GBP/USD Daily Fundamental Forecast – January 22, 2018

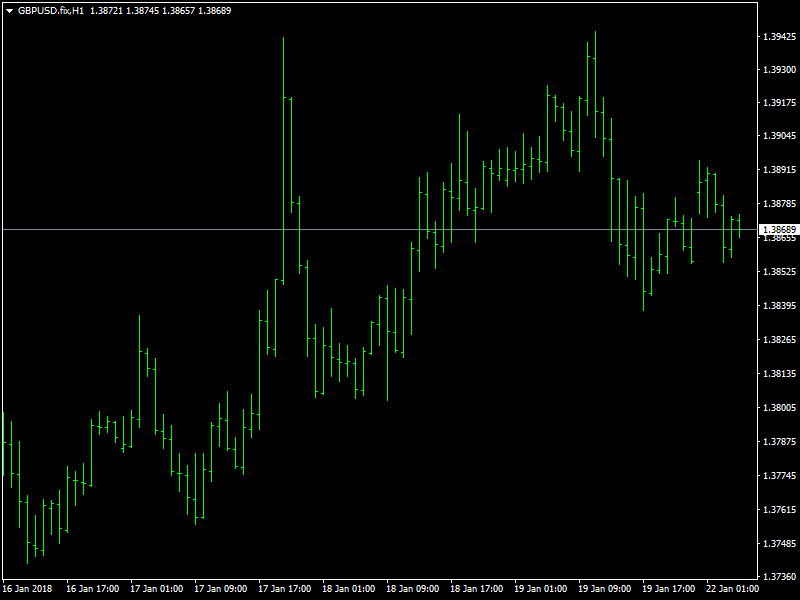

The pound closed lower for the day on Friday and the pair closed the week below the 1.38 region as the approach towards the strong psychological resistance of 1.40 has been met with a lot of selling and profit taking which is quite expected after an extended bull run. The pair is expected to consolidate in the short term and probably even correct lower before it launches an attempt at the range highs and beyond 1.40 once again.

GBPUSD Under Pressure

The dollar has been on the backfoot for over a month now and the pound has been gaining due to this. And it is not only the dollar weakness that is helping the pair to move higher, it is also the inherent strength in the pound as well as the pound has been helped by the anticipation that the Brexit could be a soft one rather than a hard one after all. This would help the UK to continue with a majority of its trade with the Eurozone which would be beneficial for the UK in the long run.

But over the weekend, there have been reports that some of the Eurozone leaders are not ready to grant easy access to their trading zone and there are also reports of some upcoming political trouble for the UK PM May with some of her opponents looking to start a new political party. But all this is a matter of conjecture at this point of time but this has been enough to bring in some uncertainty and cause the pair to move lower during the course of the day on Friday and today as well as the pair trades comfortably below the 1.39 region as of this writing.

Looking ahead to the rest of the day, we do not have any major news from the US or the UK and hence we can safely expect some consolidation in the pair. The government shutdown in the US has not had much of an impact on the prices so far but we have another round of voting in the US Senate later in the day and that could bring in some volatility. If that bill passed through, then we can expect the dollar to gain in strength and put pressure on the GBPUSD pair.

This article was originally posted on FX Empire