The e-commerce boom won’t save retail jobs

While traditional retail jobs have been on the decline, the growth of the e-commerce sector offers some hope. Just look at Amazon (AMZN). The e-commerce giant, which dominates nearly half of the online sales in the U.S., has created thousands of warehouse and delivery jobs.

But that may not be enough. Recent research by The Conference Board looking at jobs data from 2005, suggests that the growth in e-commerce jobs is not sufficient to make up for jobs lost in brick and mortar.

In the past 12 years, the share of e-commerce in total retail sales has grown from 2.3% to 9.1% in 2017. During the same period, “new” retail sectors, including warehouse and delivery, have created just 749,000 jobs.

If the trend continues, meaning every 6.8% increase in e-commerce yields 749,000 new jobs, a 100% online retail sector would employ just 12.1 million workers, far from the latest job figures in May, which shows the retail sector currently employing 17.6 million people.

“Because each percentage point of e-commerce at present generates less work than each percentage point of in-store retail, the result is 5.5 million job losses during the transition from in-store retail to e-commerce,” Brian Schaitkin, senior economist at The Conference Board told Yahoo Finance.

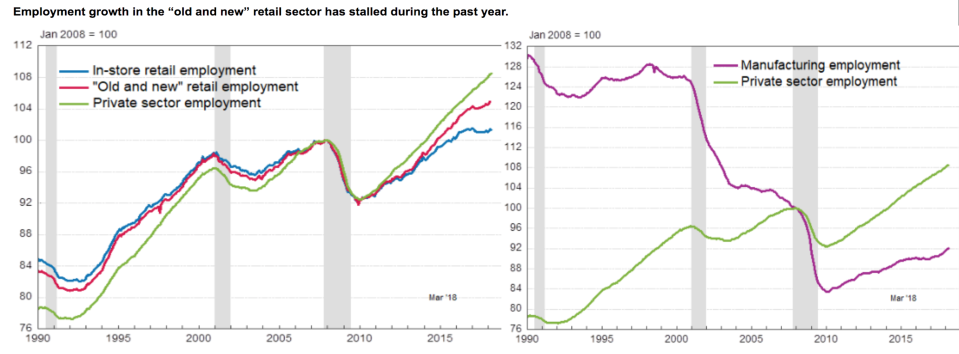

Retail is similar to manufacturing

Many believe the two types of retail (e-commerce and physical stores) will co-exist for a long time. Under a more moderate projection, the share of e-commerce in retail sales could be 21% by the end of 2040, and the “old and new” retail sector will employ 16.8 million workers, still shy of the total today.

This comparison assumes that consumer demand and sector productivity will grow at the same rate to keep these ratios constant. While the e-commerce sector is booming, retail sales per capita adjusted for inflation has largely stayed flat. Schaitkin said this is because people spend more on services instead of goods.

The lag in total growth makes the changing retail landscape a zero-sum game — e-commerce grows at the cost of the traditional retail industry. A UBS note in April estimates for each 1% increase in e-commerce penetration, an additional 9,000 stores would need to close.

And we’re seeing the beginning of that. So far in 2018, retail has been leading all sectors in job cuts, with 64,370 announced in the past four months, a 28.4% increase in the same period last year, according to consultant Challenger, Gray & Christmas.

Schaitkin compares the job loss in the retail industry to manufacturing in the 1990s, when outsourcing and automation played a major role in eliminating jobs in that sector. For instance, while Amazon has been on a hiring spree for warehouse associates, the company has also been doubling down on its Kiva robots to facilitate the work.

“Old and new retail workers who are most likely to retain their positions are those who add value to the customer experience, online or in-store,” said Schaitkin. “Customers often go to stores to consult merchandise experts. Delivery workers who can assemble and install goods will also be immensely valuable.”

Krystal Hu covers technology and economy for Yahoo Finance. Follow her on Twitter.

Read more:

Trump: The stock market ‘would’ve been up 60%, but I have to do things’

Why the soybean could be China’s trump card in the trade war