at 49.5, composite at 49.3. That is going to sting.

UK not great

UK SERIVICES PMI ACTUAL: 49.5 VS 50.6 PREVIOUS; EST 50.3Neil Wilson (@marketsneil) October 3, 2019

More follows...

UK activity figures expected to show stagnation

Those UK PMI figures are just a couple of minutes away. Analysts polled by Bloomberg are expecting a figure of 50.3 for services, and 50 overall which would indicate Britains economy was stagnant during September. Stay tuned...

Stand By Your Desks! UK Services and Composite PMI is up next and we cross out fingers after a weak equivalent number for the Euro area earlier.....

Shaun Richards (@notayesmansecon) October 3, 2019

FTSE losses near 0.5pc

Ahead of that crucial services PMI data, the FTSE 100 is sinking lower, currently off about 0.45pc.

A fifth of Londons blue-chip stocks are currently posting gains, with heavyweight Diageo leading risers on hopes that it will avoid too much damage from US tariffs. HSBC is also putting in a strong performance. Ill loop back to those two later on.

A third-quarter GDP contraction would send Germany into a technical recession

This mornings activity data make it appear likely that Germanys economy contracted in the third quarter, which would put it into a technical recession after a 0.1pc GDP decline in the three months to June. That will likely raise pressure on Angela Merkels government to look at means for stimulating Europes top economy.

All eyes will now be on the UK data, coming up in just under 10 minutes:

UK PMI up next, and as is tradition these days... pic.twitter.com/VRRfrX91Na

Rupert Seggins (@Rupert_Seggins) October 3, 2019

German private sector contracts for first time in five years

Lets focus on those German figures for a moment. That drop means that the private sector in Europes biggest economy shrunk for the first time since December 2014.

IHS Markit said:

With the downturn in manufacturing new orders deepening in September and service providers recording a contraction for the first time since December 2014, the rate of decline in total new business accelerated to the quickest since September 2012. Export sales continued to fall sharply across both monitored sectors.

Hiring across the service sector helped sustain overall employment growth in September, though the net increase in jobs was the smallest seen for almost six years as the pace of staff shedding across manufacturing accelerated. Backlogs meanwhile fell sharply, with factory capacity pressures remaining particularly low.

Perhaps luckily, Germans blue-chip DAX index is closed for a holiday, after finishing nearly 2.8pc down yesterday.

Eurozone nears stagnation

Weve had purchasing managers index numbers from across the eurozone this morning, which show the 19-member currency bloc stagnated in September.

PMI activity data based on IHS Markit research gave a reading of 50.1 overall (where 50 indicates growth), the worst result in over six years.

The weak data comes amid trade tensions, weak global growth and continued Brexit uncertainty.

Germanys private sector entered contraction, with IHS Markit economist saying of Europes largest economy:

The slowdown in the service sector in September was even worse than first feared, with the final results showing the weakest business activity growth for three years. A technical recession now looks to be all but confirmed.

He added:

It isnt all bad news, with the latest data showing overall price pressures continuing to ease and stillsolid job creation in the service sector, which should help maintain a degree of resilience in consumer spending. The worry is, though, that staff shedding across manufacturing could soon outweigh the employment growth in the service sector.

#Germany's Composite #PMI has dropped to 48.5, a 83-month low. A #recession seems 'inescapable'. pic.twitter.com/mOgX9F8OY3

jeroen blokland (@jsblokland) October 3, 2019

Stagecoach shares fall after group keeps outlook unchanged

A slightly quirky move this morning: Stagecoach shares fell as much at 8.9pc at the open after the transport group announced it expects to meet its trading expectations from the near to May 2020.

Shares quickly pared back, and are now down just under 1pc.

The group reported lower than anticipated in its regional buses division, but struck an upbeat tone on the other parts of its operations. The company said:

The Board is satisfied that the programme has largely achieved its objective of making appropriate use of our cash, whilst retaining a good financial position and maintaining an investment grade credit rating.

Market turmoil: What happened yesterday?

Yesterday, in short, was a bloodbath for global stocks.

The FTSE 100 clocked up its worst drop since January 2016 (worse than the day after the Brexit vote, although intraday drops then were greater). In the US, the benchmark S&P 500 recorded its worst back-to-back sessions since August.

Where did it all go wrong? Analysts have pointing to several major worries for investors:

Poor economic data: A wave of weak economic headlines added to worries of a global slowdown, with the mood music set by Tuesdays dire ISM US manufacturing activity results. Poor construction data from the UK and weak private payroll data from the US added to the malaise, while China continued to show signs of weakness.

WTO ruling: The World Trade Organisation gave Washington the green light to slap tariffs on the EU in response to state aid handed to Airbus. That raises the spectre of Donald Trump opening a second front against Europe in his trade wars, even as negotiations with China continue.

Brexit: Britains exit from the EU remains a pain point for the UK and Europe, delaying investment decision and adding to a sense of inertia. Though yesterday involved the first substantive plans to come out of Downing Street. several of the suggestions raised were of a flavour that had already been ruled out. Investors, who fear the potential damage of a no-deal Brexit but also hate uncertainty, were given little to celebrate.

FxPro analyst Alex Kuptsikevich said:

The tariff announcement proved to be very untimely news for the markets that had previously been under pressure from weak economic data from the US and Europe. The introduction of tariffs and fears of tit-for-tat steps could further suppress business sentiment, which is already at the lowest levels for years.

Coming up, we have services activity data from the UK. Its Britains lynchpin sector, so the results will be closely monitored.

these services PMIs are going to be pretty damn crucial to sentiment

Neil Wilson (@marketsneil) October 3, 2019

Here are some photos of Wall Street traders putting their hands over their mouths, to give a sense of how bad things were on the stock markets yesterday:

Full report: Ted Baker swings to a loss

Heres a full report on those disastrous results, by my colleague Michael ODwyer:

Ted Baker revealed it made a 23m pre-tax loss in the 28 weeks to August 10, a sharp reversal from the 25m profit it delivered in the same period last year.

It has been hit by internal management turmoil and has struggled to adapt to the changing retail environment and shift towards online shopping. The company also blamed price pressure from heavy discounting and unseasonably warm weather in September.

Read more here: Ted Baker shares tumble after retailer swings to a loss

FTSE falls

The FTSE is in the red again this morning, the day after it recorded its biggest drop since January 2016. Early signs point to continued pressure from heavyweight energy sector, with BP and Shell both sinking for a second day amid global trade fears.

Ted Baker shares plummet

London trading has been open for less than 20 minutes, and already theres one massive casualty on the markets: retailer Ted Bakers shares have plummeted by about 30pc after some seriously disappointing results.

The company blamed competition and warm weather as it reported a 23m loss for the six months to August, and said sales had declined.

Lindsay Page, who took over as its Chief Executive after the ignominious exit of founder Ray Kelvin earlier this year, said:

We are continuing to pro-actively manage the significant challenges impacting our sector including weak consumer spending, macro-economic uncertainty, and the accelerating channel shift towards e-commerce. However, we are not immune to these pressures which have impacted our financial performance during the first half of the year.

Very poor results from Ted Baker which under Ray Kelvin often outperformed its rivals. A deep slide into the red and a slide in sales on challenging backdrop

Ashley Armstrong (@AArmstrong_says) October 3, 2019

Its almost like they want the stock to be cheaper...

Julian Harris (@Hariboconomics) October 3, 2019

Imperial Brands in need of a new leadership team

Coopers departure leaves Imperial Brands searching for both a chairman and chief executive.

The firm announced earlier this year that it was searching for a new chairman to replace Mark Williamson, who has been in post since 2007, exceeding the nine-year cap in set down in new corporate governance guidelines.

Speaking about Cooper, following the announcement of her departure, Williamson said:

Alison has worked tirelessly and with great energy and passion during her 20 years with Imperial, nine of which have been as CEO, and the Board would like to thank her for the tremendous contribution she has made.

During her tenure as CEO the business has been significantly simplified and reshaped to strengthen its long-term growth potential, and more than 10 billion in dividends has been returned to shareholders.

Another one bites the dust: Imperial Brands boss Cooper steps down

Imperial Brands said boss Alison Cooper is bringing down the curtain on her two decades at the tobacco giant.

Ms Cooper has led the maker of Gaulouises and Davidoff for nine years. She will depart from the company once a successor is found, Imperial said.

The FTSE 100 firm revealed last week that profits would be flat for the year ended September 30.

It warned that the environment for its next generation products had deteriorated considerably over the last quarter amid threats of a regulatory crackdown in the US.

Read more here: Imperial Brands boss Alison Cooper ends nine-year tenure

A plethora of big City names stepped down yesterday:

Martin Gilbert is to stand down from Standard Life Aberdeen's board and join Revolut as chairman

Metro Bank founder Vernon Hill said he would quit at the end of the year

Why are markets tumbling?

Markets were rattled yesterday by a ruling by the World Trade Organisation opened the door to a tariff war between the US and EU.

The US was given permission by the World Trade Organisation to impose tariffs on $7.5bn (6.1bn) of EU goods. Levies on a wide range of EU exports from aircraft to cheese could be implemented within days,

Matters were made worse by weak jobs data in the US and woeful British construction data.

To get up to speed on a tumultuous day, take a look at Louis Ashworths report:

FTSE set to open lower

The FTSE 100 is set to open lower, continuing the sell-off that saw 63bn wiped from Londons blue-chip index yesterday.

Futures trading currently indicates the index will open more than 0.44pc lower, adding to yesterday's 3.23pc slump. Stay with us today as we could be in for another bumpy ride on global markets.

Agenda: Will markets bounce back from yesterdays rout?

Good morning. Panicked traders wiped 63bn off the FTSE 100 yesterday as Britains blue chip index endured its worst day since the Brexit vote amid a global stock market sell-off.

Only two of Londons top listed firms Flutter Entertainment and Tesco managed to close up on the day as the stock index flipped almost entirely into the red.

Across Europe, equities had their worst day since broad sell-offs in mid-August. Will markets bounce back today?

5 things to start your day

1) Tesla has reported record delivery numbers but fell short of its 100,000 target for the three months ending in September. Shares in the electric car firm fell by 4pc after hours after it posted the figures, which show the company delivered 97,000 cars. The number falls short of average Wall Street estimates, which predicted the company would deliver 99,000 vehicles.

2) Being a generous chap, Chancellor Sajid Javid wants to give four million of us a pay rise. But might he do some of us out of a job as well? The Chancellor took a shot at pushing Brexit out of the headlines at the Conservative Party conference this week with his pledge to take the National Living Wage to 10.50 an hour in five years time.

3) London trader sues Citigroup for $112m: One of the City traders acquitted of rigging the $5.3 trillion a day currency markets is suing Citigroup for $112m (90m), claiming the US bank "quite literally fabricated" a case against him. A complaint filed on behalf of Rohan Ramchandani in a US court on Wednesday claims the bank embarked on a secret scheme to try to dirty up his name.

4) The US has been given the green light by the World Trade Organization to impose tariffs on $7.5bn (6.1bn) of EU goods. In what could spark a sharp escalation of hostilities between Washington and Brussels,levies on a wide range of EU exports from aircraft to cheese could be in place within days.

5) Facebook's plan for a new global digital currency looks in jeopardy after reports that two major credit card companies may pull out. The social media giant had recruited 27 other firms to be founding members of the Libra Consortium, a group designed to protect the independence of its new coin, Libra, from Facebook itself.

What happened overnight

Asian stocks skidded to a one-month low on Thursday after the United States opened a new front in its trade dispute with Europe by imposing tariffs, adding to already-growing market fears about global growth.

MSCI's broadest index of Asia-Pacific shares outside Japan dropped 0.78pc. Japan's Nikkei stock index fell 2.2pc, on course for its biggest daily decline in six months. Australian shares slumped to a five-week low.

In Hong Kong, the Hang Seng index fell 0.48pc by the lunch break.

US stock futures were up 0.25pc, but this did little to bolster sentiment after shares on Wall Street suffered their sharpest one-day decline in nearly six weeks on Wednesday, when the three major New York share indexes all lost more than 1.5pc.

Yields on two-year US Treasury yields fell as weakening data on manufacturing and the jobs market suggested the trade war with China has damaged the US economy.

On Wednesday, President Donald Trump's administration announced the United States will impose tariffs on $7.5bn of goods from the European Union.

Washington will enact 10pc tariffs on Airbus planes and 25pc duties on French wine, Scotch and Irish whiskies and cheese from across the continent as punishment for illegal EU aircraft subsidies.

Coming up today

It has been an ugly time for Ted Baker lately. The retailer slipped out of the FTSE 250 last Monday, and shares are trading at about a third of where they stood just a couple of years ago after successive profit warnings and the sudden exit of Ray Kelvin, the founder and chief executive.

Recently appointed replacement chief Lindsay Page, who took over from Mr Kelvin, is trying to cut cost cuts while also expanding the companys product lines. Thursdays results will offer the first taste of whether she has been succeeding.

Full-year results: Macau Property Opportunities Fund

Interim results: ICG Enterprise, Ted Baker

Trading update: CMC Markets, Hyve Group