Everyone wants a byte of this company’s technology

The expected boom in spending on artificial intelligence projects led to a surge in the share prices of many leading semiconductor and technology companies last year.

One of the companies seen as a long-term beneficiary of AI is the Netherlands’ ASML, the leading global manufacturer of the lithography machines used to make advanced microchips. Shares in ASML have returned 445pc in sterling terms over the past five years and the smart money is betting on there being more to come.

Nineteen top fund managers, each among the best-performing 3pc of the 10,000 equity investors tracked by the financial publisher Citywire, own shares in ASML. That results in its top AAA rating from Citywire Elite Companies, which rates companies on the basis of their backing by the world’s best fund managers.

They include Alistair Wittet and Pierre Lamelin from French fund group Comgest, who run nine funds between them, with ASML a top 10 holding in each. All of their funds have comfortably beaten the returns from their respective markets over the past three years, while the best-performing, Comgest Growth Europe Compounders, has gained 42pc in sterling terms, more than double the 18pc market return.

Wittet and Lamelin see ASML as a likely winner from the rise of AI because its “machines will be needed to manufacture the increasingly high-performance chips” the technology requires. “With good order visibility and a strong technological roadmap into the 2030s we see the company as well placed,” they said in their latest update to investors.

Not all investors believe the companies that will profit the most from AI can be identified at this stage in the technology’s development, however. Veteran fund manager Terry Smith argued in his latest letter to the investors in his Fundsmith Equity fund that the stock market had been too quick to pick the winners from AI.

He pointed to Nokia’s mobile phones, the Myspace social network and the Yahoo search engine as examples of companies initially at the forefront of technological developments that were later overtaken by rivals.

In some of these cases, however, the businesses were too easy for competitors to copy. This is a crucial factor in determining a company’s long-term profitability. Often referred to as an “economic moat”, the most successful companies have something special that stops rivals from emulating them and eating into their profits.

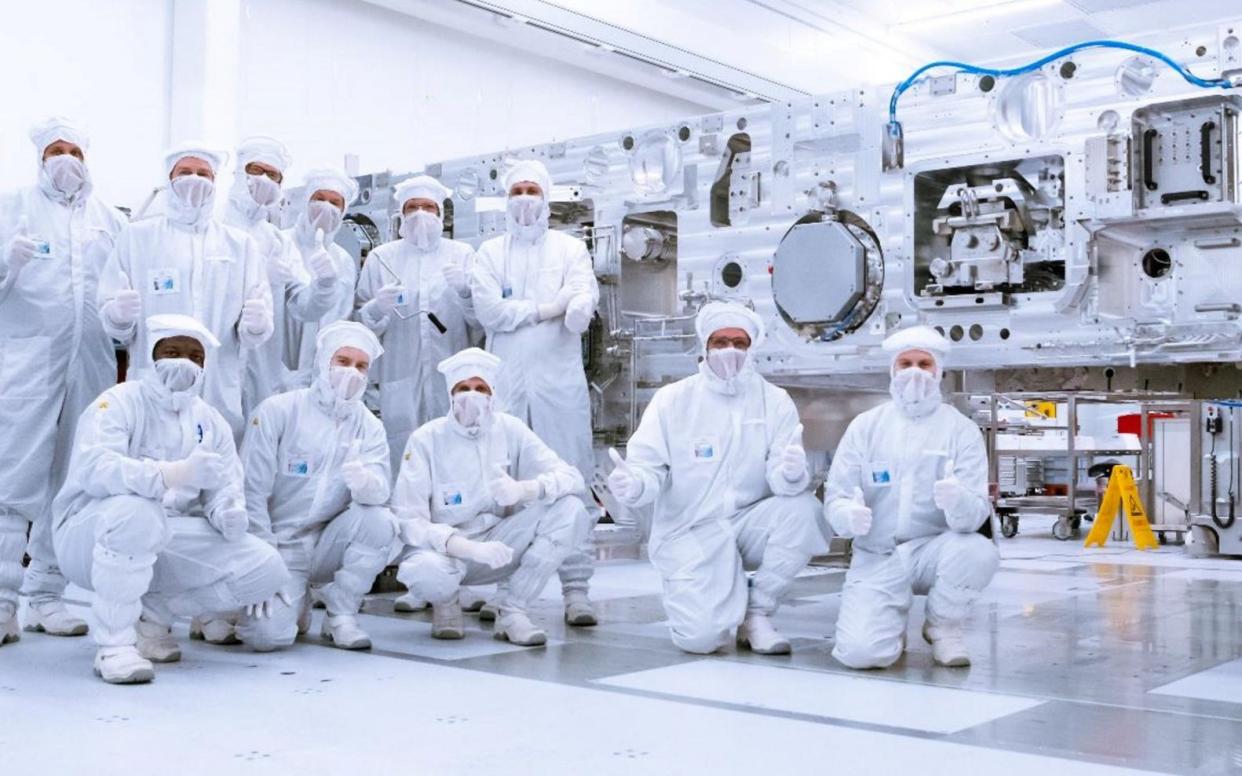

ASML has exactly this: it is the only manufacturer of extreme ultraviolet lithography machines in the world. These machines use beams of light to print tiny patterns on silicon wafers and are crucial to the next generation of advanced microchips used in AI technologies. Without ASML, the world’s biggest chip makers would be unable to make them.

ASML’s machines are hugely complex and the product of decades of investment. They can take 18 months to build and contain hundreds of thousands of individual parts, which are supplied by an impressive integrated supply chain. Users require extensive training, which is provided on site by the company.

The hardware is backed by highly sophisticated software and data that help ASML to continue to develop and improve its systems.

Put simply, it would take many years – perhaps decades – for a competitor to match ASML’s product and service quality. Its market dominance is therefore not expected to end any time soon.

Annual results published last week underlined the strength of ASML’s business and sent the shares 12pc higher. Sales hit €27.6bn (£23.6bn), a 30pc rise on 2022, while profits rose by 39pc despite a difficult period for the semiconductor industry as companies keep a tight rein on investment spending.

It’s worth noting that much of this growth came from clearing a backlog of orders from Chinese companies. That won’t be repeated this year and, as ASML is also affected by US and Dutch curbs on exports to China, the company expects flat sales in 2024.

Brokers are pencilling in a return to strong growth in 2025, however, as the semiconductor market recovers and new fabrication plants come on stream. The switch to more advanced chips should also stimulate demand for ASML’s extreme ultraviolet lithography machines, on which the company makes higher profit margins.

ASML is confident of growing revenues to between €44bn and €60bn by 2030 and raising gross profit margins (those before operating costs) from last year’s 51pc to between 56pc and 60pc. Should it meet the mid-point of those two targets, gross profits would more than double from last year’s figure.

But such market dominance and growth potential do not come cheap. The shares trade on 41 times ASML’s forecast earnings for the next 12 months and 29 times the more buoyant profits expected in 2025. However, should it deliver on its long-term targets and maintain its stellar record, the shares will be well worth the expense.

Questor says: buy

Ticker: AMS:ASML

Share price at close: €797.20

Phil Oakley is a contributing journalist for Citywire Elite Companies

Read the latest Questor column on telegraph.co.uk every Monday, Tuesday, Wednesday, Thursday and Friday from 6am

Read Questor’s rules of investment before you follow our tips