February Materials Dividend Stocks To Look Out For

A favourable economic condition has been a large driver of growth for companies in the materials industry. Hence an eye toward macroeconomic factors, such as demand for commodities, is necessary when investing in the materials sector. Another key driver of a materials company’s profit is the commodity prices which in turn steers the level of dividend payouts and yield. If you’re a buy-and-hold investor, these healthy dividend stocks in the materials industry can generously contribute to your monthly portfolio income.

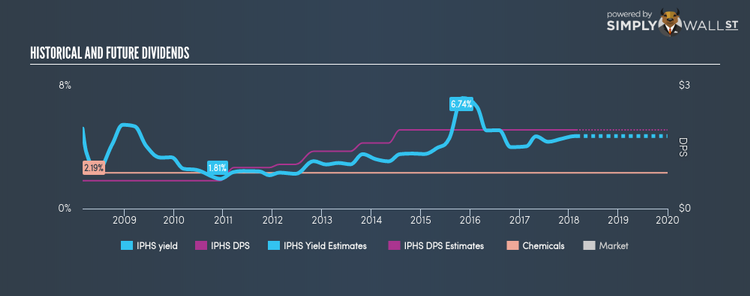

Innophos Holdings, Inc. (NASDAQ:IPHS)

IPHS has an alluring dividend yield of 4.43% and pays 168.80% of it’s earnings as dividends . Over the past 10 years, IPHS has increased its dividends from US$0.68 to US$1.92. To the enjoyment of shareholders, the company hasn’t missed a payment during this period. The company also looks promising for it’s future growth, with analysts expecting an impressive doubling of earnings per share over the next year. Continue research on Innophos Holdings here.

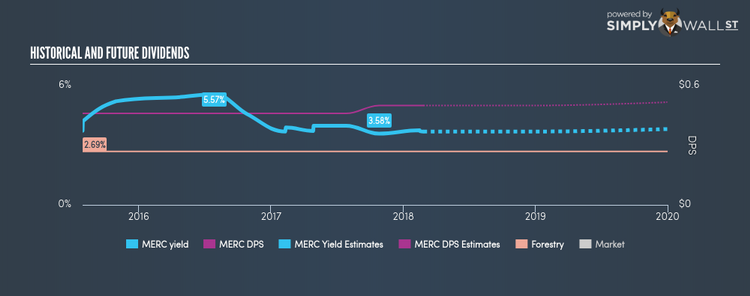

Mercer International Inc. (NASDAQ:MERC)

MERC has a sizeable dividend yield of 3.69% and the company currently pays out 43.29% of its profits as dividends . MERC’s dividend is not only above the low risk savings rate, but also amongst the top dividend payers in the market. It also looks like Mercer International has some promising growth in store for the next year, with analysts expecting the company’s earnings to increase by 32.96% over the next 12 months. More on Mercer International here.

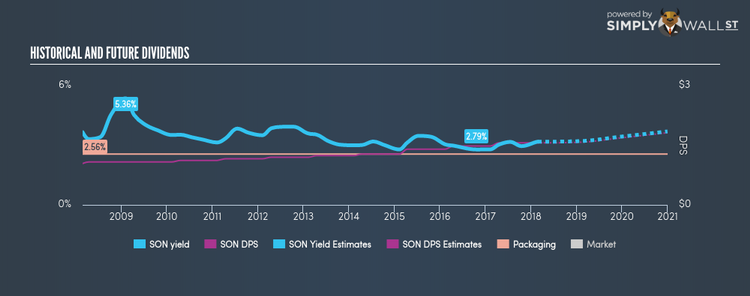

Sonoco Products Company (NYSE:SON)

SON has a wholesome dividend yield of 3.18% and is currently distributing 88.58% of profits to shareholders . The company’s dividends per share have risen from US$1.04 to US$1.56 over the last 10 years. They have been reliable as well, ensuring that shareholders haven’t missed a payment during this 10 year period. Analyst estimates for Sonoco Products’s future earnings are certainly promising, predicting a triple digit earnings growth over the next three years. More on Sonoco Products here.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.