This Energy-Dividend Stock Fell 50% and Kept On Minting Money

You can't tell by its stock, but Kinder Morgan (NYSE: KMI) has become more profitable since cutting its dividend.

Not only that, but based on Kinder Morgan's distributable cash flow (DCF), it has continued to grow throughout the energy downturn.

The simple truth that Kinder has continued to spout profits from its pipelines and storage assets has enormous ramifications. Yet it seems to have been lost on investors, who have sent shares down over 50% since the company made the fateful decision to cut its dividend on Dec. 7, 2015.

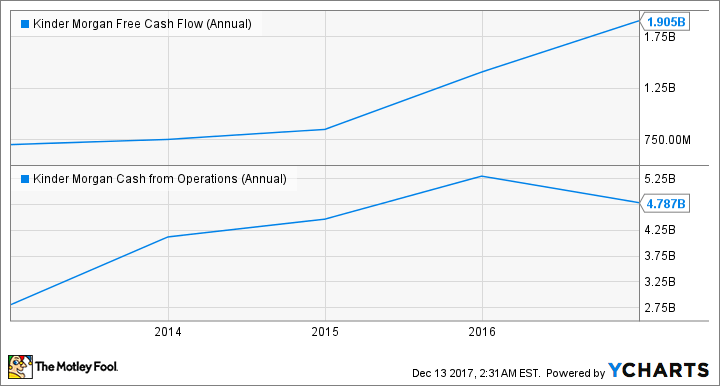

KMI Free Cash Flow (Annual) data by YCharts

When investors buy KMI, they are buying all the future cash flows from its assets. This figure held up, despite KMI stock's poor performance, and continues to grow -- point for the bull case.

Could Kinder Morgan's projected dividend growth be a gift to long-term investors? Image Source: Getty Images.

DCF is an all-important performance measure in the energy infrastructure industry. It's defined as the cash flows from operations available for dividends and organic growth, minus things like interest expenses and taxes. DCF is used industrywide to assess an energy midstream like KMI's ability to satisfy all stakeholders. By this measure, Kinder Morgan is a gem. It has continued to generate cash:

Kinder Morgan | FY 2016 | FY 2015 | FY 2014 |

|---|---|---|---|

Dividends per share | $0.50 | $1.61 | $1.74 |

Distributable cash flow (DCF) (In millions) | $4,511 | $4,699 | $2,618 |

Dividend coverage (DCF/dividend payment) | 4.03 | 1.11 | 1.49 |

Data Source: Kinder Morgan 2016 Annual SEC Filing.

Also, its distributable cash flow was $3.29 billion year-to-date for the nine months ending Sept. 30, 2016 and $3.36 billion for the nine months ending Sept. 30, 2017.

Kinder Morgan bulls immediately bring up KMI's strong cash generation as proof that an eventual turnaround is a lock.

And they have a point -- the vast majority of Kinder Morgan's assets service energy producers on a fee-based structure, meaning that they get paid a certain amount no matter what happens to energy prices.

Can Kinder be trusted?

However, there are some caveats to the bull case. KMI's shares have been under pressure ever since management was forced to cut its dividend 75% in October 2015. Kinder's payout was thought to be sacred, and executives had said as much. By reducing the dividend, KMI admitted that even its predictable cash flow wasn't enough to guarantee both dividend growth and operational expansion. Bears can't argue with KMI's cash flow, but they're right when they say Kinder Morgan's management tarnished the company's reputation as a top dividend stock by taking the actions that it did.

A problem that fixed itself

Ironically, the dividend cut that has left investors so jaded was the very act that righted the ship. Just a week after the fateful announcement, ratings agency moved KMI's outlook up from "negative" to "stable."

The real "sunbeam through the clouds" occurred on July 19, 2017, when the company not only announced a planned 60% increase in its payout for FY 2018, but also 25% per-year increases through FY 2020. By that year, Kinder's annual payout will be in the neighborhood of $1.25 per share. The past two years have given the company time to use its billions in cash flow to right the ship and retrench.

What you need to know

Some of Warren Buffett's best investments have been in great companies suffering from what he calls "temporary but fixable" problems. That seems to be the case with Kinder Morgan. Its distributable cash flow has held steady, even grown, in the face of the worst energy downturn in a generation. It has also managed to expand its domain (and future earning power).

True, it lost some credibility with Wall Street when it was forced to cut its dividend, but the fundamentals of its business have remained. Profitability that hasn't disappeared, coupled with surging natural gas production in the United States, makes Kinder Morgan a compelling stock for Foolish investors.

More From The Motley Fool

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

Sean O'Reilly owns shares of Kinder Morgan. The Motley Fool owns shares of and recommends Kinder Morgan. The Motley Fool has a disclosure policy.