Fed holds, jobs loom — What you need to know in markets on Thursday

Stocks sold off Wednesday despite markets getting no surprises from the Federal Reserve.

On Wednesday, the U.S. central bank kept its benchmark interest rate target unchanged in a range of 1.5%-1.75% and made only a few small tweaks the language it used in its policy statement.

Markets were initially slow to react to this news, though stocks did slide in the final hour of trading as each of the major averages lost ground and the Dow and S&P 500 finished with losses of 0.7%. The tech heavy Nasdaq lost a more modest 0.4%.

Bond markets were also little changed with the front end of the curve getting a small bid as the 2-year Treasury yield settled near 2.48%, while the 10-year yield was unchanged at just under 2.97%.

Following this report, Andrew Hunter, U.S. economist at Capital Economics, said, “The Fed was never likely to signal a major shift in policy at the conclusion of the FOMC meeting [on Wednesday],” adding that, “officials remain on course to raise rates again in June and we expected two further 25 basis point rate hikes in the second half of this year.”

Economists at UBS said that while the Fed did not raise rates on Wednesday, it looks set to do so in June.

So while markets will look to get back on track on Thursday, the busy week of earnings and economic data will continue.

Notable earnings reports expected out on Thursday include Overstock.com (OSTK), Cardinal Health (CAH), Kellogg (K), CBS (CBS), Pandora (P), GoPro (GPRO), and Herbalife (HLF).

Investors will also keep track of some big after hours reports that dropped Wednesday, notably Tesla (TSLA), which saw shares reversing lower after an initial post-results pop, and Spotify (SPOT), which saw shares off as much as 9% in after hours trade following its first quarterly report since going public earlier this moth.

The economics calendar will also be busy Thursday with the weekly report on initial jobless claims, as well as readings on worker productivity, service sector activity, the U.S. trade balance, and factory orders all set for release.

The week’s biggest economic report, however, won’t come until Friday morning when the monthly jobs numbers are set for release. That report is expected to show 192,000 jobs were created in April while the unemployment rate is expected to fall to 4%.

Earnings are rising at an ‘unheard of’ pace

In case you haven’t heard, first quarter earnings have been stellar.

With a bulk of the S&P 500 having already reported results, earnings for members of the benchmark index are on track to grow 25% over the prior year, according to analysts at Credit Suisse. And when you back out the one-time benefit from tax reform, earnings are still growing 18% over last year.

Credit Suisse calls this an “unheard of pace for this stage in the cycle.”

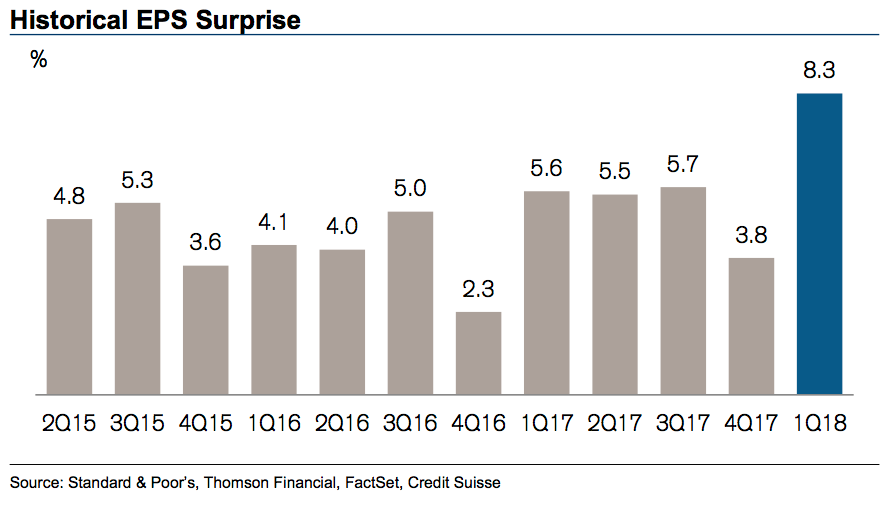

And relative to expectations — which were ratcheted higher after the passage of tax reform — earnings have still been great. “Beats have been equally impressive, with companies surpassing expectations by 8%,” the firm said in a note to clients on Wednesday. “Importantly, corporate guidance has been constructive and earnings are expected to expand at a low-twenties pace throughout 2018.”

In recent years, market skeptics have often pointed to a price-to-earnings, or P/E, ratio for the market that is elevated relative to history. This ratio measures roughly how much investors are willing to pay for one dollar of earnings from S&P 500 companies.

But with the P in this formula — that is, the price of the stock market — going down slightly so far this year while earnings, the E, are rising, the market has gotten relatively more attractive with the S&P 500’s P/E ratio now at 16.1 against 18.2 at the beginning of the year.

And yet it seems as if investors still smell a rat.

More attractive valuations and still-growing earnings have not given investors enough reasons to continue betting on stocks going higher this year, despite Wall Street having expected 2018 to be a year somewhat similar to 2017.

Credit Suisse notes that, “concerns surrounding peaking EPS and economic growth, rising inflation/rates, a flattening yield curve, and a maturing business cycle are weighing on stocks.”

And while the firm argues that investors under-estimating upside potential for the market and overstating the present risks to the market and the economy, investors appear somewhat locked in to their story for this year. And that story calls for a more cautious view of the stock market.

Because if 2017 was a year in which stocks went up and volatility was low regardless of what the risks to the economy or market appeared to be, 2018 has been the inverse — whether risks are sizable or not, investors have decided this is the year to be jittery. And, evidently, a year to fade a whole bunch of good news.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: