Fiat Chrysler Nosedives on Increased Economic Slowdown Fears

- By James Li

On Thursday, a day where the U.S. market tumbled on increased global slowdown fears, Fiat Chrysler Automobiles NV (FCAU) nosedived over 12% on weak earnings guidance for fiscal 2019 across several regions, including the U.S., China and Europe.

Warning! GuruFocus has detected 1 Warning Sign with FCAU. Click here to check it out.

The intrinsic value of FCAU

Although the U.K.-based auto manufacturer reported total net revenues of 115.4 billion euros (approximately $131.04 billion) for the year ending December 2018, weak results in both Asia Pacific and Europe offset strong results in North America and Latin America.

Geopolitical concerns in Europe and Asia dent sales results

Fiat Chrysler said in its earnings presentation that full-year revenues for the Asia Pacific region were 2.7 billion euros, down 13% at constant exchange rates. Combined shipments declined over 20% primarily due to trade, regulatory and competitive challenges in a weakening China market. CEO Mike Manley said on the call that key hurdles included the unexpected slump in the Chinese auto market and increased competition, particularly in SUVs.

Although Europe, Middle East and Africa revenues of 22.8 billion euros represented a slight increase from fiscal 2017 revenues, Chief Financial Officer Richard Palmer gave a weak guidance for fiscal 2019, driven by "worsening macroeconomic factors" in Turkey, Italy and the U.K. The expected decline can potentially exacerbate the company's three-year revenue growth rate, which is already underperforming 74% of global competitors, which include Ford Motor Co. (NYSE:F) and Elon Musk's Tesla Inc. (TSLA).

Stock tumbles on weak guidance for fiscal 2019 across all regions, including the U.S.

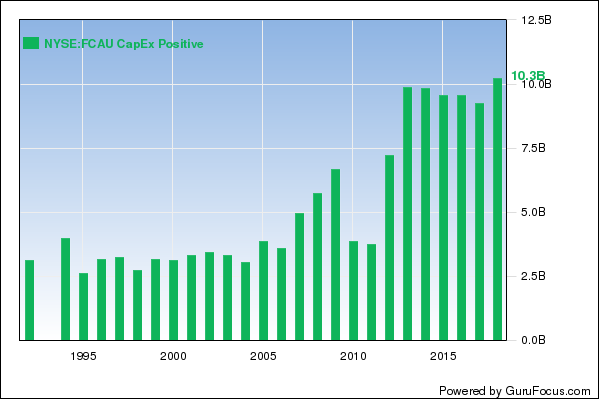

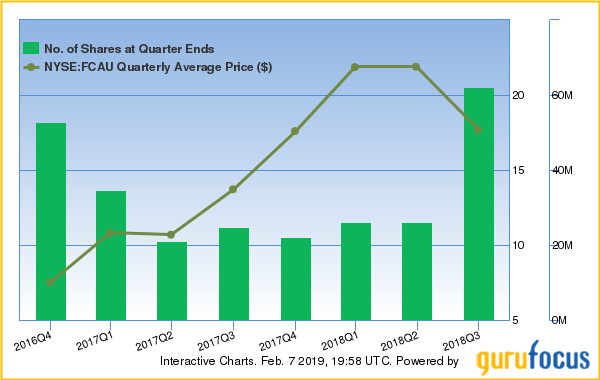

Oakmark fund manager Bill Nygren (Trades, Portfolio) said in his fourth-quarter shareholder letter that Fiat Chrysler still makes the majority of its profits through its Jeep and Ram brands despite its company name. However, Manley said U.S. operating performance for the first half of 2019 is expected to decline due to two main factors: the lack of benefits from the planned production overlap of Jeep Wrangler models that existed during the first half of 2018 and the planned retooling of the Jeep Wrangler plant for the new model coming out in 2020. Such plans expect to increase capital expenditures to $8.5 billion for fiscal 2019, up approximately $3 billion from fiscal 2018.

While the company's profitability ranks 7 out of 10, Fiat Chrysler's profit margins are underperforming over 53% of global competitors, suggesting modest profitability among its peers. Despite this, other gurus with large holdings in Fiat Chrysler include Ruane Cunniff (Trades, Portfolio) and Chase Coleman (Trades, Portfolio)'s Tiger Global Management.

Dow nearly falls below 25,000 on increased trade war and economic slowdown fears

The Dow Jones Industrial Average traded near an intraday low of 25,004.15, down approximately 386 points from Wednesday's close of 25,390.30 on increased fears of economic slowdown in Europe and rekindled worries about the lack of a trade deal between the U.S. and China. The European Commission said growth in the European Union is expect to decline from 2018's rate of 1.9% to 1.3% on potential global trade tensions.

CNBC columnist Fred Imbert reported Sam Stovall, chief investment strategist at CFRA Research, said "the keystone in the wall of worry" is the discord between U.S. President Donald Trump and Chinese President Xi Jinping. While Trump said he remained optimistic about a trade deal with China, White House economic advisor Larry Kudlow said the two economies are still "far away from striking a trade deal." Imbert also mentioned a meeting between Trump and Xi is unlikely before the March 1 deadline, further increasing the fear of a "no deal."

Stocks leading the Dow's decline on Thursday included Caterpillar Inc. (CAT), Deere & Co. (DE) and Boeing Co. (BA).

Disclosure: No positions.

Read more here:

Chase Coleman's Tiger Global Management Buys More Fiat Chrysler

5 Chinese Undervalued Predictable Companies for Chinese New Year

Elon Musk's Tesla Skids on Otherwise Strong Day for Stocks

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 1 Warning Sign with FCAU. Click here to check it out.

The intrinsic value of FCAU