Facebook and the Fed — What you need to know in markets on Wednesday

So it seems like the market in 2018 is not going to be same as it was in 2017.

On Tuesday, stocks had another rough day with the Dow losing 362 points, or 1.4%, to pace losses as all of the major indexes closed in the red. The S&P 500 lost 1.1% while the tech-heavy Nasdaq saw the narrowest losses with a 0.86% decline.

And on the heels of this market sell-off, investors are about to face a hectic couple days in markets news with Wednesday bringing Facebook (FB) earnings and a Federal Reserve meeting, both in the afternoon.

Facebook will report earnings after the market close, with investors focused on any and all questions about how the company is handling the various controversies that have broken out around the company’s treatment of content in its main News Feed product. The company will also likely face questions over CEO Mark Zuckerberg’s comment back in November that, “We’re investing so much in security that it will impact our profitability.”

The Fed meeting, meanwhile, is expected to be a relative non-event with no press conference scheduled to follow the announcement, which is due out at 2:00 p.m. ET. The two-day meeting also marks Fed Chair Janet Yellen’s final before Fed governor Jerome Powell takes over as Chair next month. Investors expect the central bank to keep its benchmark interest rate target unchanged at 1.25%-1.5%.

The economics calendar outside of the Fed is also busy with the January private payroll report from ADP due out at 8:15 a.m. ET. The government’s January jobs number is due out Friday morning. Markets will also get the fourth quarter employment cost index, pending home sales, and the January reading on manufacturing activity in the Midwest.

The earnings calendar outside of Facebook is also quite busy, with Microsoft (MSFT), Qualcomm (QCOM), eBay (EBAY), and PayPal (PYPL) all releasing results after the bell. Dow members AT&T (T) and Boeing (BA) are also expected to report results.

…since January 2000

At this point in the market cycle — with stocks having hit records seemingly every day to start the year, with markets having rallied more than 20% in 2017, with the market having tripled from the post-crisis bottom in 2009 — any comparison to prior tops will raise eyebrows.

Especially when it comes to retail investors.

On Tuesday, The Conference Board released its January report on consumer confidence, which showed an increase in overall optimism around the economy.

“Consumer confidence improved in January after declining in December,” said Lynn Franco, Director of Economic Indicators at The Conference Board. “Overall, however, consumers remain quite confident that the solid pace of growth seen in late 2017 will continue into 2018.”

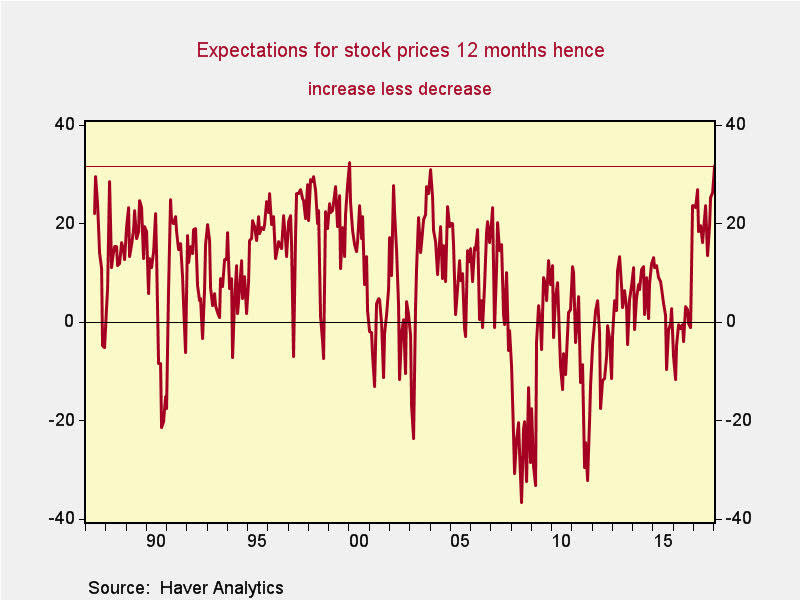

But in this report, we also learned that consumers are bullish on stocks. Very bullish. In fact, the most bullish they’ve been since January 2000, a fact pointed out to us by Neil Dutta, an economist at Renaissance Macro.

Dutta notes that the differential between consumers who think stocks will be higher in 12 months minus the number of consumers who see stocks lower in 12 months is the highest its been since January 2000, just two months before the market topped out ahead of the tech bubble.

Last week, we saw discount broker E-Trade (ETFC) highlight what Bloomberg View’s Conor Sen noted was more or less record retail trading activity, another sign of enthusiasm among a segment of the investing community that many experts have said are underinvested.

And amid a very ugly day for stocks on Tuesday, this data certainly adds credence to the notion that despite the strong corporate earnings and solid economic growth expected by the consensus Wall Street community, retail investors have again piled in right at the top.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here:

One candidate for Amazon’s next headquarters looks like a clear frontrunner

Tax cuts are going to keep being a boon for the shareholder class

Auto sales declined for the first time since the financial crisis in 2017

Foreign investors might be the key to forecasting a U.S. recession

It’s been 17 years since U.S. consumers felt this good about the economy