ETFs And A Calif. Muni Storm

For municipal bondholders, California’s “shocking” $16 billion deficit is a startling development that should raise major red flags about the state’s ongoing ability to service its debt.

So, ETF investors who hold muni bond funds need to understand the ways they can protect themselves.

Whether that means steering clear of California altogether or finding a broad ETF less larded up with muni bonds from the not-so “Golden State,” the market of muni-focused ETFs is deep enough for investors to have real options.

That said, finding those options does take some work, as the most populous U.S. state casts a long shadow in the muni market.

But make no mistake:As California governor Jerry Brown looks for ways to close a nearly $16 billion dollar budget deficit, the proposed solutions may well exacerbate an already big problem. And, the ramifications for the muni bond market could be profound.

After all, California is not only the largest issuer of municipal bonds in the U.S., it has the lowest credit rating of any state in the union—an unwanted distinction if ever there was one.

At the root of the problem is the fact that the unexpected jump in the state’s budget deficit stems from lower-than-expected revenues, the lifeblood of debt service.

Avoiding Obvious Pitfalls

As I said, it’s hard to hide from California municipals in broad portfolios, and that’s because so many bond indexes are market weighted, and the state is the largest issuer in the country.

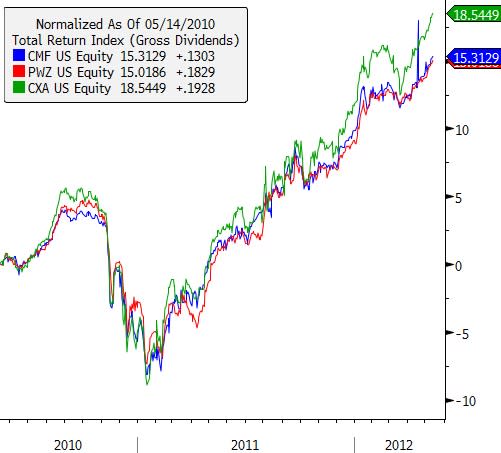

If you’re concerned about the sustainability of California’s debt, avoiding for now the three California-focused muni ETFs would be an obvious place to start—the iShares S'P California AMT-Free Municipal Bond Fund (CMF - News), the PowerShares Insured California Municipal Bond Portfolio (PWZ - News) and the SPDR Nuveen Barclays California Municipal Bond ETF (CXA - News).

These portfolios have had a huge run since Meredith Whitney’s scathing analysis prompted a sell-off in municipal bonds at the end of 2010, so it takes real conviction to unload them now.

Perceived Risk Grows With Time

Even if you’re not ready to sell such holdings, it’s worth noting that of the three portfolios, CMF has the lowest effective duration and therefore the lowest interest-rate risk of the group. That’s crucial should you be concerned about the state’s longer-term outlook.

After all, with a higher duration comes more uncertainty. It also means you have to wait longer to get your money back. Securities with a longer time to maturity have more sensitivity to changes in credit risk expectations; thus, California does not need to default for investors to be punished. They only need to see a change in the expectations of a default to get hammered.

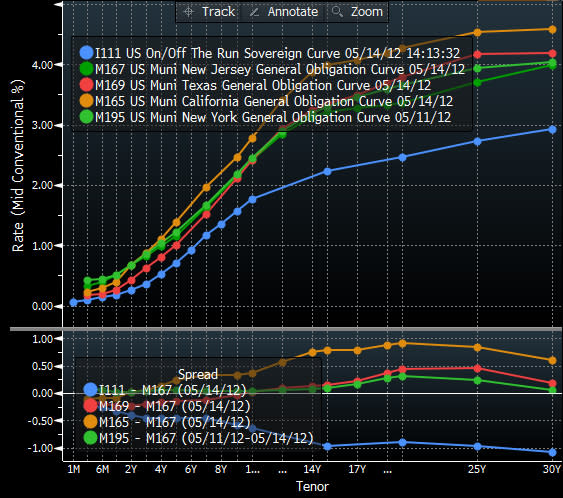

The chart below highlights this dynamic.

Below are the yield curves for the three most heavily weighted states in the broad-based iShares S'P National AMT-Free Municipal Bond Fund (MUB - News)—California, New York and Texas—plus the U.S. Treasurys yield curve.

It’s clear from the graph that short-term California paper is actually considered safer than that of Texas or New York.

But as you move farther out along the curve, it becomes increasingly clear that investors are concerned about the sustainability of California’s debt service abilities. Thus spreads widen considerably.

Sifting Through Danger

Build America Bond portfolios tend to have high exposure to California as well, as California was one of the biggest users of the stimulus program aimed at jump-starting the economy and improving state infrastructure after the market crash of 2008.

Take the SPDR Nuveen Barclays Build America Bond ETF (BABS - News), for example. The fund has more than 36 percent of its assets by weight in bonds issued by California.

Just to give you an idea how prevalent California is in the muni bond space, consider two broad market municipal bond ETFs – MUB, which I mentioned above, and the Market Vectors Pre-Refunded Municipal Bond ETF (PRB - News).

MUB focuses on AMT-free municipal bonds, while PRB focuses on prerefunded municipal issues. As of this writing, California made up nearly 18 percent of PRB’s portfolio and more than 22 percent of MUB’s.

Some Actionable Alternatives

Again, that’s not to say you can’t find alternatives.

New York-focused municipal portfolios like the iShares S'P New York AMT-Free Municipal Bond Fund (NYF - News), the PowerShares Insured New York Municipal Bond Portfolio (PZT - News) and the SPDR Nuveen Barclays New York Municipal Bond ETF (INY - News) are options, although New York faces its own set of very serious issues.

Another option is finding broad portfolios with less exposure to California.

The SPDR Nuveen Barclays Municipal Bond ETF (TFI - News) is a broad muni product from SSgA that only carries 12 percent exposure to California.

Also, BlackRock has a number of fixed maturity-date portfolios that have lower California exposure as well—some a lot less than others, so buyer beware.

For example, the iShares 2016 S'P AMT-Free Municipal Series Fund (MUAE - News), which will “mature” and close at the end of 2016, has less than 11 percent of its portfolio by weight in debt issued by the state.

The iShares 2015 S'P AMT-Free Municipal Series Fund (MUAD - News), meanwhile, has less than 8 percent exposure to California.

Either of those are a lot less unsettling than the 22 percent position in California debt that the iShares 2013 S'P AMT-Free Municipal Series Fund (MUAB - News) has. This makes it easy to see how wildly portfolios differ even from the same issuer.

Actively Managed Options Too

Pimco is another firm where two muni offerings have very different exposures to California’s debt.

Its two actively managed muni portfolios—the Pimco Short Term Municipal Bond ETF (SMMU - News) and the Pimco Intermediate Municipal Bond Strategy ETF (MUNI - News)—hold 10 percent and 15 percent, respectively.

Since these portfolios are actively managed, their holdings are fluid, meaning what you see today could be very different from what you see next week or next year.

Portfolio managers of the two ETFs also have the flexibility to rotate out of California’s bonds should the state’s fiscal outlook deteriorate further. If you’re going to trust anyone to be nimble in its portfolio response to such an event, Pimco would be at the top of the list.

The good news in all these choices is that if you see California’s budget mess as a canary in the coal mine, you can take steps to protect yourself without abandoning your municipal exposure and the tax benefits that go along with them altogether.

You just have to know what you own—or in this case, what you don’t.

Permalink | ' Copyright 2012 IndexUniverse LLC. All rights reserved

More From IndexUniverse.com