Flood of China Used Cooking Oil Spurs Call to Hike US Levies

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

(Bloomberg) -- As President Joe Biden prepares a new wave of tariffs against China, a US soybean trade group is pushing for higher levies on Chinese used cooking oil that it says is undercutting American crops used for biofuels.

Most Read from Bloomberg

Trump Vows ‘Day One’ Executive Order Targeting Offshore Wind

Biden Accuses China of ‘Cheating’ on Trade, Imposes New Tariffs

Macron Puts French Banks in Play With Plan to Transform Europe

Flood of China Used Cooking Oil Spurs Call to Hike US Levies

Five Under-the-Radar Billionaires Making Vast Fortunes in Modi's India

A group that represents the biggest US soybean processors, including Cargill Inc., Bunge Global SA and Archer-Daniels-Midland Co., wants the levies to be higher than the current 15.5% rate, according to a notice the National Oilseed Processors Association, or NOPA, sent to its members over the weekend that was seen by Bloomberg.

NOPA Chief Executive Officer Kailee Tkacz Buller said the memo was sent in response to rumors of possible additional tariffs being applied on used cooking oil. Association members support a boost on par with other clean energy sources, such as electric vehicles and solar, to level the playing field, Buller said in an email.

Read more: Biden’s Plan to Hit China With More Tariffs Is Mostly Symbolic

Soybean crushers worry a flood of used cooking oil imports from China is weakening demand for US crop-based ingredients that can be used to make renewable diesel and sustainable aviation fuel. There’s also widespread, unconfirmed speculation the used oil from Asia may not be authentic and instead is mixed with fresh vegetable oils, such as palm, potentially distorting commodity values and undermining US biofuel laws.

China’s exports to the US of processed animal and vegetable fats and oils — a category that includes used cooking oil — reached $201 million in the first three months of this year, versus $770 million in the whole of 2023, Chinese customs figures compiled by Bloomberg show. That compares to about $47 million worth of shipments in 2022 from April onward, when the data begins.

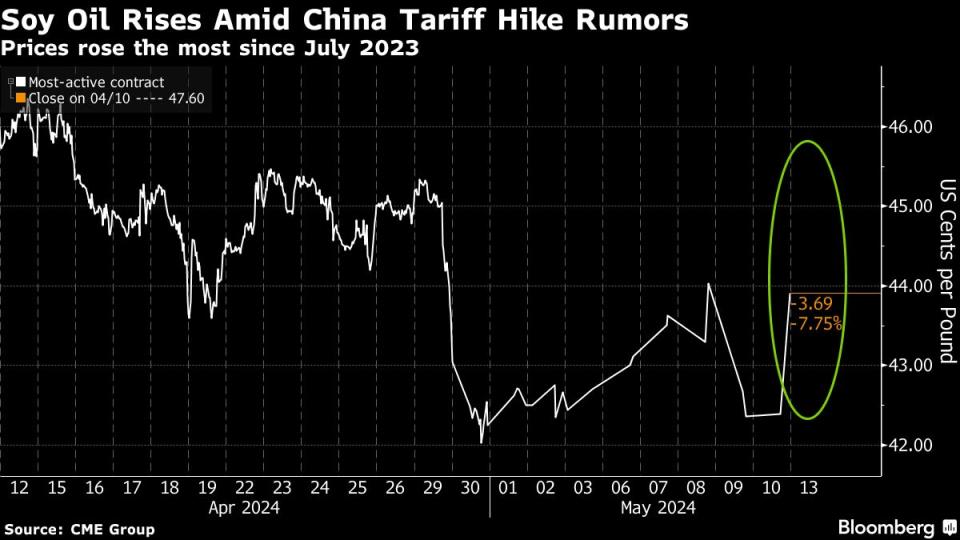

Soy oil values are down so far this year, though futures in Chicago have seen an uptick in the last couple of trading days as commodities traders await tariff news. Biden on Tuesday is expected to unveil an increase in some levies first imposed under former President Donald Trump. It’s not known if the announcement will include used cooking oil.

White House officials declined to comment.

Read More: Suspicions of Fake China Cooking Oil Alarm US Biofuel Industry.

Tariffs on used cooking oil would add to other incoming US trade measures against Chinese goods. Biden will quadruple tariffs on Chinese electric vehicles and sharply increase levies for other key industries, Bloomberg News reported this week. Semiconductors have been another key battleground.

The 2024 presidential race looms large over the moves: Biden is trying to crack down on China and differentiate himself from Trump. It comes as the world’s two largest economies are at odds over a slew of issues, including espionage, Beijing’s clampdown on Hong Kong and the status of Taiwan.

In the cooking oil rift, US growers of soy and other crops used to make renewable diesel stand to lose the most from the trade imbroglio, according to agriculture traders. That sets the stage for possible tension between farm groups and biofuel producers who are making money importing used cooking oil from China.

US imports of used cooking oil more than tripled in 2023 from a year earlier, with more than half coming from China, according to the US International Trade Commission. The surge is eroding profits for processors who crush whole soybeans to extract the oil, forcing some plants to slow down.

The increased imports also jeopardize plans to ramp up US crushing capacity amid a flurry of government incentives aimed at making lower-carbon fuels to help fight climate change.

NOPA plans to discuss the tariff issue with members this week as well as look at other possible options, according to the memo.

--With assistance from Hallie Gu, Philip Glamann and Andrew Janes.

(Adds value of China exports and information on other trade measures from fifth paragraph.)

Most Read from Bloomberg Businessweek

How the ‘Harvard of Trading’ Ruined Thousands of Young People’s Lives

US East Coast Ports Are Spending Billions to Profit From Asia’s Shifting Exports

Cheap Prison Labor Is Keeping People Locked Up Longer, Suit Alleges

‘The Caitlin Clark Effect Is Real,’ and It’s Already Changing the WNBA

©2024 Bloomberg L.P.