GBP/USD Daily Fundamental Forecast – July 26, 2017

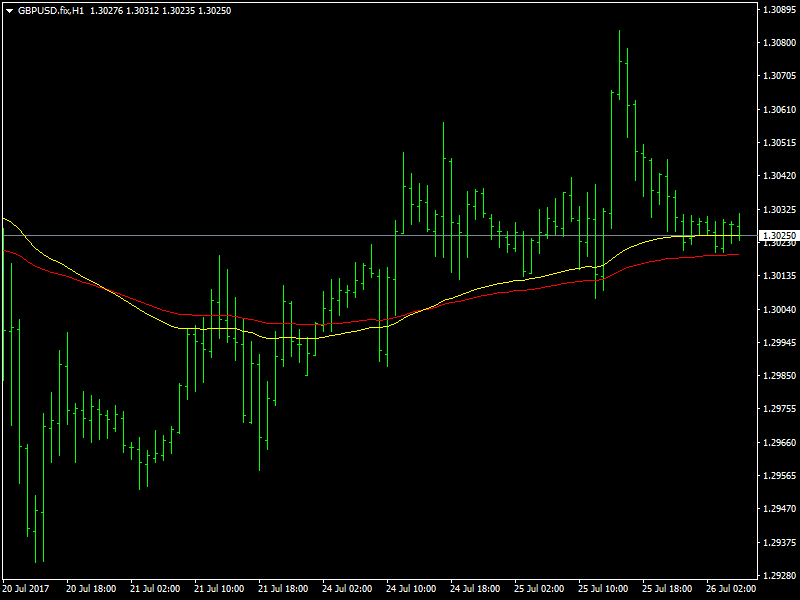

The price action in GBPUSD pretty much followed that of EURUSD during the course of the day which was something to be expected due to the lack of economic data in most parts of the world, as this is the last week of the month. So, we saw the pair rising during the early half of the day and then correcting towards the end of the day to finish almost at the same place where it has started the day.

GBPUSD Follows the Euro

The point to note in the price action from yesterday is the support that the pair seems to be having in the 1.3000 region which should give a lot of confidence for the bulls. We had seen this kind of buying support in the 1.28 region during the course of last week which helped the pair to move towards 1.31 towards the close of the week and this level of support seems to have moved higher during the course of this week and now we see it at 1.300. On the other hand, this region makes it the obvious target of the bears who would want to push the prices below this to bring in some panic selling.

So far, the region around 1.3000 has held up very well this week and it remains to be seen whether the pound bulls would be able to use this as a launch pad to push it even higher. We have only one piece of economic data of note for this week and that is the FOMC meeting minutes that is to be released late in the day today. Yesterday, we saw some recovery in the dollar on the back of strong consumer confidence data and also due to the resurrection of the healthcare bill as the Republicans voted to reopen debate on the same.

We have to see whether the dollar recovery continues today as well as all eyes would be glued to the minutes to see what the Fed thinks about the economic and monetary policy and also to see whether there is any hint of when the next rate hike from the US would be.

This article was originally posted on FX Empire