Pound surges as Bank of England's Haldane turns hawkish; Oil heads for steepest first-half fall since 1997

British budget deficit narrows as expected in May

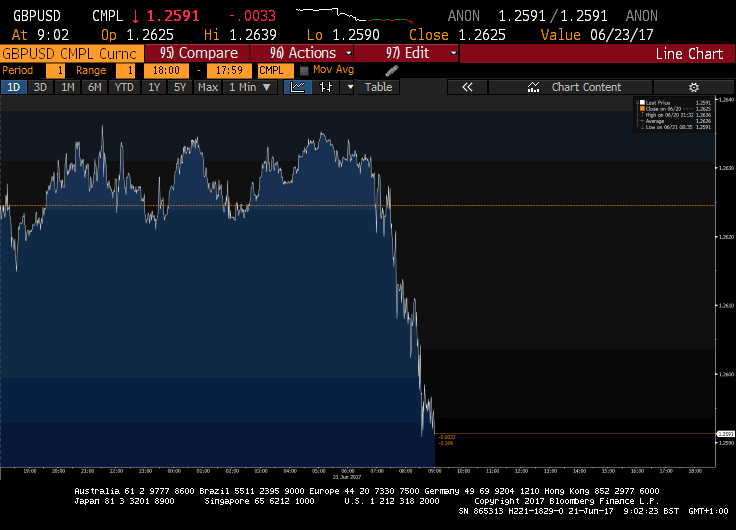

Pound sinks below $1.26 for first time since April

Bank of England chief economist poised to vote for interest rate hike this year

European shares close lower as oil weakness weighs

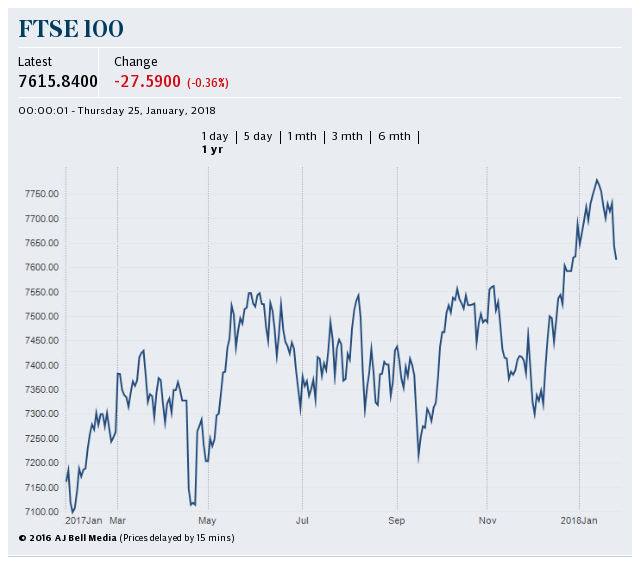

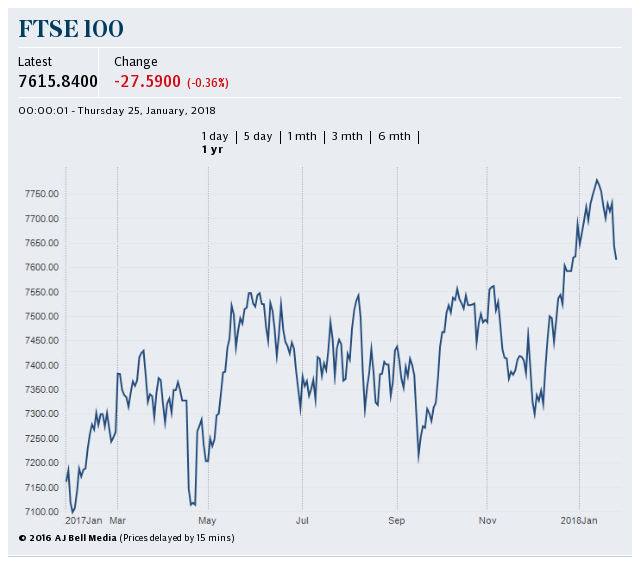

European shares ended the day in the red after a renewed slide in oil in afternoon trading. In London, the pound strength weighed on the FTSE 100.

Here are the provisional closes:

FTSE 100: -0.33pc

DAX: -0.50pc

CAC 40: -0.51pc

IBEX: -0.16pc

Chris Beauchamp, of IG, said: "Were it not for Andy Haldane, the FTSE 100 may have managed to end the day in positive territory. A day after Mark Carney soothed nerves by declaring his unwillingness to raise rates, chief economist Andy Haldane chucked a spanner into the works by announcing that he thought the time was nearly upon us. Mr Haldane is one of the internal members of the MPC, and so his conversion from dove to hawk sent the pound flying higher, on expectations that others on the committee will follow his lead, boosting the hawkish caucus that was so surprisingly vocal last week.

"Top of the FTSE was Whitbread, which rallied 3.7pc on a trading statement that pointed to further growth both in the UK and abroad for its Costa chain; Whitbread looked remarkably cheap at £38 per share this week, but it will take a lot of strength and plenty more in the way of good trading updates to push the shares through the £43 level that has held back progress for over a year."

Pound turns negative (again) despite fall in crude stocks

After ticking higher after data showed US crude stockpiles fell last week, oil prices have tumbled into the red again.

Brent crude is now down 0.5pc at $45.81-barrel.

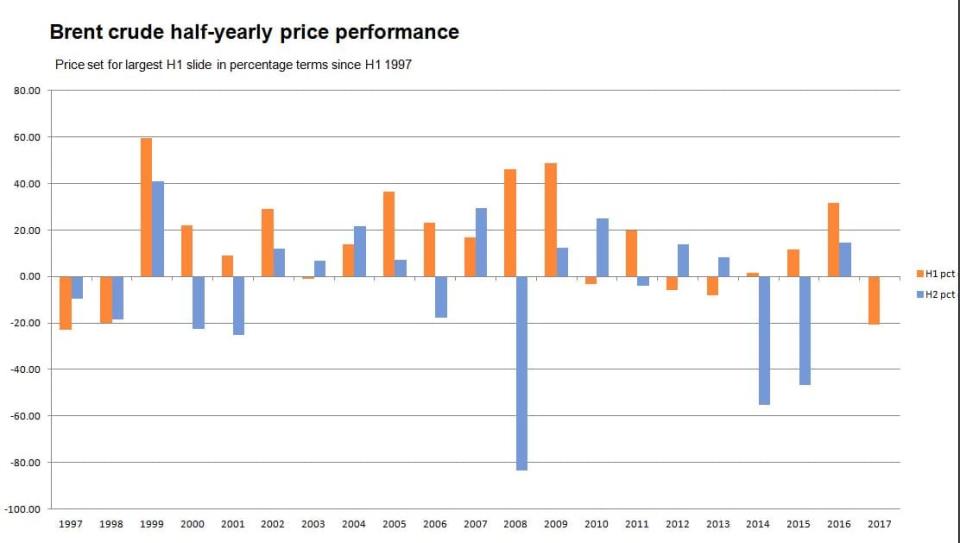

Oil prices have fallen by more than 20pc since January, putting it on track for its worst first six months of the year in two decades.

US crude and gasoline stocks fall in week

Good news for oil prices! US crude stockpiles fell by more than expected last week, data from the Energy Information Administration showed this afternoon.

Crude inventories fell by 2.5m barrels in the last week, surpassing analysts' expectations for an decrease of 2.1m barrels.

Crude stocks at the Cushing, Oklahoma, delivery hub m fell by 1.08m barrels, EIA said.

Gasoline stocks fell by 578,000 barrels, compared with analysts' expectations in a Reuters poll for a 443,000 barrels gain. An seasonally unusual gasoline build last week was seen as bearish in the market.

#UnitedStates EIA Crude Oil Stocks Change at -2.451M https://t.co/FqwAVTRHATpic.twitter.com/zQb94sa4Dp

— Trading Economics (@tEconomics) June 21, 2017

US existing home sales rise unexpectedly in May

Over in the US, home resales unexpectedly rose last month, touching their highest level in a decade, data showed this afternoon.

The National Association of Realtors said existing home sales increased 1.1pc to a seasonally adjusted rate of 5.62m units last month.

Forecasts pointed to a drop of 0.5pc.

The number of homes on the market rose 2.1pc, but supply was down 8.4 percent from a year ago.

#UnitedStates Existing Home Sales at 5.62M https://t.co/7dSBQ3LOpJpic.twitter.com/bRT2QFNQrZ

— Trading Economics (@tEconomics) June 21, 2017

ING sees no Bank of England rate hike this year

Despite Andy Haldane's hawkish speech today, ING still thinks a consumer squeeze and uncertainty means the Bank of England will not raise rates this year.

#Haldane the hawk's comments certainly mix things up a bit, but we still think consumer squeeze + uncertainty means no #BoE hike this year pic.twitter.com/S7LWNZZEge

— James Smith (@SmithEconomics) June 21, 2017

Nomura: Trading sterling with a medium-term view has been 'painful'

Jordan Rochester, of Nomura, says trading sterling with a medium-term view has been "painful".

He sad: "The price action has been lower in recent weeks, with only three notable days where it fell (UK election and BoEinspired events) but the days in between showing small but consistent inclines so the flow is perhaps not all one way.

"We expected the hung parliament to lead to a pricing of less austerity and softer Brexit hopes, but thanks to the mixed BoE communication both have failed to materially lift the pound. However, with Andrew Haldane’s more hawkish comments today we may have witnessed a game-changer in the BoE’s MPC."

Wall Street opens higher as tech stocks regain ground

Wall Street opened higher this afternoon, despite persistent oil weakness, as tech stocks regained momentum.

At the opening bell on Wall Street:

Dow Jones: +0.07pc

S&P 500: +0.13pc

Nasdaq: +0.29pc

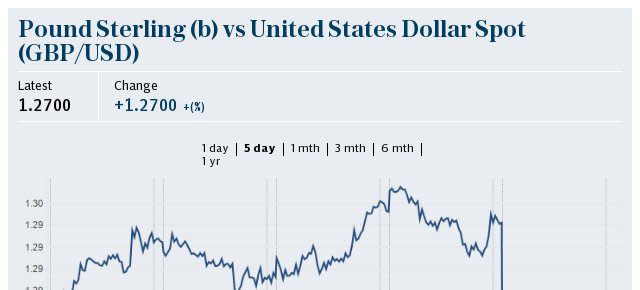

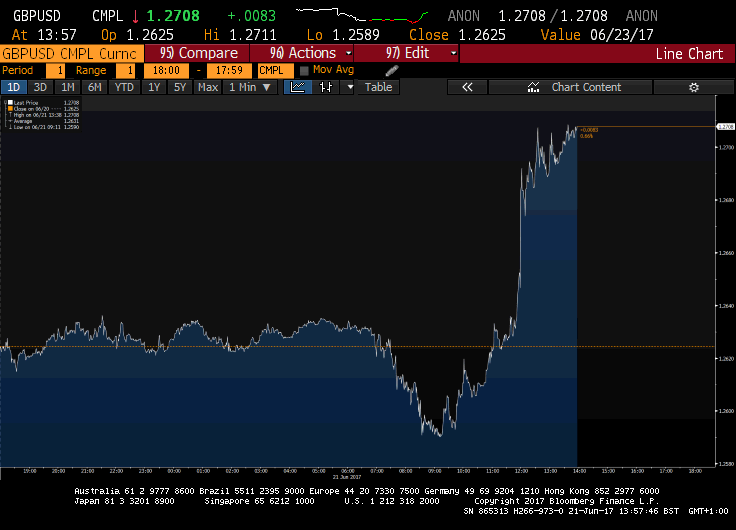

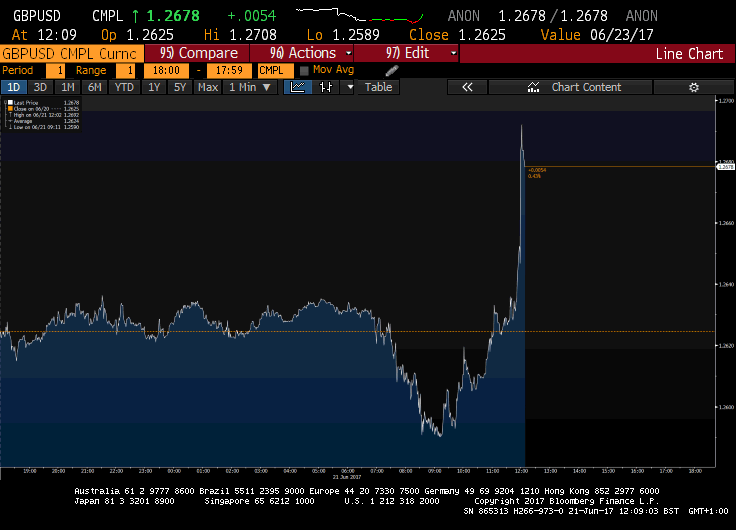

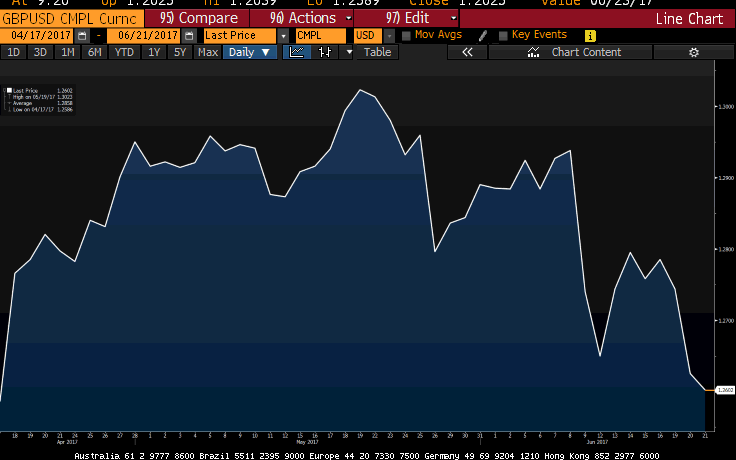

Pound continues ascent higher after Haldane speech

Forget the Queen’s Speech, it was all about Andy Haldane this morning, Fawad Razaqzada, of Forex.com, said this morning.

Razaqzada said Haldane's comments came as "a major surprise" as the Bank of England economist has long been a known dove.

"He is going head-to-head against the Governor Mark Carney, who is fast losing support on his dovish stance. He said that “a partial withdrawal of the additional policy insurance the MPC put in place last year would be prudent relatively soon," Razaqzada added.

"Mr Haldane said that the risk was that the Bank tightened its belt too late rather than too early. This is something which the Bank of Canada is also worried about and what the US Federal Reserve had long been wary of, and the European Central Bank better be ready for. The latter came across pretty dovish at its last meeting. With the BoE turning hawkish and ECB remaining dovish, the EUR/GBP could come under pressure in the coming days and weeks."

The pound has held on to its gains following Haldane's speech, and continues its ascent higher. It is currently trading up 0.62pc on the day at $1.2706.

US stocks set to open lower as oil slide weighs

US stocks are set to join their European counterparts in negative territory when the opening bell sounds on Wall Street later today.

Oil has lost more than 20pc in value this year, putting it on track for its worst performance for the first six months of any year since 1997. The oil slide is set to weigh on energy stocks.

Here are the opening calls courtesy of IG:

US Opening Calls:#DOW 21480 +0.05%#SPX 2436 -0.04%#NASDAQ 5719 -0.12%#IGOpeningCall

— IGSquawk (@IGSquawk) June 21, 2017

Want a pay rise? Get a new job, says Bank of England

Workers are getting pay rises - but only if they move jobs, as companies make big wage offers to new staff but are holding off giving existing workers a raise.

Unemployment is at record low levels and businesses are keen to hire more staff, a combination that should result in rising salaries.

But wages are sluggish and employees are becoming worse off as prices rise more quickly than pay, a situation that economists have struggled to understand.

Now the Bank of England’s agents - staff who speak to businesses across the country - have found that pay rises are focused on new staff, not the total workforce.

More than 50pc of companies said they were finding it increasingly difficult to retain and recruit key staff.

As a result “a small majority had made changes; of those, the most common response was to increase the pay offered to new recruits or to key existing personnel. Such responses were common across all sectors, and were most frequently cited in construction”, the Bank’s agents said.

Read the full report by Tim Wallace here

Two-year UK gilt yields rise to highest level since January after Haldane speech

Two-year UK gilt yields have touched their highest level since January as markets digest Andy Haldane's speech.

They rose to 0.208pc, up seven basis points on the day, after Bank of England's chief economist Andy Haldane turned hawkish and said he expects to vote to raise rates later this year.

Another hawk unmasked

Ian Kernohan, Economist at Royal London Asset Management, reacts to Haldane's speech:

“Having thought there were only two hawks left on the MPC, it is now clear that there are three. Andy Haldane considered a rate rise in June, but decided to wait. He clearly considers a tightening is needed well ahead of market expectations.

“However, our own view is that the impact of political uncertainty on business confidence and the continued squeeze on household real incomes make a rate rise unlikely. It is not yet clear if any weakness in consumer spending is being offset by investment and net trade. Domestic inflationary pressures and in particular wage growth remain very subdued, with most of the recent rise in inflation due to the temporary impact of sterling devaluation.”

Markets still expect rates to remain on hold on 2019, despite Haldane's hawkish comments

Despite the hawkish signals from the Bank of England's Andy Haldane, Capital Economics points out that markets still expect interest rates to remain unchanged until 2019.

Despite recent hawkish signals from BoE - including Haldane's comments today - markets still expecting rates to remain on hold until 2019 pic.twitter.com/VOXDsLxDw7

— Capital Economics (@CapEconUK) June 21, 2017

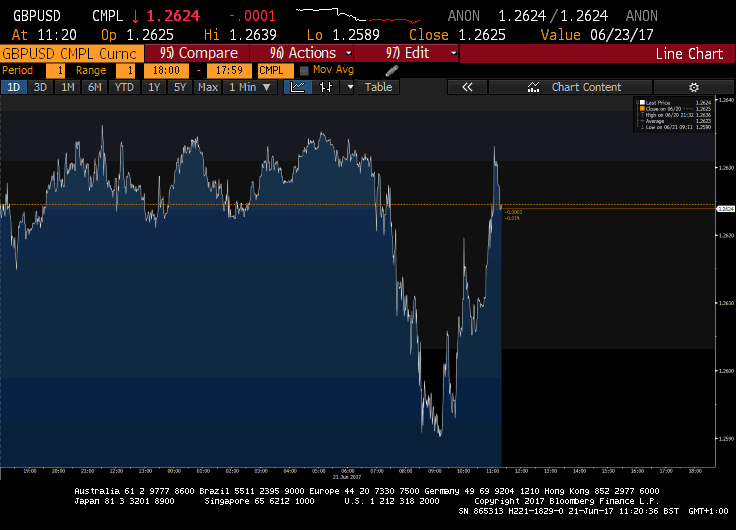

Pound extends gains after Haldane comments

The pound continues to push higher after Bank of England's Andy Haldane turned hawkish.

It is now trading up 0.6pc at $1.2710.

Andy Haldane's hawkish comments giving #GBPUSD a lift and sending $FTSE lower: pic.twitter.com/5MXgY3yVLG

— Chris Beauchamp (@ChrisB_IG) June 21, 2017

Bank of England's Andy Haldane: From dove to Hawk

Our economics correspondent Szu Ping Chan reminds us that last year Andy Haldane supported a "sledgehammer" approach to stabilising the post-Brexit economy.

Haldane began MPC life on "front foot"(Jun 2014), started to watch inflation "like a dove"(Nov 14), called 4 Brexit "sledgehammer", now this pic.twitter.com/p57VuxTVRU

— Szu Ping Chan (@szupingc) June 21, 2017

Danske Bank: Looks like a 70's video game

Looks like 70's video game ...

���� ... but #BoE's Haldane's comments now suggest he is not as dovish as we previously thought. #UK#Brexitpic.twitter.com/Cuw7WwzTm4— Danske Bank Research (@Danske_Research) June 21, 2017

Reaction to Haldane speech: 'Major change in position from BoE chief economist'

Major change in position from BoE chief economist and uber dove Andy Haldane. Says he expects to vote for a rate hike soon. Sterling jumps. pic.twitter.com/3sUXSdknmg

— Jamie McGeever (@ReutersJamie) June 21, 2017

GBP desks following the Haldane speech pic.twitter.com/x6RPzS0e8y

— World First (@World_First) June 21, 2017

The Independent's Ben Chu points out that Andy Haldane had "a flip-flop on raising rates in 2014".

...worth bearing in mind that Haldane had a flip-flop on raising rates in 2014. Could well happen again if the data comes in worse... pic.twitter.com/nANApfjZBe

— Ben Chu (@BenChu_) June 21, 2017

HALDANE the hawk? @bankofengland chief econ says interest rate rise needed "relatively soon" if growth remains steady (if not spectacular) pic.twitter.com/H1W9vwQRie

— Szu Ping Chan (@szupingc) June 21, 2017

Andy Haldane's speech is mostly about how weak wages are, but he turns hawkish at the end. Why?

— Chris Giles (@ChrisGiles_) June 21, 2017

FTSE 100 hits session low on Haldane's comments

On equity markets, the FTSE 100 slipped to a session low, now down 0.5pc, after Bank of England's chief economist Andy Haldane said he expects to vote for an interest rate hike this year.

Meanwhile, the mid-cap index also accelerated its looses, down 0.5pc, on Haldane's comments.

Markets react: Pound spikes above $1.27 as Haldane goes from dove to hawk

The pound spiked above $1.27 after Bank of England's chief economist stroke a more hawkish tone than the Bank's governor.

In a speech published on Wednesday, Haldane, who voted to keep rates unchanged last week, said he was likely to change his vote in the coming months.

"Provided the data are still on track, I do think that beginning the process of withdrawing some of the incremental stimulus provided last August would be prudent moving into the second half of the year," he said.

In its wake, the pound popped by more than 0.4pc to $1.2708, having traded below $1.26 earlier today.

Meanwhile, against the euro, the pound gained 0.3pc to trade at 87.86p per euro.

UK gilt futures fell around 20 ticks on the speech, while December 2017 short sterling contracts fell by 6 basis points to 99.58 - reversing its whole move since yesterday's Mansion House speech.

Bank of England chief economist poised to vote for interest rate hike this year

Bank of England Chief Economist Andy Haldane said he was likely to back an increase in interest rates in the second half of this year. Our economics correspondent Tim Wallace reports:

Interest rates might have to rise this year to nip inflation in the bud and prevent a sharp jump in interest rates in future, the Bank of England’s chief economist, Andy Haldane, has said.

GDP is still growing and employment is rising strongly, indicating that the economy may be getting back to normal, he said. This indicates that the emergency level of ultra-low rates might no longer be needed, he added.

But Mr Haldane has not voted for a rate rise just yet because of the uncertainty caused by the general election, and because wage growth has remained weak.

Markets were shocked last week when three members of the Monetary Policy Committee (MPC) voted to raise rates, and now Mr Haldane has revealed that he considered joining them - and anticipates doing so later this year.

Such a decision would have left the committee evenly split at its June meeting - and so rates would only have stayed flat because Mark Carney, the Governor, has a deciding vote.

Mr Haldane held off for now, but said he might join those calling for a rise in the coming months.

“A partial withdrawal of the additional policy insurance the MPC put in place last year would be prudent relatively soon, provided the data come in broadly as expected in the period ahead,” he told an audience in Bradford.

Pound spikes higher after Queen's Speech

The pound has regained momentum following the Queen's Speech.

It is now trading 0.2pc higher on the day at $1.2648, having slumped to a two-month low of $1.2589 in early trade.

Naeem Aslam, of Think Markets, said: "The biggest news flash in her speech was that Trump was not mentioned. King of Spain is coming to the UK but nothing about Trump. In the light of Brexit, this is an important element to look at. What it means is that the UK is looking for a more better relationship with the EU and the US is not on top of the agenda. Remember, that Trump did say that the UK is front of the line in terms of making a deal. But if there is no invitation for Mr Trump, it could sour the relationship which the UK was seeking with the US.

"In terms of currency, the market was pretty much zombie during her speech but the after the reaction is positive for the sterling as the currency moved higher against the dollar."

Queen's Speech: The Government will introduce a Great Repeal Bill

The Queen's Speech is underway. Here's the latest from our politics correspondent Jack Maidment:

The Queen said: “A bill will be introduced to repeal the European Communities Act and provide certainty for individuals and businesses.

“This will be complemented by legislation to ensure that the United Kingdom makes a success of Brexit, establishing new national policies on immigration, international sanctions, nuclear safeguards, agriculture and fisheries.”

Head over to our live politics blog for the latest: Queen's Speech live: Theresa May to set out plans for hard Brexit

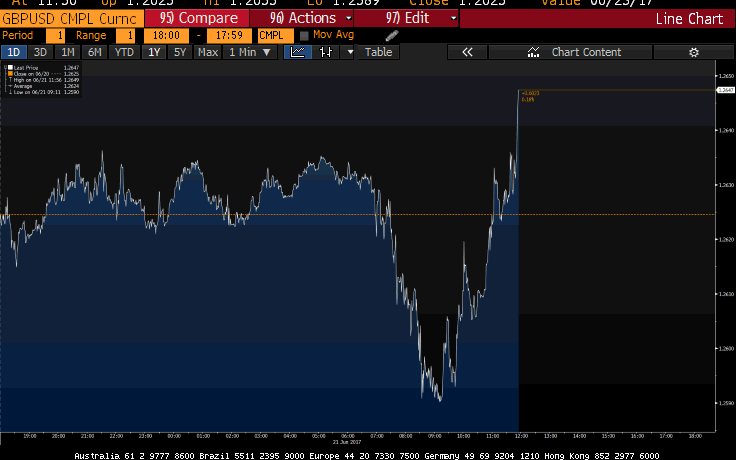

Pound recoups early losses

The pound has recouped early losses and is now trading flat on the day.

Earlier this morning, the pound slumped below $1.26 against the US dollar to its lowest level since April 18 (when Theresa May called the snap election).

It is now changing hands at $1.2625- flat on the day.

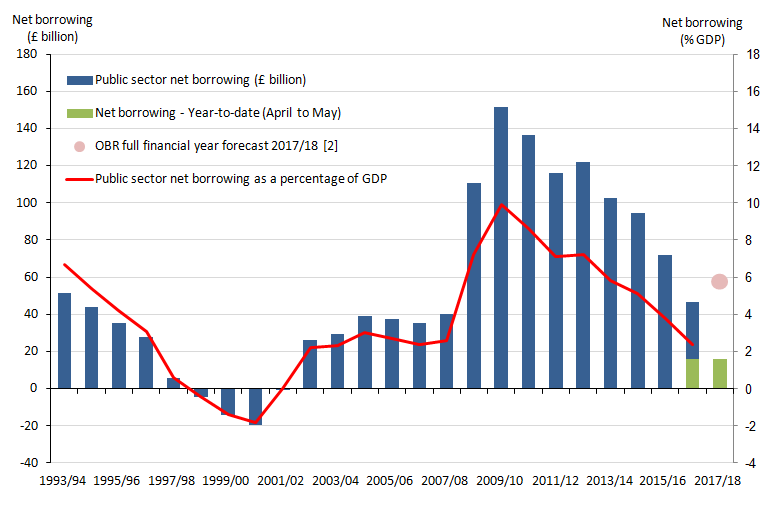

Boost for Philip Hammond as deficit drops to decade low in May

Government borrowing fell to its lowest in a decade in May, handing the Chancellor a welcome boost following a general election result that left the Tories without a majority in Parliament.

Public sector net borrowing, excluding public sector banks, fell to £6.7bn in May, according to the Office for National Statistics (ONS).

This was £0.3bn lower than the same month a year ago and the lowest May deficit since 2007. Economists had expected the deficit to edge down to £6.8bn.

The reduction in borrowing was helped by record May VAT receipts, while income tax and national insurance revenues also rose.

It came as the ONS also revised down its estimate for borrowing in the previous fiscal year to £46.6bn.

This is well below the Office for Budget Responsibility's (OBR) estimate of £51.7bn in the March Budget and the ONS's estimate of £48.7bn last month.

Oil bear market: You don’t pull the mask off that old Lone Ranger

Neil Wilson, of ETX Capital, weighs in on the oil price slump:

“You don’t tug on Superman’s cape and you don’t spit in the wind. So is OPEC’s production cut a similarly futile gesture? With crude entering a bear market it’s hard to see it as anything but.

"As hedge funds turn increasingly bearish and dump long positions oil has come under heavy selling pressure and is now trading at levels seen before the OPEC cut was agreed late last year as doubts mount about efforts to cut supply. Crude is enjoying its worst first half in 20 years and the plunge might get worse.

"Prices are now roughly 15% below where they were just before OPEC’s agreement to extend production cuts for another 9 months. As noted at the time, OPEC would have done a lot better to cut a lot harder, even if for a shorter period, than tinkering at the edges. It had the chance to really drain those excess supplies but failed to deliver."

But will oil continue to plunge, or have we hit the bottom? Mr Wilson says there are several factors to consider:

Does OPEC have the stomach or muscle for a prolonged fight? Saudi Arabia and Russia both say they’ll do whatever it takes, but there is only so much they can do when producers elsewhere can fill the void.

Complicating matters, output from Libya and Nigeria is climbing. They produced about 350,000 barrels a day more in May than in April. This is worth about a quarter of the monthly curbs agreed by OPEC. It’s clear that OPEC will have to bring these two countries, currently exempt from cuts, into line with the rest of the cartel if it wants to do something meaningful.

The floating of Saudi Aramco. Put simply, a higher oil price would make investors pay more for stock. We note that Mohammed bin Salman has been named as crown prince. He has been central to the Aramco IPO and the push for production cuts, which hints at where the regime is looking. (Saudi stocks have jumped on the news).

US output is climbing. Weekly field production data from the EIA shows this has jumped to 9.3 m b/d from a low of 8.5m last year. US refineries are also operating at record levels and have plenty of utilization flex left thanks to an increase in capacity in recent years. Inventories are showing a general trend lower, with stocks declining every week since the start of April but one.

Baker Hughes data shows the number of rigs drilling for oil in the US has risen by 509 to 933 in the last year as the cost of production has dropped while oil prices have until lately been reasonably well supported by OPEC’s efforts.

The cost of production is key as price moves are happening at the margins. Marginal falls in production costs for US tight oil fills the gaps in output easily. So far we’ve seen the average breakeven for shale producers in the US fall more than half in the last 4 years and the ‘raw’ breakeven now sits below $40 a barrel for Eagle Ford, Permian and Bakken.

US output is also set to rise quickly although the meltdown in prices could constrain a touch. The IEA expects US production to rise by 780,000 b/d in 2018 after an increase of 430,000 b/d in 2017.

Mr Wilson adds: "This suggests there is little upside to prices in the medium term unless OPEC can do something meaningful over the summer. This could be move to incorporate Libya and Nigeria into curbs, although the impact may be short-lived. OPEC and its allies could cut a lot deeper (+1m b/d to current curbs)– this would have the biggest effect on prices in the near-term as it would signal a willingness to follow up on ‘whatever it takes’ and would help mop up the excess supply in the market that currently exists a lot quicker.

"However as noted the fundamentals of falling US shale production costs means any one-sided defence of prices is spitting in the wind. Nevertheless, with oil an increasingly a very crowded short trade there is not much left in the long tank so we could see a brutal short-covering rally if there is significant movement from OPEC to tackle the supply side.”

Queens Speech watered down amid weakened Tory hand

With the Queen’s Speech ahead, it is clear that the UK will be the focus for the day, Joshua Mahony, of IG, said this morning.

"Today’s Queen’s Speech has to be one of the most memorable in living memory, and it hasn’t even taken place yet. In the first Queen’s Speech from a minority government in 39 years, we have seen this speech delayed, heavily amended, and ultimately overshadowed by calls for Theresa May’s resignation. She is a leader by name, but seemingly not by nature, and the crises of recent weeks have laid bare Theresa May’s personal shortcomings, which only add to the difficulty of passing a raft of unpopular austerity-focused policies.

"Ultimately the fact that Theresa May is having to drop so many elements of the Queen’s Speech not only goes to show that she is bowing to the pressure of the left, but also highlights the difficulty she would have passing any Brexit bill in two years’ time."

Oil set for worst H1 since 1997

Oil is set for its largest price slide in the first half of any year for the past two decades, Reuters has reported this morning.

So far this year, oil has lost 20pc in value, that's its worst performance for the first six months of the year since 1997.

Bank of England reports consumer squeeze, solid business investment

The Bank of England Agents' report has been released this morning. Reuters has the details:

The Bank of England reported that consumers were under growing pressure form rising inflation, but business investment plans had strengthened and sterling weakness was boosting export volumes.

The assessment from the BoE's regional agents broadly matches that in last week's policy statement, when three of the BoE's eight rate-setters unexpectedly voted to increase the cost of borrowing.

"In light of the further increase in price inflation for retail goods ... annual sales growth in volume terms had continued to slow. Higher price inflation in areas such as food had also squeezed consumers' ability to fund discretionary big-ticket purchases such as homeware," the BoE said.

The central bank also said businesses had reported reduced inflows of migrants from continental Europe, due to the weaker value of the pound and concerns about their residency status after Britain leaves the EU.

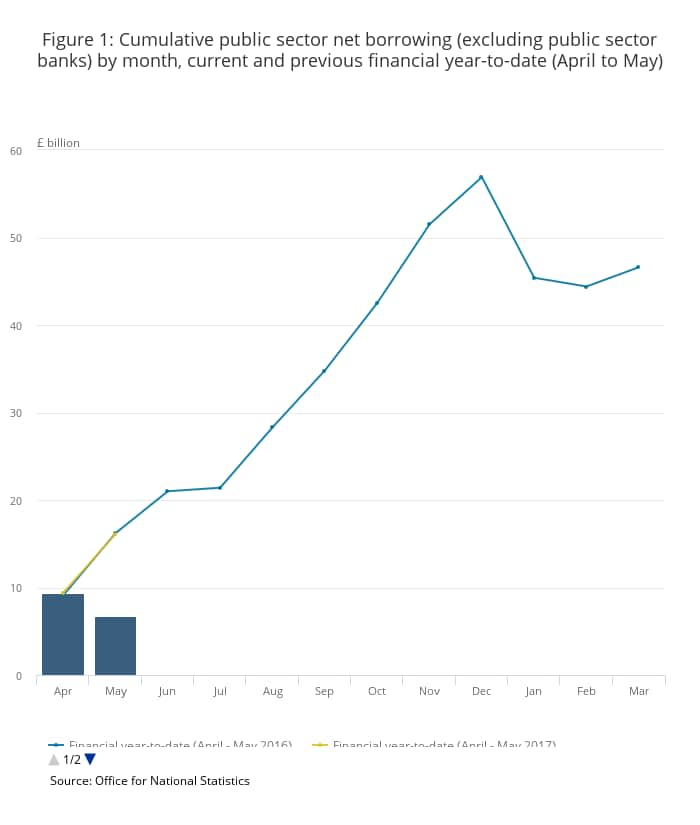

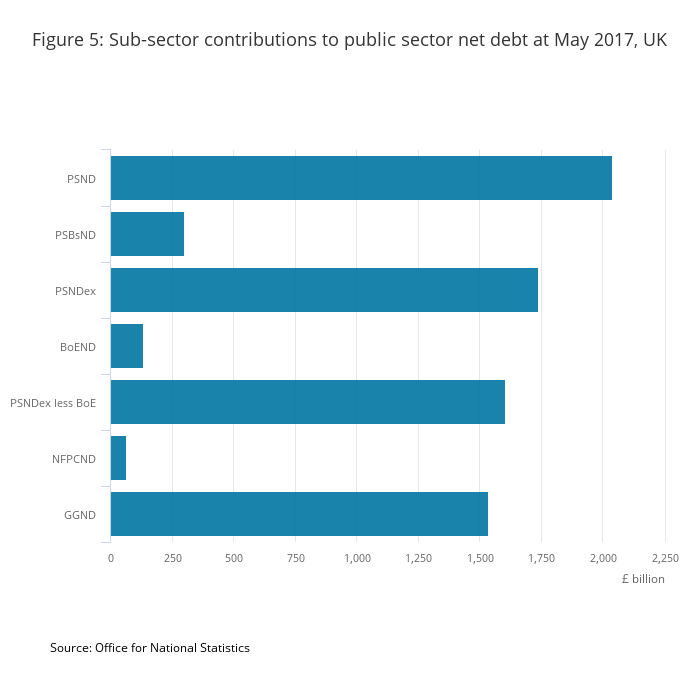

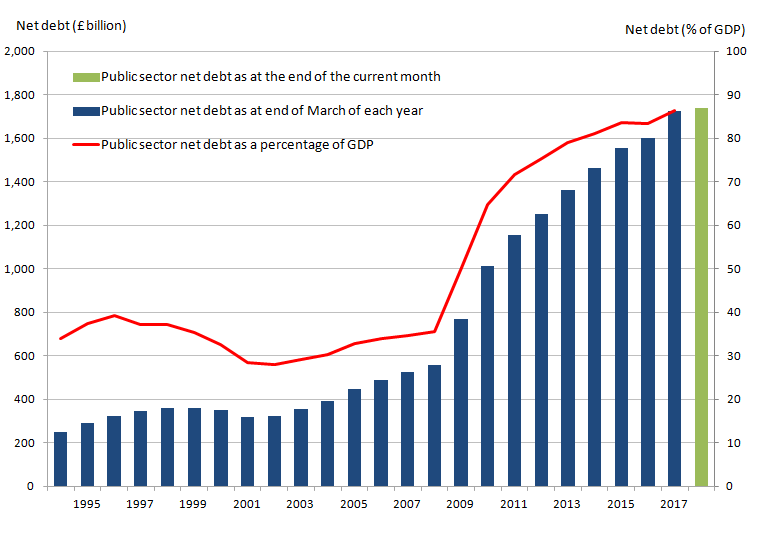

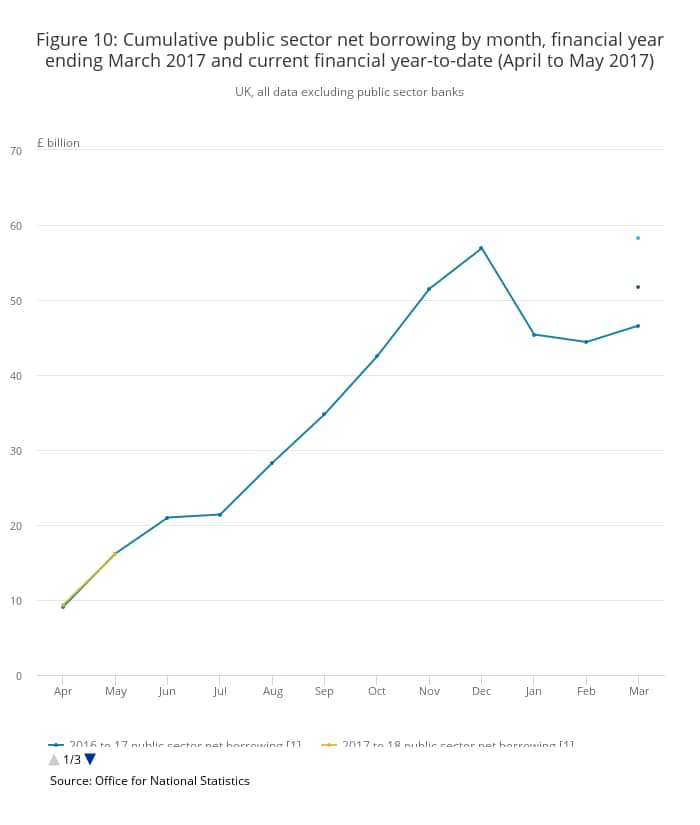

Public sector net borrowing: Key charts

Here are the key charts on the ONS data on public sector borrowing:

Figure 1 presents cumulative public sector net borrowing (excluding public sector banks) by month in the current financial year and compares the cumulative borrowing with that in the previous financial year.

Figure 2 illustrates that annual borrowing has generally been falling since the peak in the financial year ending March 2010 (April 2009 to March 2010).

Figure 3 breaks down outstanding public sector net debt at the end of May 2017 into the sub-sectors of the public sector. In addition to public sector net debt excluding public sector banks (PSND ex), this presentation includes the impact of public sector banks on debt.

Figure 4 illustrates PSND ex from the financial year ending March 1994 to the end of May 2017.

Figure 5presents the cumulative public sector net borrowing for the latest full and previous financial years. The figure also presents the OBR forecasts for the corresponding financial years.

Budget deficit narrows to £6.7bn: Key points

Here are the key points from the ONS data release on the UK public sector net borrowing:

Public sector net borrowing (excluding public sector banks) decreased by £0.1 bn to £16.1bn in the current financial year-to-date (April 2017 to May 2017), compared with the same period in 2016; this is the lowest year-to-date net borrowing since 2008.

The Office for Budget Responsibility (OBR) forecast that public sector net borrowing (excluding public sector banks) will be £58.3bn during the financial year ending March 2018.

Public sector net borrowing (excluding public sector banks) decreased by £0.3bn to £6.7bn in May 2017, compared with May 2016; this is the lowest May borrowing since 2007.

Public sector net borrowing (excluding public sector banks) decreased by £25.bn to £46.6bn in the financial year ending March 2017 (April 2016 to March 2017), compared with the financial year ending March 2016; this is the lowest net borrowing since the financial year ending March 2008.

The Office for Budget Responsibility (OBR) forecast that public sector net borrowing (excluding public sector banks) would be £51.7bn during the financial year ending March 2017.

The Office for Budget Responsibility thinks it will widen to 2.9pc GDP in 2017/18 when Hammond will have fewer one-off factors to help him.

Income tax revenues rose 2.7pc year-on-year in May to £11.7bn, while corporation tax revenues increased 2.5pc to £4.7bn.

Breaking: British budget deficit narrows as expected in May

Britain's budget deficit narrowed last month, helped by a recovery in value-added tax receipts, data from the ONS revealed this morning.

The deficit in May stood at £6.7bn, down nearly 5pc compared with the same month last year, the ONS said, citing figures that exclude state-controlled banks. This is the lowest year-to-date net borrowing since 2007.

The figures were in line with market expectations.

The public finances were boosted last month by the biggest intake of value-added tax receipts for any May on record, after these sales taxes stalled in April.

UK Net #borrowing (PSNB Ex) was £6.7bn in May 17, down £0.3bn on last year; lowest May borrowing since 2007 https://t.co/J7wkdc7pljpic.twitter.com/OwCAg86YkH

— Fraser Munro (@FraserMunroPSF) June 21, 2017

More to follow...

Pound trades at lowest level since May called snap election

The pound is now trading at its lowest level since Theresa May called the snap election on April 18. Here's a graph of sterling's performance against the dollar from April 18 to now:

Sterling could easily rebound on a deal

Jeremy Cook, of World First, reckons the pound could rebound easily.

He said: "Sterling did not collapse yesterday but its fall was accelerated by reports late in the day that the Conservatives and the Democratic Unionist Party are still very far apart on any agreement to support the Conservative government. Today is the Queen’s speech and while the Queen will read out a shopping list of plans and progress that Theresa May’s government want to get on with, she currently does not have a majority from which to govern.

"For now the pound needs only a ray of good news and it could easily hit back pretty quickly, the mood for sterling is not as dark as it was earlier in the year but an agreement would be enough in the short term to stall this grind lower."

Queen's Speech could easily fit in a tweet - World First Morning Update June 21st - https://t.co/8oZLUhQSbTpic.twitter.com/hVvla3Iw4m

— World First (@World_First) June 21, 2017

Premier Inn sales boost Costa Coffee owner Whitbread

In London, shares in Premier Inn and Costa Coffee owner Whitbread have jumped to the top of the blue chip index, up 4.5pc to £40.37, on the back of strong first quarter results. Sam Dean reports:

A strong spring performance from Whitbread’s Premier Inn hotels softened the impact of slowing growth in its Costa Coffee chain.

Premier Inn sales grew more than twice as fast in the spring this year than in 2016 as it benefitted from what the FTSE 100 company described as a “resilient hotel market”.

Whitbread is also starting to reap the rewards from the 9,000 rooms it opened over the last two years as Premier Inn’s like-for-sales rose 4.7pc in the 13 weeks to June 1, compared to 2.1pc like-for-like growth in the same period last year.

The hotel chain recorded total sales growth of 9.2pc, while its total occupancy was marginally up compared to the first quarter of last year.

However, trading at Costa continues to be challenging, with like-for-like sales rising 1.1pc compared to 2.6pc growth last year. Costa’s total sales were up 8.7pc.

Queen's Speech live: Theresa May to set out plans for government as her deputy casts doubt on DUP deal

Theresa May will unveil her Queen's Speech at 11:30am this morning. Here's the latest from our political correspondent Jack Maidment:

Theresa May's deputy has cast doubt on whether the Tories will be able to do a deal with the Democratic Unionist Party to prop up a minority government as the Prime Minister prepares to unveil her Queen's Speech.

Damian Green, the First Secretary of State, told BBC Radio 5Live that "it's possible we won't be able to agree" on a formal arrangement which would see the DUP's 10 MPs back the Conservatives.

Mr Green appeared to pour more fuel on the fire as he suggested on BBC Radio 4's Today programme that there is a possibility that no deal will be done.

Damian Green on DUP talks: "Its possible we wont be able to agree." @bbc5live

— norman smith (@BBCNormanS) June 21, 2017

Asked if there is still a chance of a DUP deal or whether the Tories will have to govern on their own, he said: "There is still the possibility, there is every possibility of a DUP deal. The talks have been taking place in a constructive way.

"Clearly two political parties, we have some differences but we have a lot in common."

Mrs May will unveil her Queen's Speech today despite the fact she currently has no guarantee that it will command a majority in the House of Commons after the DUP threatened to walk away from a deal to prop up her minority Government.

The Prime Minister will set out her legislative agenda but she will do so despite the DUP failing to sign off on an arrangement to keep her in power with the Northern Irish party criticising the Tories' approach to trying to secure its support.

Senior DUP sources in Belfast said the Conservatives had to give "greater focus to discussions" about a confidence and supply deal which Mrs May needs in order to govern.

Last night there was even speculation that the Conservatives could open talks with the Liberal Democrats' 12 MPs about supporting the Government if the DUP talks fail.

Head over to our live politics blog for the latest: Queen's Speech live: Theresa May to set out plans for government as her deputy casts doubt on DUP deal

Pound falls below $1.26 to lowest since mid-April

The pound has dropped below $1.26 for the first time since mid-April in early trade, following a sharp fall on Tuesday.

The local currency was hit by dovish comments from Bank of England governor Mark Carney, when he said now is not the time for an interest rate rise.

This morning it fell by as much as 0.26pc to $1.2590 against the US dollar. This marks its lowest level since April 18 (the day Prime Minister Theresa May called the snap election) when it touched $1.2505.

Connor Campbell, of SpreadEx, explained the move lower in sterling:

"Sterling had a miserable open this Wednesday. That’s because, despite the state opening of parliament being just a few hours away, Theresa May is yet to fully secure the support of the DUP, the Irish party unhappy with what they see as a lack of respect from certain sections of the Conservatives."

Back in bear market: What the experts say about a renewed oil slump?

Here's what the experts had to say after oil crashed back into bear market territory yesterday:

Jim Reid, Deutsche Bank

"Rather than there being one specific catalyst yesterday the move just appeared to be an extension of the slide that we’ve seen for the last few months now with markets questioning the impact of the OPEC-led output cuts and also a reinvigorated US shale market. Risk assets were hit hard too as a result."

Mr Reid also noted that oil is now back at levels last seen on September 16 last year, highlighting it has only been lower than this for 6pc of the time (188 days) since the start of 2005.

Jakob Ekholdt Christensen, Danske Bank

"Focus will most likely be on the developments in the oil markets where prices have fallen back significantly over the past month. The sharp falls are weighing on global risk sentiment and therefore have been setting off significant movements in financial markets in the past days."

Lukman Otunuga, FXTM

Although OPEC initially displayed good intentions when it exempted some members from the production cuts, Mr Otunuga thinks that this has come back to haunt them with more production from Libya, Nigeria, and Iran.

He said: "With the bias towards oil heavily tilted to the downside, further losses should be expected as bears exploit persistent oversupply concerns to ruthlessly attack the commodity."

Naeem Aslam, Think Markets

"Investors are becoming a little anxious towards the rising production out of Libya, however, OPEC has stated it before that the production level out of Libya is already taken into account in the part of their production cut strategy. Saudi Arabia also reported higher export data on Tuesday. It is important that not only production cuts are under control but also the export numbers as well."

Michael Hewson, CMC Markets

Mr Hewson points out that there is a risk we could see further declines in oil prices, particularly if shale producers continue to add rigs, and demand continues to slow in Asia, and there are no further supply disruptions.

He added: "The key support levels sit down at the November lows at $43 on Brent and $42 on US WTI, which if they give way $40 could come into view very quickly indeed and drag equity markets down with them, especially if today’s weekly inventory data disappoints."

'A' shares get MSCI nod in landmark moment for China's markets

China's stocks took a major step towards global acceptance, finally winning a long campaign for inclusion in a leading emerging markets benchmark, in what was seen as a milestone for global investing.

US index provider MSCI said it would add a selection of China's so-called "A" shares to its Emerging Markets Index after having rejected them for three years running.

Inclusion in the index marks a key victory for the Chinese government, which has been working steadily over the past few years to open up its capital markets, investors said.

"Given the size and importance of China as an economic superpower, I think this is a historic moment," Kevin Anderson, senior managing director of State Street Global Advisors and head of investments in the Asia Pacific region told Reuters.

"It's a long-awaited and much-debated decision in the past, and I think it's more than symbolic as it will create additional flow of capital and potentially a new segment of institutional investors in the China market."

#China stocks win MSCI Inclusion as early market reaction muted. Decision should draw $17-18bn into China initially. https://t.co/Fqag3ixlbJpic.twitter.com/QuqHd5Qozf

— Holger Zschaepitz (@Schuldensuehner) June 21, 2017

Traders said MSCI's widely-expected "Yes" decision had been largely priced in, with the announcement triggering some profit-taking in blue-chips, which are no longer cheap after strong rallies this year.

MSCI in March relaxed its criteria for inclusion by cutting the number of proposed stocks to 169 from 448 in a bid to address ongoing curbs on repatriating capital from China and investor concerns over the country's high number of suspended stocks.

The 169 stocks can be easily accessed by foreigners through the "Stock Connect" link launched in 2014 and significantly expanded in December.

MSCI said it had increased the selection to include a further 53 domestic Chinese stocks that are also listed in the Hong Kong market, and which will be better known to foreign investors.

Report from Reuters

Uber boss Travis Kalanick resigns as CEO

Uber co-founder Travis Kalanick has stepped down as chief executive. Here's our full report:

Uber chief executive Travis Kalanick has resigned, capping a series of controversies that have rocked the world’s largest privately backed start-up.

The company confirmed Mr Kalanick’s departure from the top executive’s role on Tuesday, after the New York Times reported major backers including Benchmark Capital demanded he resign. Mr Kalanick will remain on the board of directors, the newspaper said.

Uber confirms CEO Travis Kalanick has resigned, capping a series of controversies https://t.co/bmWqF2Rijnpic.twitter.com/fE1ambtDCM

— Bloomberg (@business) June 21, 2017

While Uber has become the world’s most valuable start-up, it has been dogged by drama including allegations of sexual harassment and the use of software to bypass regulators.

The resignation of the man who founded Uber in 2009 comes after a series of controversies shone a light on problems with the famously aggressive start-up’s culture and governance.

European shares skid into negative territory as oil slump weighs

European shares opened in negative territory this morning, extending yesterday's losses as a renewed slump in oil prices weighed on energy stocks.

Here's a snapshot of the current state of play in Europe:

Mike van Dulken, of Accendo Markets, said: "A negative opening call comes after Asian equities followed their Wall St counterparts lower as sharp falls in the price of oil weighed on sentiment, helping drag indices further from recent highs.

"MSCI finally including some China mainland stocks (A-shares) in its indices, thereby obliging $1.6tn of tracker funds to hold the shares, has done little to boost investor mood. It had been on the cards for years, many of those included were already available via the new HK trading links and they will still only represent a small portion (0.7%) of MSCI’s flagship index."

Agenda: Investors eye UK public sector net borrowing data

Good morning and welcome to our live markets coverage.

Ravaged by a renewed slump in oil prices, Asian investors were on edge overnight. MSCI's broadest index of Asia-Pacific shares outside Japan fell 0.8pc overnight.

Yesterday, oil crashed into bear market territory, touching a seven-month low, as rising supplies threatened to undermine attempts by Opec to support the market through reduced output.

Oil enters a bear market, again. Good morning Asia pic.twitter.com/2YBS9ihxy1

— David Ingles (@DavidInglesTV) June 20, 2017

Oil prices have now fallen by more than 20pc since it touched a peak of $57.10 in January. Since late May, when Opec and non-Opec producers agreed to extend output cuts until next March, prices have plummeted 15pc.

The fresh leg lower came on signs of rising output from Libya and Nigeria, two countries that are exempt from the Opec production cuts.

This morning oil has extended its fall, sliding by 0.4pc to $45.84 a-barrel.

Good morning from Berlin! Asia stocks drop as #Oil slump spooks investors. China up after MSCI added China’s domestic stocks to its EM index pic.twitter.com/s6DRjFHb2z

— Holger Zschaepitz (@Schuldensuehner) June 21, 2017

On currency markets, the pound continues to nurse losses triggered by dovish comments from Bank of England governor Mark Carney. During his delayed Mansion House speech yesterday, he said now is not the time to raise interest rates.

In London, attention shifts to UK public sector net borrowing figures which will be released at 9.30am.

Previewing the data, Michael Hewson, of CMC Markets, said: "This morning’s public sector borrowing figures for are expected to show that in May the government borrowed £7.2bn, down from £9.6bn in April."

Also on the agenda:

Full-year results: Hornby, Berkeley Group

Trading update: Whitbread

AGM: Tarsus, Xeros Technology Group

Economics: Public sector net borrowing (UK), existing home sales (US)