E*TRADE Stock's Recent Rally May Be Over

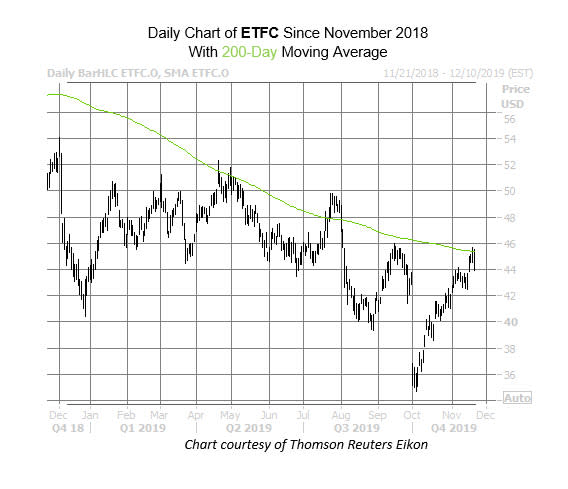

The shares of E*TRADE Financial Corp (NASDAQ:ETFC) have been on a tear since bottoming out at a two-year low of $34.68 in early October -- tacking on roughly 29% since then, and popping north of their year-to-date breakeven level late last week. This rally may have come to a head, however. While ETFC is trading higher today, it's once again bumping up against its 200-day moving average, which has had bearish implications for the stock before.

In fact, during the last three years, the broker has come within one standard deviation of this trendline three other times, according to Schaeffer's Senior Quantitative Analyst Rocky White. One month after each signal, the security was lower each time, averaging a 10.4% drop. At its current perch of $44.66, a similar move would send ETFC back near the $40 level for the first time since late October.

Despite today's dip, options bulls have been coming out of the woodwork today. So far, 7,400 calls have exchanged hands -- three times the average intraday amount -- compared to 1,600 puts. The December 45 call is by far the most popular, with the bulk of these contracts being bought. The most popular put is much further down the list at the 11/22 44 strike, where positions are being sold to open.

This bullish behavior is nothing new. In the past 10 days, calls have more than doubled puts on the the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX). This resultant call/put volume ratio of 2.01 sits in the 63rd percentile of its annual range, suggesting a healthier-than-usual appetite for bullish bets of late.

That being said, now might be an opportune time to speculate on ETFC's next move with options. The equity's Schaeffer's Volatility Index (SVI) of 30% falls in the 27th percentile of its annual range, meaning options players are pricing in relatively low volatility expectations at the moment.