Gas prices expected to stay low because of the coronavirus

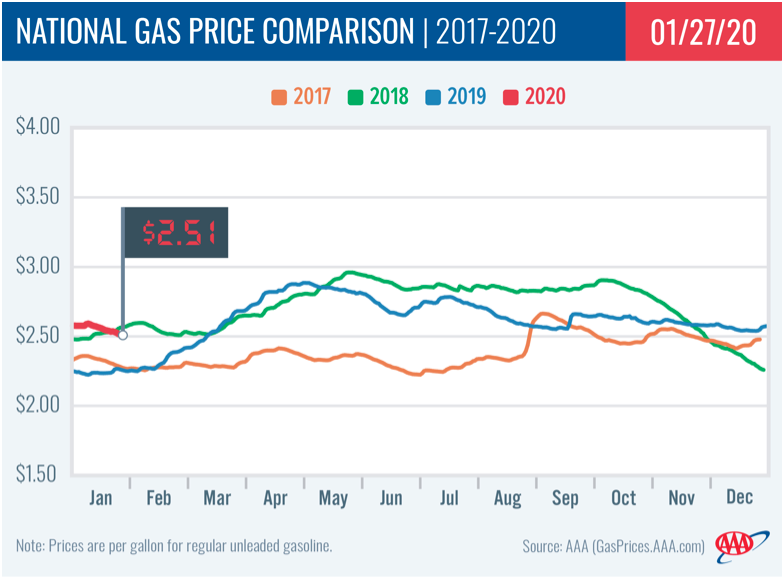

Gas prices nationwide are at an average of $2.517 per gallon of regular, down 4 cents from last month, according to AAA. This is the lowest since March 10, 2019, according to GasBuddy.

But prices might sink lower — and stay lower.

According to Patrick DeHaan, head of petroleum analysis at GasBuddy, today’s market action saw prices 20 cents lower per gallon than last week.

“Easy call to say lower #gasprices coming,” he wrote on Twitter.

The Energy Information Administration (EIA) said last week that domestic stocks have grown to 260 million barrels, the largest supply stock ever. This isn’t too different from winter of 2019, but with one big difference — less demand from consumers.

“As these trends continue, American motorists will likely continue to see lower pump prices,” AAA wrote last week. According to AAA, the biggest decreases are in Florida (-8 cents), Michigan (-8 cents), Pennsylvania (-6 cents), South Carolina (-6 cents), Delaware (-5 cents), North Carolina (-5 cents), Maryland (-5 cents), and Louisiana (-5 cents).

Other factors are contributing to lower demand. According to both AAA and DeHaan, the coronavirus could lead U.S. gas prices to fall further, potentially dropping by 15 to 30 cents per gallon if the pace of the infection continues, DeHaan says.

DeHaan pointed to the fact that China is the world's second largest oil consumer, and the travel restrictions and demand suppression from fears over infection could further hurt demand and erode the value of oil — which would also lower gas prices worldwide.

“Should the coronavirus spread for several more weeks with little success of slowing, it could erode or delay the seasonal rise in gas prices that typically starts in late February,” DeHaan told Yahoo Finance in an email. Furthermore, he added, the coronavirus is significant enough to draw OPEC’s attention and put more oil production cuts into consideration.

-

Ethan Wolff-Mann is a writer at Yahoo Finance focusing on consumer issues, personal finance, retail, airlines, and more. Follow him on Twitter @ewolffmann.

The first thing to do after you're involved in a hack, according to experts

Companies are secretly scoring you, but good luck getting your data

'Snake oil salesmen': Two neurologists respond to the CBD craze

Large-scale credit card hackers back for the holiday season, ex-FBI investigator says

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.