Gary Lineker used offshore firm to buy Barbados home

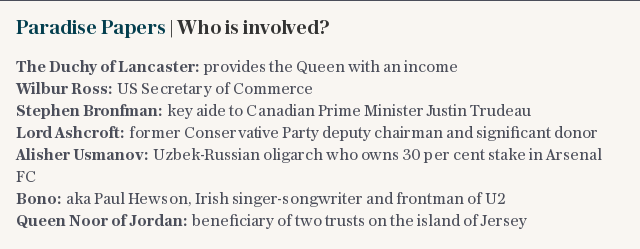

Gary Lineker avoided stamp duty when selling his luxurious Barbados home because he purchased it through an offshore firm, the Paradise Papers suggest.

The Match of the Day host co-owned a property through a company called Goalhanger Inc, based in the British Virgin Islands, which allowed him to avoid the tax when it was sold, five years later.

Stamp duty is only payable in Barbados when a home is sold, but the offshore structure makes it possible to avoid paying the tax altogether, ensuring that any profits can be transferred out of the country immediately.

The revelations come just days after Linker, 56, stated on Twitter that he would “sleep very soundly” in the wake of the latest data leak, adding: “I rather doubt I’ll be mentioned as I happily pay my taxes.”

Shortly after he was implicated in the Paradise Papers, he returned to Twitter to point out the tax had been paid and declared to HMRC.

When a journalist drew attention to the story concerning his property, writing “Now read this,”' Lineker hit back: “Please do so, especially this bit ‘the sale had been declared to HMRC and all taxes due in the UK and abroad had been paid in full.”

Lineker’s agent told the Telegraph there would be “no reaction” to the allegation that he had avoided tax through the use of an offshore vehicle.

The father-of-four purchased a five-bedroom mansion on the exclusive Royal Westmoreland Golf and Country Club development in Barbados in 2005.

The property featured sweeping ocean views, a 50ft heated swimming pool and marble bathrooms and was once described by Lineker as the perfect location for a family getaway.

The former England captain is said to have personally overseen the renovation work on the £2.2 million property.

It is not known whether this is the home referenced in the so-called Paradise Papers, which show that a property was sold by Goalhanger, of which Lineker is a director, to new owners in 2010.

In Barbados, if a home is purchased by an individual or a local company, when it is sold they are liable to pay 1 per cent stamp duty and 2.5 per cent in transfer taxes, potentially amounting to hundreds of thousands of pounds.

The issue of giving tax breaks to foreigners has proved an ongoing concern in Barbados, which is in the midst of an economic crisis.

Grenville Phillips, the founder of Solutions Barbados, a political action group which will field candidates in next year’s general election, told the Guardian: “We plan to institute a system where tax avoidance will be challenging, very, very difficult.

“We are not persecuting anyone, that should be very clear. We’re not saying you have to pack your bags and go, or you pay all sorts of fees to live in Barbados. But we will look at things and see if they are fair.”

Other Britons who reportedly have BVI companies registered to own property in Barbados in the same way include Mike Gatting, the former cricketer, who owns a BVI company with his wife, Elaine.

Gatting told the Guardian the arrangements had been put in place by a family solicitor at a time when BVI companies were less contentious and said he was currently trying to sell his property.

“The indications are that any profit on sale will be modest. If a taxable profit is made, the tax due will be paid,” he said.

Until 2007, there were restrictions on how much money from a property sale could be transferred out of Barbados in one go.

But the rate of transfer tax was cut from 7.5per cent and the rules were changed to allow those from abroad to repatriate their takings without controls.

Owen Arthur, the then prime minister of Barbados, said the adjustments were designed to “stop the leakage of revenue that occurred when transactions involving the sale of property were done offshore”.