FTSE 100 erases 2017 gains, as pound steadies below six-month high after general election surge

FTSE 100 erases 2017 gains

Pound steadies below six-month high

Investors digest implications of snap election

Gold falls as investors add risk

Market report: Oil majors knocked by rating downgrades

Oil majors need a reality check. That was the message from US investment bank Citigroup as it downgraded the ratings of Royal Dutch Shell and BP to “sell” and “neutral”, respectively.

Analyst Alastair Syme said: “Fine-print of 2016 annual reports indicates that most big oil companies still believe in $70-80s oil prices longer term.”

But that’s a level oil has not touched in more than three years.

Citigroup thinks big oil companies need to cut costs by a further 20-25pc to “truly align” their businesses to the current oil price range of $50-60 a-barrel.

Mr Syme added: “A deepening of structural reforms is surely going to have to address the high cost of dividends that, for the most part, has not yet been reset.” Although dividend resets are painful, the bank thinks they would ultimately prove “cathartic”.

Although Citi thinks management perseverance will prevent either Shell or BP from cutting their dividends this year, it downgraded Shell amid under-investment concerns, while worries about BP’s balance sheet prompted its rating revision. Royal Dutch Shell B shares lost 58p, or 2.7pc, to £20.67, while BP dropped 4.8p to 447.8p.

Separately, oil prices edged lower after US data showed a smaller-than-expected decline in overall crude inventories. Mid-caps Tullow Oil slipped 9.7p to 208.3p and oilfield services group Hunting dipped 7p to 573.5p.

Elsewhere, gold miners were also among the laggards, as the dollar gained. A stronger dollar makes the precious metal more expensive for other currency holders. Gold prices fell by 1pc, while Randgold Resources tumbled 215p to £71.55 and Fresnillo retreated 47p to £15.45.

Luxury fashion house Burberry suffered its steepest fall since October 2015, tanking 135p to £15.66, after it reported a slight slowdown in fourth-quarter sales growth.

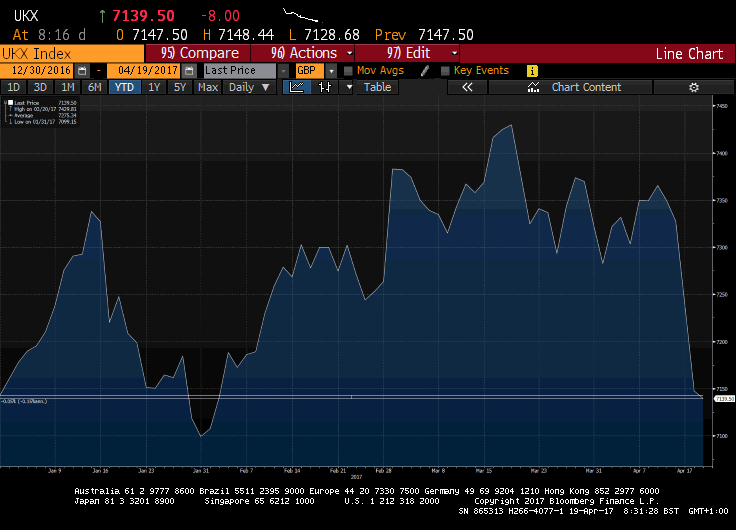

On the wider market, the FTSE 100 extended its losses, wiping out all of its 2017 gains, as the pound steadied below a six-month low. It fell 33.14 points, or 0.46pc, to 7,114.36. Meanwhile, the mid-cap index recovered the bulk of its losses, rising 119.85 points to 19,417.76.

Royal Bank of Scotland found itself among the risers on a rating upgrade. JP Morgan lifted its rating from “underperform” to “neutral” as it sees the potential for a long-dated recovery, with 30pc upside if the bank is able to execute its 2020 targets. Separately, Bernstein raised its price target to 190p from 160p. Shares edged up 11p to 235.7p. Its peers Lloyds climbed 1.5p to 63.7p and Barclays advanced 1.2p to 208.5p.

A price target upgrade by RBC Capital Markets lifted British Airways owner IAG 14p higher to 542.5p, while low-cost carrier easyJet rose 53p to £11.17.

Grocers also gained ground, with Sainsbury’s jumping 12.8p to 267.4p and Marks & Spencer adding 4.9p to 358.4p. Meanwhile, Primark owner Associated British Foods hit its highest level since September, up 35p to £27.53, on better-than-expected full-year results.

Goldman Sachs cut Land Securities rating to “neutral” from “buy” as it expects the group to deliver a cautious outlook for the market when it unveils its results next month. The US investment bank also downgraded Derwent London to “neutral”. Shares in Land Securities shed 12p to £11.13 and Derwent London closed down 11p to £29.83.

Away from the blue chips, Fenner made gains of 2p to 327.8p on forecast-beating half-year results. The British engineering company posted a 60pc increase in underlying operating profit to £24m.

Defence group Cobham plunged 12.1p to 126.4p after 683m new shares were added to trading in its rights issue.

Finally, Aim-listed gold miner Stratex jumped 4.2pc after it said it has resumed talks with Bahar Madencilik, its joint venture partner at the Altintepe gold mine in Turkey, about due cash distributions. Stratex, which owns a 45pc stake in the mine, is due to receive 20pc of net cash from operations.

With that, it's time to close for the day. I'll be back again tomorrow from 8.30am.

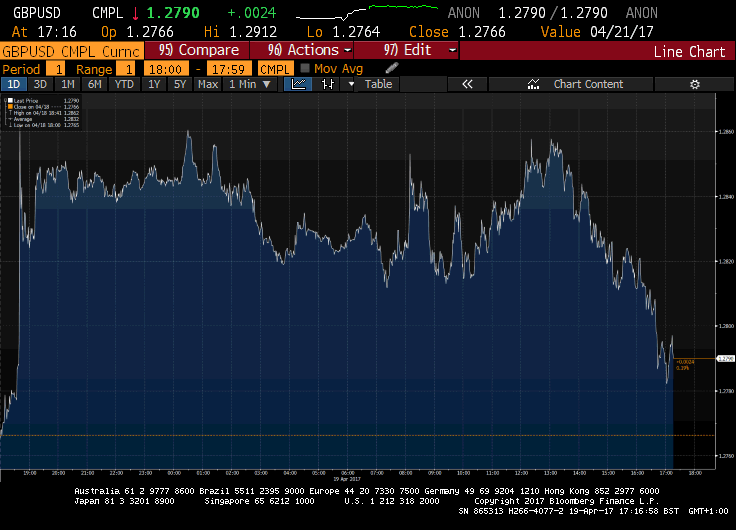

Pound drifts below $1.28 in late trading

The pound has drifted lower this evening, dropping below $1.28 against the US dollar.

However, it still remains up 0.18pc on the day, changing hands at $1.2789.

European bourses end mixed; FTSE 100 undeperforms

European bourses ended the day higher helped by a bounce in banking stocks in the region. However, the FTSE 100 remained in negative territory as it erased all of its 2017 gains on the back of the pound strength.

By close of play:

FTSE 100: -0.46pc

DAX: +0.15pc

CAC 40: +0.35pc

IBEX: +0.98pc

FTSE pauses for breath after yesterday’s selloff

The FTSE 100 is nursing modest losses today as it fails to recover from a torrid sell-off yesterday, that wiped £46bn off the value of blue chips.

With just over 10 minutes until closing time, the FTSE 100 has drifted 25.72 points lower, or 0.36pc, trading at 7,122.08.

Joshua Mahony, of IG, said: "The FTSE has suffered a somewhat disappointing end to Wednesday’s trade, as early gains were eroded in the wake of the vote to dissolve parliament ahead of a snap General Election in seven weeks’ time.

"After yesterday’s dramatic crash for the FTSE, today has been more about stability as traders seek to ascertain whether such a dramatic selloff is really justified ahead of what looks likely to be a landslide for the Conservatives."

UK midcaps beating FTSE 100 by most ever

Bloomberghighlights that the FTSE 250 is beating its bigger peer, the FTSE 100, by the most ever:

"The FTSE 250 Index is eclipsing the exporter-heavy FTSE 100 Index by the most on record, as measured by the absolute spread between the two equity gauges. UK midcaps’ outperformance comes as Prime Minister Theresa May’s call for a snap general election in June has boosted the pound. A stronger sterling is a drag on the FTSE 100, whose members get about three-quarters of their revenue from outside the UK.

"The midcap gauge, whose constituents get roughly 50pc of sales domestically, also dipped after May’s decision sent the pound surging Tuesday, but its drop was nearly half that of the FTSE 100. It recovered Wednesday, up 0.8pc, while the gauge of mega caps fell for a second straight session, erasing its gain for the year."

U.K. midcaps back in the spotlight beating FTSE 100 by most ever https://t.co/rAgJ46vdNl via @alekswritespic.twitter.com/fAb6xhtQ6I

— Bloomberg Markets (@markets) April 19, 2017

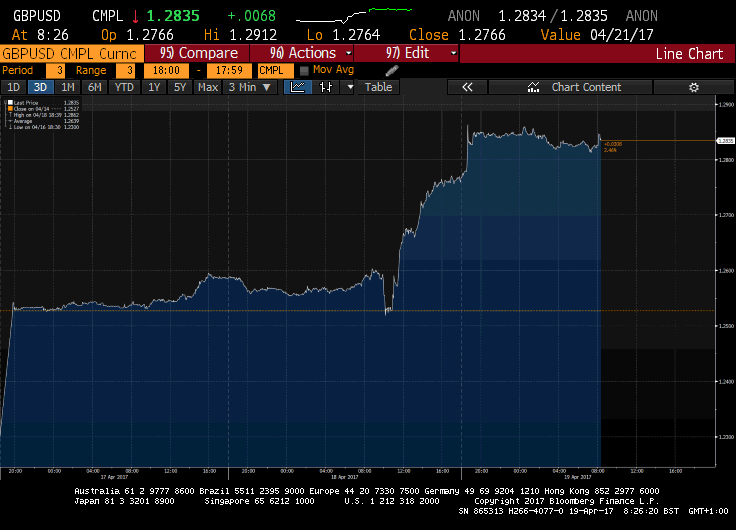

Sterling may have further to go

Given the pound has managed to consolidate its gains (thus far) seen in yesterday's surge, it may have further to go, Michael Hewson, of CMC Markets points out.

"The gains seen in recent days have been a long time coming and there is no reason we can’t head higher in the coming weeks. The market still remains in a negative mindset for sterling with short positions still elevated."

Mr Hewson think that the US dollar side of the story suggests we could see further dollar weakness, which in turn push the pound through 1.3000 level in the longer term.

He added: "The Brexit negotiations aren’t likely to get underway in earnest until after the German elections in September, which means that the any early skirmishes aren’t likely to tell us too much about how the next two years will pan out."

General election 2017 | How MPs voted General Election 2017 | MPs who voted against the election

Austerity is over: after five years of belt tightening, the IMF says the rich world has stopped cutting

Austerity is over as governments across the rich world increased spending last year and plan to keep their wallets open for the foreseeable future.

After five years of belt tightening, the International Monetary Fund says the era of spending cuts that followed the financial crisis is now at an end.

“Advanced economies eased their fiscal stance by one-fifth of 1pc of GDP in 2016, breaking a five-year trend of gradual fiscal consolidation,” said the IMF in its fiscal monitor.

“Their aggregate fiscal stance is expected to remain broadly neutral in 2017 as well as in the following years."

The British Government is still trying to reduce the deficit but at a slower pace, as Philip Hammond, the Chancellor, wanted to ease spending cuts following the vote for Brexit last year.

Read the full story by Tim Wallace here

FTSE 100's performance since Brexit vote in pound and US dollar terms

Here's a useful graph showcasing the FTSE 100's performance since the Brexit vote in pound and US dollar terms:

And here's the percentage change in the FTSE 100 in both GBP and USD terms since the #EUrefpic.twitter.com/wsvBx3CjrU

— David Scutt (@David_Scutt) April 19, 2017

MPs vote 522 to 13 in favour of an early general election on June 8

MPs have voted overwhelmingly in favour of Theresa May’s plan to hold a snap general election on June 8.

The House of Commons backed the poll by 522 votes to just 13.

It's a non-event for the markets! Pound remains up 0.44pc against the dollar and the FTSE 100 remains in negative territory.

Follow our live politics blog for the latest: General Election 2017: MPs back Theresa May’s plan for a snap poll on June 8

Big GBP sell if general election motion fails

Anthony Cheung, of Amplify Trading, points out that the motion for a general election is expected to pass with no issues.

Vote over the motion for a General Election underway with 434 votes required (2/3's)... Expected pass with no issues, big GBP sell if fails!

— Anthony Cheung (@AWMCheung) April 19, 2017

However, if it failed it would cause the pound to sell-off. The pound is currently edging downwards, but remains up 0.46pc on the day at $1.2824.

Wall Street opens higher as earnings pick up

US stocks opened higher this afternoon as investors digested more first quarter earnings.

At the opening bell:

Dow Jones: +0.05pc

Nasdaq: +0.45pc

S&P 500: +0.35pc

Global Ports to float in London with Mandelson on board

Ports operator Global Ports Holding plans to list in London in a $250m (£195m) flotation that some believe could value the company as high as $500m. Alan Tovey has the full story here.

The business is the world’s largest independent operator of ports used by the huge cruise ships and recently appointed former Labour minister and EU trade commissioner Lord Peter Mandelson to its board.

Proceeds from the flotation will be used to expand GPH’s portfolio, adding to the 14 ports in eight countries it already owns, which handle 7.8m passengers a year. Ports operated by GPH include Venice, Barcelona, Bodrum and Dubronik.

FTSE 100 trading at 11 week low

The FTSE 100 is currently trading 25 points down at 7,122.24, the lowest it has been since February 2 when it opened at 7,107.65.

"The FTSE 100 underperforms due to a continued drag from the oil majors (oil price lower, GBP strength) but now joined by some big currency-sensitive defensives," commented Mike van Dulken, head of research at Accendo Markets.

Pound has a long way to go to improve long-term outlook, Rabobank says

Some comments from Rabobank on the sustainability of the pound's bounce:

"The rally in GBP/USD that followed yesterday’s election announcement had several drivers. The notion of strong majority government is generally currency positive since it tends to reduce the prospect of political wrangling.

"The USD has also been on the back foot on a reappraisal of optimism regarding the size of Trump reflation bets. The momentum behind GBP/USD’s gain was fed by a reversal of the substantial short positions that have been built in the market. CFTC data have suggested that in recent weeks GBP speculators’ short have hit record highs. As these went into reverse, stops were triggered which added more fuel to GBP’s advance.

"Further momentum was found as GBP/USD broke through the multi-month trend-line resistance at 1.2637 and the February high of 1.2706. Technical indicators now suggest that as long as GBP/USD continues to hold above the February high at 1.2706 and the December high at 1.2775 (important levels to watch should a corrective pullback from overbought levels unfolds), the short-term bias will remain skewed to the upside.

A break above the resistance zone at 1.29~ would bring into focus various potential targets up to the 1.35/34 area. That said, while the bullish breakout is a major warning signal for the GBP bears as it caught many of them by surprise, GBP/USD would have to rally above the multi-year trend-line resistance at 1.3320 to improve the long-term outlook.

The pound is currently trading at $1.2848 after surging to $1.2904 yesterday, its highest level since early October.

Tesco offloads opticians chain to Vision Express

Tesco has unveiled plans to sell its 206 optician practices to Vision Express this morning. Ashley Armstrong has the full story:

All 1,500 staff who work within the optician business in the UK and Ireland will be transferred to Vision Express following a consultation process.

The supermarket opened its first opticians in Peterborough in 1999 and said it expected the sale to go through later this year, following approval from the UK's competition watchdog.

Vision Express, which is owned by the world's biggest optical chain Grand Vision, will have 598 shops across the UK following the deal.

FTSE 100 remains in negative territory

The FTSE 100 has failed to recover from yesterday's torrid trading session that wiped £46bn off the value of blue chips.

It is currently trading down 0.12pc at 7,139.08.

Chris Beauchamp, of IG, said: "As the shock fades from the election announcement, there is a real possibility of a rebound in UK stocks, since yesterday’s fall provided the kind of dip that bargain hunters have been praying for over the past few weeks. Investors rushing to pronounce Burberry’s doom should be careful, the shares have performed very well since November, and until today’s fall they had left the FTSE 100 trailing in the dust.

"Signs of weakness in the US market will give cause for concern, but overall it still looks like a strong update that points to more growth further down the line."

MUFG: Pound bounce more than just a position squeeze

Strategists at MUFG are arguing this morning that this pound bounce, following Theresa May's move to call an early election, will prove more sustainable and is more than just a position squeeze in a continued pound bear market.

Derek Halpenny, of MUFG, said: "This decision will in fact shift us away from the probability of a ‘Hard Brexit’ and an easing of those concerns can propel the pound further higher.

"The pound fell out of the 1.3000-1.3500 trading range against the US dollar in response to the speech by PM May on 2nd October last year outlining the strategy for Brexit that included the deadline date of 31st March 2017 for triggering Article 50. That speech was deemed as confirming PM May as being in the ‘Hard Brexit’ camp.

"We suspect the calling of this election will slowly see this conclusion shift and the consequence of that should be pound moving back into the 1.3000-1.3500 trading range against the US dollar."

General election YouGov polls 11:21AM

Bunzl revenues rise 18pc on acquisition spree

Shares in Bunzl are trading down 1.2pc this morning despite reporting a rise in first quarter revenues. Rhiannon Bury has the details:

Anumber of acquisitions and favourable exchange rates pushed Bunzl’s revenue in the first three months of 2017 up 18pc, the firm said today.

The distribution company’s overall trading was consistent with guidance it gave in February, it commented. Its revenue was up 18pc on the same period last year, although discounting currency movements the increase would only have been 4pc. Around 3pc of this came from acquisitions and new business.

“The underlying revenue growth is mainly due to the previously announced additional business won, albeit at lower margins, in North America towards the end of 2016,” Bunzl said.

It has made five acquisitions already this year, spending £260m, which it hopes will add £330m of revenue to its total. The largest of these was the purchase of DDS, a US packaging supplier, which is waiting for sign-off from the Federal Trade Commission.

Morgan Stanley: Snap election increases the chances of an orderly Brexit

Strategists at Morgan Stanley think the snap general election increases the chances of an orderly Brexit.

The US investment bank doesn't expect the EU to be ready to formally open exit negotiations until June anyway, so in the event that the Conservatives are returned to government and the key Cabinet ministers in charge of the Brexit negotiations do not change, the UK elections imply little to no delay to the exit timetable.

The bank added: "We think the chances of avoiding a disorderly Brexit have now increased." It cites two reasons:

In the base case the UK government would have the Parliamentary majority to push through difficult decisions to seal a deal.

The next Parliament should be able to complete the Brexit negotiations by the European deadline of March 2022 (assuming UK exit in March 2019, 2 years after Article 50 is triggered and the EU Parliament's limit of three years on any transition agreement), before the next scheduled UK election in June 2022.

Why this election doesn’t increase uncertainty for the pound

Kathleen Brooks, of City Index, explains why the snap election doesn't increase uncertainty for the pound:

"In and of itself the UK election shouldn’t be a key driver of UK asset prices, particularly if Theresa May wins a landslide, as she is expected to do. This election shouldn’t change domestic policy too much, and Brexit was going to happen with or without the vote on June 8th.

"However, if the polls are to be believed about the Tory lead over Labour then this election could add certainty to the UK’s Brexit positioning stance and to domestic policy for the next 5 years, and that is good for markets. For GBP/USD 1.30 is now in view, and as we lead up to the election then we could see more unwinding of the GBP/USD short positions which could take us to 1.35 around the time of the election result."

About | Calling an early general election 10:45AM

CMC Markets: Sterling bears could get bitten further

Michael Hewson, of CMC Markets, says there's no reason the pound can't head higher in the coming weeks.

He said: "The market still remains in a negative mind-set for sterling with short positions still elevated. While there is likely to be a few twists and turns over the course of the next few weeks, the US dollar side of the story suggests that we could see further US dollar weakness, pushing the pound back through the 1.3000 level in the longer term."

Pound stays above $1.28 after surging 2.2% when Theresa May called for a general election https://t.co/9MLpcOUhzZpic.twitter.com/eupNnp6FFq

— Bloomberg Brexit (@Brexit) April 19, 2017

Mr Hewson also points out that UK economic data has shown some signs of weakness in the past couple of months particularly on the consumer side; however employment rates remain high and average earnings growth appears to be stable at about 2.3pc.

He added: "The big unknown remains headline inflation, how high it goes and more importantly how much gets passed down to the UK consumer. This may well feed into a slightly more subdued rate of consumer spending which may weigh on the UK economy but will it slow it to an extent that will cause the pound to head back down."

Eurozone inflation confirmed at 1.5pc in March

Eurozone inflation slowed dwon to 1.5pc year-on-year in March from a four-year high of 2pc in February, data from EU's statistics Eurostat confirmed this morning.

However, core inflation, which excludes volatile prices of energy and unprocessed food and which the European Central Bank monitors closely, was revised upwards to 0.8pc year-on-year.

Euro area annual inflation confirmed at 1.5% in March 2017 (February 2.0%) #Eurostathttps://t.co/vqVlXpR5ubpic.twitter.com/8i6w25vlig

— EU_Eurostat (@EU_Eurostat) April 19, 2017

BoAML: UK remains the least preferred region in Europe

Delving deeper into the latest Bank of America Fund Manager Survey, it shows that the UK remains the least preferred region in Europe and its relative positioning compared to eurozone equities is within 1pc of an all-time low.

The data showed sentiment continued to deteriorate towards UK stocks and is now at net 30pc underweight.

Germany remains the most popular equity market despite contraction in the overweight for two consecutive months.

The biggest positive change was in sentiment towards France stocks. The net underweight was at -24pc in February to overweight +22pc this month, despite the looming French presidential elections.

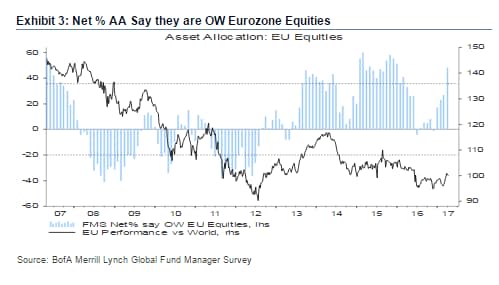

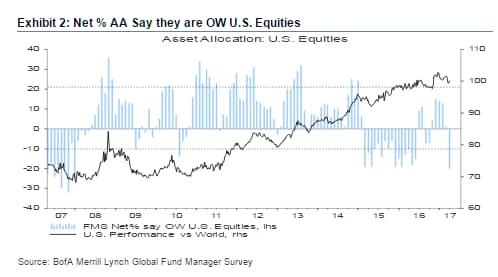

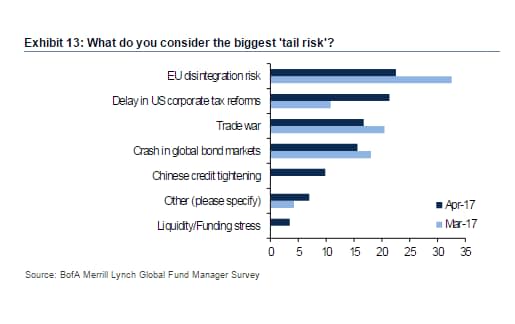

BoAML: Allocation to US equities slumps to lowest levels since Jan 2008 as investors pile into eurozone stocks

Despite the looming French presidential election, investors dumped US stocks in favour of eurozone stocks this month, a closely-followed monthly survey of investors around the world has revealed.

The proportion of portfolio managers who bought eurozone equities hit a 15-month high, Bank of America Merrill Lynch found, after polling 203 investors managing $593bn in assets earlier this month.

Data showed the allocation to US equities plunged to its lowest level since January 2008, while the allocation towards emerging markets hit its highest level in five years.

Hope that Donald Trump can deliver his ambitious economic agenda also appears to be waning, with only 5pc of investors expecting his tax reform plans to be passed before the summer recess.

Meanwhile, the biggest tail risks as cited by investors include European elections raising disintegration risk (23pc), delay in US corporate tax reform (21pc) and trade war (17pc).

Domestically-focused FTSE 250 rebounds

Although the FTSE 100 has wiped out all of its gains for this year, the more-domestically focused mid-cap index has rebounded in early trade, recovering most of yesterday's losses.

The FTSE 250 is trading up 168.62 points, or 0.87pc, at 19,466.68. Yesterday, the mid-cap index fell 1.16pc.

FTSE 250 +165 points +0.85% - RULE BRITANNIA, BRITANNIA RULES THE WAVES! - FTSE 100 down 10 points 7 7140at 9.56am

— David Buik (@truemagic68) April 19, 2017

Pound's explosive tick up to $1.2929 driven by short squeeze

Anthony Cheung, of Amplify Trading, points out that the explosive tick up in the pound at around 6.30pm last night to $1.2929 against the US dollar was driven by a short squeeze.

He explained people were looking to short at this significant level. Mr Cheung also said in his morning briefing that he would not discount that the pound will continue to climb over the next week or so, with the obvious target being $1.30.

Why did it rise so aggressively yesterday?

Mr Cheung says the pound rose so aggressively yesterday because of the idea of Theresa May can take advantage of the current domestic political situation (Conservatives hold a 20+ point over Labour at present).

He also added: "It is the most opportune moment to hit Labour. There is a substantial gap at the moment and a lack of credible opposition."

While he thinks the election doesn't alter the perception of Brexit happening, what May is trying to do is "lessen the risk of her being held hostage by minority pressure groups".

Think Markets: Sterling rally not sustainable

Naeem Aslams, of Think Markets, is a little skeptical of the sterling rally. He thinks traders are "getting well ahead of themselves" on the back of the polling data.

He adds: "Theresa May could easily win the upcoming election according to the latest polls, however, this doesn't mean that Brexit negotiations with her EU partners would be any easier. We do not think that Theresa May's victory will have a substantial impact on the Brexit negotiations because it is the EU which will be calling the shots."

Another reason he thinks the sterling rally could fade as there is a lot of time between now and June 8 , adding that the race to Number 10 will "not be an easy one".

Countdown to the General Election 9:19AM

Burberry shares fall despite sales boost as restructuring continues

Away from the general election, shares in luxury fashion house Burberry fell 6.6pc following a slight slowdown in fourth quarter sales growth. Sam Dean reports:

Burberry's shares tumbled in early trade despite the fashion giant reporting an “exceptional” performance in the UK that helped its sales rise 3pc.

The FTSE 100 stock dropped 5pc on opening in London after its performance for the six months to March 31 disappointed analyst expectations.

A strong growth in sales of leather goods was a key driver of the results, said Burberry, which also reported better sales in mainland China.

Retail revenue at Burberry rose 3pc to £1.27bn compared the same period last year.

However, total sales were down to £1.4bn from £1.6bn, as wholesale and licensing revenues fell 13pc and 38pc respectively.

Those declines are a result of the ongoing restructuring of the business, Burberry said, with wholesale revenue affected by a “rationalisation” of distribution in key markets.

Can the pound gains remain?

In his morning briefing, Jeremy Cook, of World First, explains why the pound soared yesterday. Here are the three reasons he cites:

Markets love mandates and a government that is more able to get on with the policies that it is was voted into power to enact is seen as a positive. Given the expectations of the bookmakers and pollsters the Tories look certain to add to their current majority of 17. Should the majority be larger, expect to see Theresa May ignore the more extreme members of her party on leaving the EU without a deal.

The change in election timing is important. While the Fixed Term Parliament Act means that elections must happen every five years, yesterday’s announcement means that the election after the one in June will take place in 2022. Given the Brexit stopwatch expires in March 2019 then that left a little over a year for everything to be tied up on Brexit before the next election; now we have another two years. This makes the chances of a transitional arrangement – an orderly withdrawal as opposed to crash-out-on-WTO-rules – more likely.

The number of investors and traders who came into this week short on the pound – i.e. betting that the pound would fall – was at a record highs. Those same investors pulling those bets out of the market and going off to lick their wounds will have helped the pound higher too.

Sterling flies on election call but can it last? - World First Morning Update April 19th - https://t.co/a3E7yocacDpic.twitter.com/KRKegMZlw0

— World First (@World_First) April 19, 2017

Can the pound gains remain?

To answer this, three other questions must be answered, Mr Cook says:

What does this do to change policy in Brussels?

Can an election change the economic bearing of the UK economy?

And do you believe the pollsters?

Mr Cook adds: "We think that any belief that Europe will give the UK a better deal because Theresa May has a bigger mandate at home is mistaken. Many leaders in the past have gone to Brussels with domestic victory medals shining on their chest only to get little from EU leaders. We do not think an increase in the Government’s seats will change that.

"On the economy, cynics would suggest that May is getting this election in before things really go to pot here in the UK. We are forecasting that UK consumption will remain weak and investment flows poor, providing further opportunity for UK data to underperform."

Nomura: Pound to continue to $1.30 before losing steam around $1.32

Strategist Jordan Rochester, of Nomura, reckons the pound is trading higher because, quite simply, markets like "certainty".

"We think a stronger Conservative majority in government would provide that," he added.

"One could argue that it would reduce Theresa May’s reliance on the Hard Brexit side of the party and lead her to soften her approach to the negotiations. This may prove true but could take a while to surface."

Here are some key points flagged by Nomura:

What we believe to be the biggest driver of markets here is that the Hard-to-Soft Brexit probability distribution has shifted from the “cliff edge” pricing and more towards the “smooth” Brexit via a transitional deal rather than renewed hopes of a softer Brexit.

Short term upside pressure on GBP to continue: Going forward, GBP is likely to continue to 1.30 before losing steam around 1.32 as the market proceeds to digest what a General election win for the conservatives may bring. Eventually the market may realise that this is likely to deliver the Conservatives a Hard Brexit mandate so a “softer Brexit” political turnaround still seems unlikely to push the market back to “pre-Brexit” lofty highs for now.

While we don’t see this election being the key driver of Gilts, one concern may be around non-resident buying (or lack thereof).

Could an “anti-Brexit” political movement succeed? Not likely, it would need the Lib Dems (given Labour is not anti-Brexit) to have a 10 to 15pc surge in the polling that we’ve only seen happen once (2010) in such a short amount of time, that was actually a fade as polling fell away again in the final few weeks.

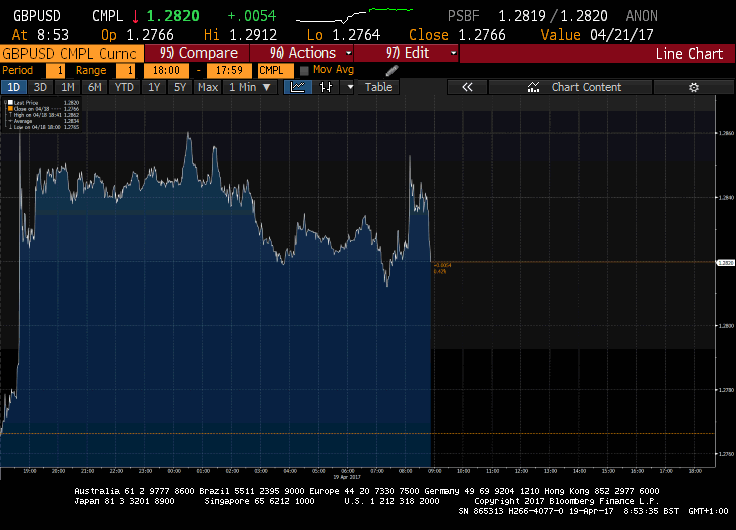

Pound steadies below $1.29 after hitting six-month high

After surging to its highest level since early October yesterday following May's call for a snap general election, the pound has eased back.

However, it's still trading up 0.47pc on the day at $1.2827 against the dollar.

Against the euro, its trading 0.22pc higher at €1.1949.

European bourses mixed as British and French political jitters weigh

European bourses had a mixed start to the day after tumbling to a three-week low yesterday, as investors remained nervous ahead of the looming French presidential election and after Theresa May called a snap general election yesterday.

Here's a snapshot of the current state of play in Europe:

Mike van Dulken, of Accendo Markets, said: "Calls for a negative open for equities come after losses on Wall St amid mixed corporate results overnight (Yahoo! beat, IBM missed), another leg down for Crude Oil drove a poor session in Asia and additional GBP strength took FTSE futures lower. Copper may be off its worst levels, but remains in a clear downtrend, although a rebound for Iron Ore offers some respite for a commodity sector troubled by scepticism about stimulus; too much in China and nothing to show yet from Trump in the US."

FTSE 100 erases 2017 gains on pound strength

After posting its biggest daily decline since the Brexit vote yesterday, the FTSE 100 has had another torrid start.

The blue chip index has wiped out all of its 2017 gains, slumping 0.2pc to 7,135.67.

The pound strength weighed on blue chips as the majority of FTSE 100 constituents are dollar earners.

Agenda: Investors digest implications of snap election as poll suggests May landslide

Good morning and welcome to our live markets coverage.

After a wildly volatile trading sessions yesterday, investors are attempting to digest the implications of the snap general election.

Sterling soared jumped by as much as 2.37pc to $1.2904 against the dollar yesterday, marking its highest level since early October, after Prime Minister Theresa May surprised markets by calling a snap general election in June.

Against the euro, the pound also hit a four-month high of €1.1936, up 1pc on the day. The pound also passed through its 200-day moving average - a key resistance level - for the first time since the EU referendum last June.

Deutsche Bank, one of the world’s biggest sterling bears, described the early election as “a game-changer” for the pound, adding that it would raise its sterling forecasts in the coming day.

Chancellor Philip Hammond said the bounce in the pound demonstrated the “confidence that the markets have in the future of the country, under a Conservative government with a new mandate.”

Stocks, however, were rattled by the announcement. The FTSE 100, which tends to be inversely correlated to the pound as around 70pc of its constituents are dollar earners, suffered its worst day since the immediate aftermath of the Brexit vote. It surrendered 180.09 points, or 2.46pc, to close at 7,147.50, wiping almost £46bn off the value of Britain’s biggest blue chips.

This morning the FTSE 100 has erased all of its 2017 gains as political jitters continue to weigh and the pound holds steady below its six month high.

Later today, the IMF will release its Global Financial Stability Report, which will document the biggest threats to the global economy.

Also on the agenda:

Full-year results: e-Therapeutics

Interim results: Fenner, Associated British Foods

Trading update: Burberry Group, Henderson Group, Segro, Bunzl, Rentokil Initial, RELX, Rio Tinto, Acal

AGM: Bunzl, Greggs

Economics: Beige book (US), trade balance (EU), final CPI y/y (EU)

European opening update courtesy of CMC MARKETS - FTSE100 -27 at 7,120, DAX is expected to open unchanged at 12,000,CAC40 -3 points at 4,987

— David Buik (@truemagic68) April 19, 2017