Conservative think tank says ad slamming the wealth tax is not about defending the wealthy

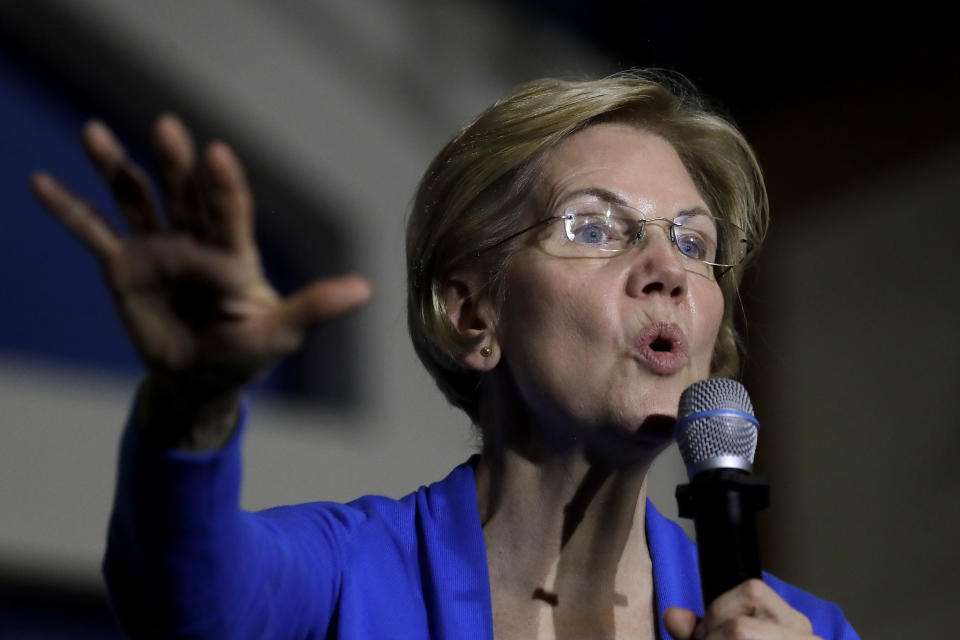

There’s a new ad campaign slamming Sen. Elizabeth Warren and Sen. Bernie Sanders’ call for a ‘wealth tax’, urging them not to ‘punish success.’

Conservative think tank Employment Policies Institute is behind the campaign that began airing on Monday, just a week after Sen. Warren’s ad ‘Elizabeth Warren stands up to billionaires’ launched.

“I’m not out here to defend the wealthy - Bill Gates can defend himself,” said Michael Saltsman, Managing Director of EPI on YFi PM. Saltsman is also partner at a public relations firm Berman and Company.

“It’s more sending a message to the next Mark Zuckerberg, or Elon Musk, the next Bill Gates or whoever else that we value entrepreneur activity and we’re not trying to punish success if you are successful and if you have an idea that makes it big,” he said.

The ad featured images of ultra-wealthy business figures including Jeff Bezos, Warren Buffett, Elon Musk, Mark Cuban, Oprah Winfrey and Mark Zuckerberg along with his wife Priscilla Chan.

Saltsman believes wealthy Americans do not hoard piles of money in their basement, rather they have different uses of it from reinvesting it in startups to philanthropic uses - and he adds that they go beyond writing $1 million checks to charity.

“If you look at even the top 20 wealthiest Americans, there was $9 billion that just the 20 people gave to charity in 2018… Those have gone to pay medical students at NYU, or it’s gone to fund a new cancer center like Memorial Sloan Kettering,” he said.

According to Chronicle of Philanthropy through an analysis of public disclosures, that figure is actually $7.8 billion from America’s 50 biggest donors, half of 2017’s figure of $14.7 billion.

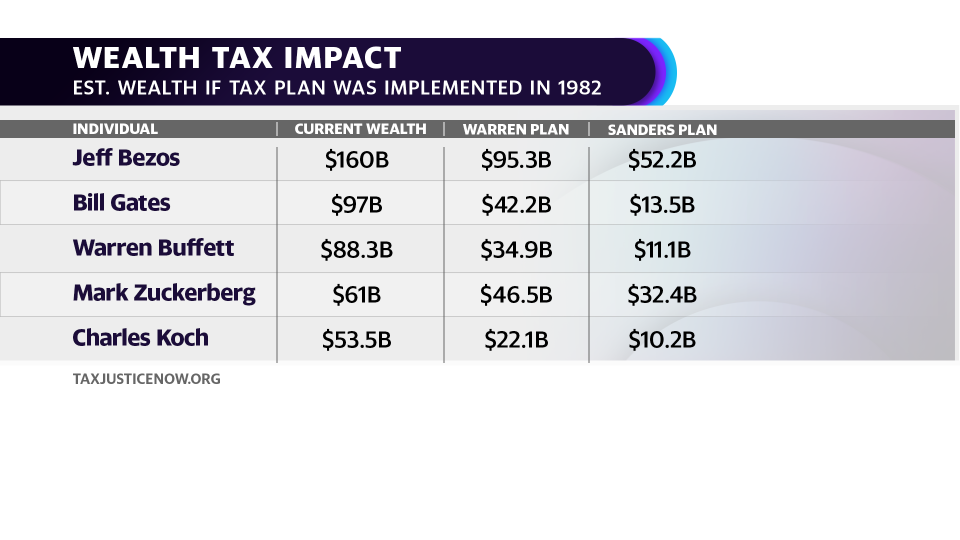

On Sen. Warren’s campaign that the amount that wealth tax can raise, Saltsman is skeptical citing France as an example that the rich will just leave.

“When you talk about Sen. Warren’s math, if the money she’s going to raise from that kind of wealth tax is so great, why not make it 4% on wealth over $50 million, and why not make it 12% on wealth over $1 billion,” he said

“I’m pretty skeptical the senator would raise the kind of money she thinks she can raise from this policy,” he added.

Billionaires call for ‘wealth tax’

Priscilla Chan has said earlier this year that paying more taxes is not a bad thing, while her husband Mark Zuckerberg is critical of Sen. Sanders comment that billionaires shouldn’t exist. Mark Cuban has slammed Sen. Warren’s wealth tax as a way to divert attention from her own wealth.

But not all billionaires would agree with the ultra-rich’s backlash against the wealth tax In fact, some billionaires penned an open letter “to support a moderate wealth tax on the fortunes of the richest 1/10 of the richest 1% of Americans — on us.”

Signatories of the letter include co-founder of Facebook (FB) Chris Hughes, George Soros, his son Alexander, and Molly Munger - daughter of Charles Munger (BRK-A) along with Abigail Disney - heiress to the Disney fortune (DIS).

Still, Saltsman is convinced that targeting the ultra-rich is not the way to go.

“The government shouldn’t be in the business to take billionaires down a couple of pegs on the wealth tax,” he said.

“There’s a bipartisan agreement that it’s a bad idea and potentially even unconstitutional.”

Grete Suarez is producer at Yahoo Finance for YFi PM and The Ticker. Follow her on Twitter: @GreteSuarez

Read more:

Why the Disney+ 'hack' shows data is like 'oil' that needs to be secured

Study: Female-led startups are gaining more ground in venture capital race

Air taxi startup Lilium eyes NYC as aviation scrutiny tightens

Why Facebook's Libra has a friend in GOP Senator Mike Rounds

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.