EUR/USD Daily Forecast: Euro Eases Back From 3-Month High

The Markets are Confident the Fed Will Cut in July

And Fed chair Powell will have a chance to communicate that as he is scheduled to speak later today. The futures markets have fully priced in a rate cut for the July Fed meeting and are even pricing in a 40% chance of a 50 basis point cut.

Powell has an opportunity to signal a heads up today at his speech. There are two ways this can play out. He might opt to readjust dovish expectations since there is a major divergence between where the markets are and where the bank is in terms of easing expectations. Alternatively, he confirms that the Fed will move next month.

I am leaning towards the second scenario. Indeed, the Fed Funds futures market is not always 100% right in predicting the next move. However, there is clearly a strong view that the Fed will move in July. They are pricing in a 0% probability that the rate will stay the same, confident might be an understatement here.

Treasury yields are also pointing to the same thing with the 10-year poised to fall to a 2% yield. A strong case can be made that the Fed is behind the curve.

The Fed is not likely to surprise the markets with a cut, even though they are pricing one in. So I think Powell might indicate in his speech that the Fed will take action next month. If he does, the dollar stands to fall further. If he doesn’t, or rather, signals the opposite, the dollar will likely surge higher and I would expect a sharp fall in equities.

Technical Analysis

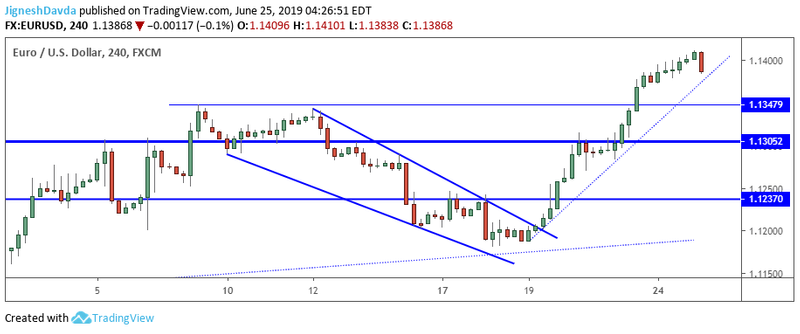

I think the line in the sand for EUR/USD falls at 1.1350. The 200-Day moving average is currently residing around there. On a weekly chart, the same indicator is also within close vicinity.

While above the above-mentioned support, I expect EUR/USD will make an attempt for 1.1450. This is a level that has been highly respected on the larger time frames.

On a 4-hour chart, there is also a horizontal level around 1.1450 which reflects the early June high. The pair is attempting to print a bearish engulfing candle which could trigger some short-term weakness.

Bottom Line

Powell’s speech stands to create a volatile dollar fluctuation if monetary policy is discussed

A major support confluence is in play around 1.1350

EUR/USD looks poised to test 1.1450.

This article was originally posted on FX Empire