Embedded accounting startup Layer secures $2.3M toward goal of replacing QuickBooks

Embedded finance is usually what we hear about when brands and non-financial businesses want to offer financial products or services — like banking, insurance, lending and payments — to provide a better user experience for customers.

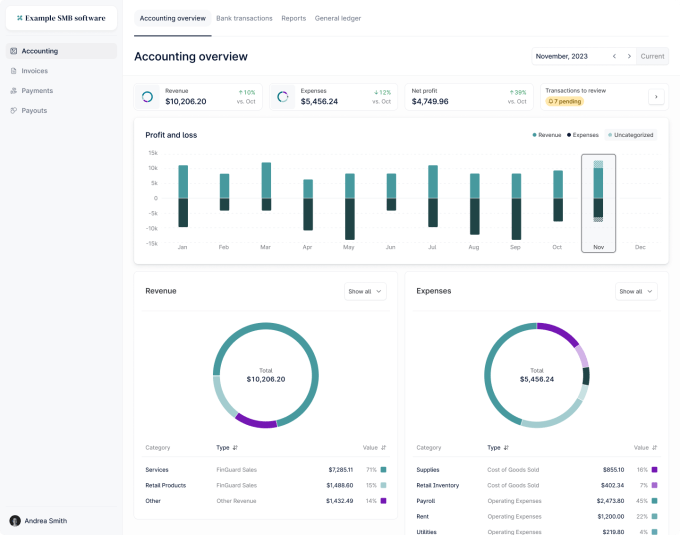

Layer is leaning into that better user experience, but with embedded accounting. Its customers are those, like Square or Toast, working with small and medium-sized businesses to offer accounting and bookkeeping features inside their own products. These larger companies would embed Layer's tools into their platform for small businesses to use.

SMBs can now access bookkeeping and accounting tools inside the Square or Toast platforms they use to run their business. This is instead of using a separate accounting software, like QuickBooks, to manage their business finances.

Justin Meretab, a former product leader on Square’s Banking team, started San Francisco-based Layer in 2023 with Daniel O'Neel, a former engineering leader at Wealthfront. Their goal was to create a set of APIs that allows platform customers to pass data from their small business customers to Layer. Then Layer provides connections to external bank accounts and credit cards to pull in the data and flow that into Layer’s ledger and account system. This allows the small businesses to then build a complete picture of all their financial data.

In a way, Layer is like Unit or Check, but for SMB accounting instead of banking and payroll. In fact, the company aims to completely replace legacy accounting and bookkeeping platforms like QuickBooks, Meretab told TechCrunch.

So did investors laugh them out of the room when they explained how they wanted to replace QuickBooks? Kind of.

“Many investors we’ve spoken with have told us this is a lofty goal given how much QuickBooks currently dominates the SMB accounting market,” Meretab said. “However, they also agree with our core belief that there’s been a fundamental shift in how SMBs run their businesses that now makes it possible to disrupt QuickBooks’ moat.”

Meretab went on to explain that over the last few years, platforms like Square, Toast and Shopify became the hubs where SMBs run their businesses. These platforms have built deep relationships with those customers, and as a result, increasingly help them manage all of their day to day operations.

Meretab was at Square for six years and heard from customers that they wanted to do their accounting directly within these platforms instead of in separate tools. He and O’Neel spoke to potential customers and learned it would be challenging to build that kind of embedded accounting feature internally, so they did it.

Layer is not alone here. There are some companies doing embedded accounting for SMBs, like Hurdlr and Fiskl. However, Meretab said Layer differentiates itself by focusing on building comprehensive accounting products without making customers do a lot of work themselves, or without them even needing to understand how accounting works.

The company has a small set of early customers, four in fact, that have launched their own SMB accounting products embedded within their platforms. Customers serve a wide range of SMB industries, from truck drivers to medical spas, and collectively work with over 100,000 small businesses.

“One surprise has been that many SMB users tell us our embedded accounting views are actually the first time they’ve ever seen a clear profit and loss view of their business,” Meretab said. “Many tried to use separate accounting software but found it too complicated or difficult to keep in sync with their main operational software.”

Layer’s different approach has also attracted investors. Better Tomorrow Ventures led a $2.3 million pre-seed investment into the company and was joined by a group of executives at companies, including Square, Plaid, Unit and Check.

The company plans to deploy the new funding into expanding its services to additional small business software platforms this year. It will also expand its team of four across engineering and business operations roles.

“Over the course of this year, our goal is to grow customers significantly, like triple the number of customers, and scale revenue,” Meretab said.

https://techcrunch.com/sponsor/visa/embedded-finance-is-having-a-moment