GBP/USD Daily Fundamental Forecast – July 19, 2017

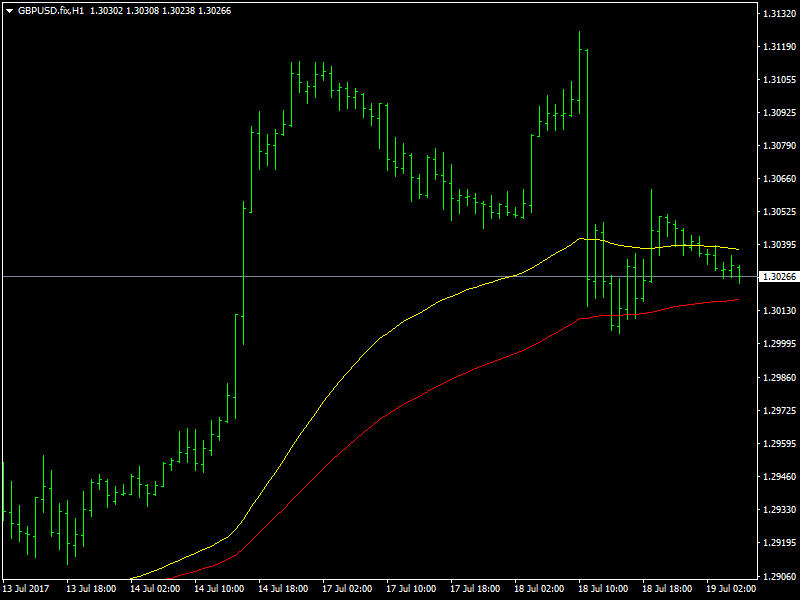

The GBPUSD pair corrected back lower yesterday as the inflation data came in much weaker than expected. This made the pair push back below the crucial 1.3030 mark thus negating the move that came in last Friday. With the pair now below the critical mark, it remains to be seen how the pair is likely to behave in the coming days and we will have to see whether the pair is able to break back above that region to continue its onward journey in the short term.

GBPUSD Falls on Weak Inflation

It has been noticed that over the last few weeks, the economic data from the UK has been weaker than expected. This is in contrast to the trend since the beginning of the year when the UK data had always managed to beat the expectations despite a lot of political and economic turmoil being brought about by the Brexit process. This should be a matter of concern for the BOE especially in times when they are seriously discussing about the hiking of rates in the near future. The economic data is likely to be a key component in that decision making process and so the weakness in the data should make them think twice.

The GBPUSD pair has largely managed to brush aside the concerns over the weak data and the Brexit process over the last few weeks mainly due to the weakness in the dollar across the board and also due to the support of the BOE. But if and when the dollar begins to stabilise, the focus will shift back to the BOE and the economic data and unless they support each other, the going could get tough for the pound bulls.

Looking ahead to the rest of the day, we do not have any major news from the UK or the US for today and we expect the pair to have some choppy trading around the 1.3050 region as the market consolidates and ranges.

This article was originally posted on FX Empire