Donald Trump wants you to pay more for smartphones, TVs and a lot else

What to do about China? It employs millions of people manufacturing things that used to be Made in America, and sells way more stuff to the United States than it buys from us.

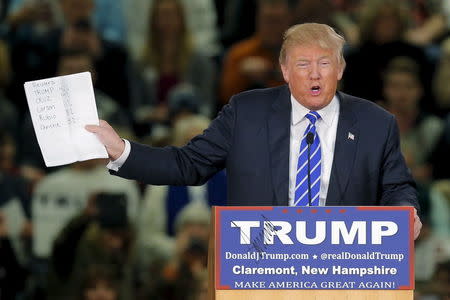

Donald Trump’s solution is to get tough on China by imposing steep new tariffs on products made in China. The Republican presidential candidate told the New York Times recently that he’d levy a 45% tax on Chinese imports. The idea is to make Chinese goods more expensive so that American producers who pay their workers more can gain a competitive edge.

There’s a painful side effect to this plan, however: It would, well, make a lot of products more expensive, and most of the price hikes would come straight out of consumer wallets. China ships about $500 billion worth of goods to the United States every year, which is about one-fourth of all imports. Goods from China include iPhones, TVs, clothes, furniture, toys and a lot of other things found in nearly every American home. A 45% tariff on Chinese imports would encourage other low-cost exporters, such as Vietnam, Bangladesh and Mexico, to ship more goods to America. Whether U.S. producers would gain an edge is debatable.

Consumers would feel the pain

Protectionists often argue that the cost of tariffs is borne largely by producers in foreign countries. But inevitably, some or most of any additional tax gets passed on to people who buy the products. “When you institute a tariff, the price goes up for consumers,” says economist Adam Ozimek of Moody’s Analytics. “People will also buy less. So consumers are hurt not just by rising prices, but by consuming less.”

The portion of Trump’s 45% tax that would be passed onto consumers would depend on how much competition there is for any given product. Anything made exclusively in China would become considerably more expensive. A fancy $100 sweater made only in China wouldn’t suddenly cost $145, because there would be fewer buyers at the higher price, and weaker demand would force the manufacturer to adjust the price downward. But it might rise to $115 or $125, since the producer won’t sell at a loss and would have to account for the big jump in costs caused by the new tariff.

Even if there’s competition from producers in other countries, prices would still rise somewhat, since higher prices from one major source allows other sources to raise their prices, too, and make a bit more profit. So if clothes made in China were suddenly 45% more expensive to Americans, similar clothes made in Bangladesh would cost more, as well—not 45% more, but still, more.

That might help American producers making competing products, but even if it did, prices for consumers would still go up. And many low-wage industries that have migrated to China, such as textiles and electronics manufacturing, are likely to stay there. American businesses and entrepreneurs are more interested in making specialized products that can't be produced just anywhere, and in coming up with new producs that command higher profit margins. The best way to boost U.S. growth is to encourage high-end innovation, not to fence off low-wage jobs that can be performed anywhere.

If Trump were to get elected and actually put his tariff into effect, it would reverse a 20-year trend of declining prices for many consumer goods, which has helped offset the rising cost of important things like healthcare and college tuition and occasional spikes in the cost of energy. Overall inflation, excluding food and energy, is a scant 2% at the moment, a level so low that economists worry more about deflation than inflation. But a big tariff on imports would quickly make inflation a big pocketbook concern and leave consumers with less money to spend on other things. Combine that with rising energy prices or some other mild shock and it could even cause a recession.

Trump’s tariff plan would likely meet firm public resistance. Economists would also protest. “Economists disagree about a lot,” says Ozimek, “but there’s very strong agreement that free trade benefits Americans, on average.” A poll of economists by the University of Chicago, for instance, found that 100% of them believe U.S. trade with China makes most Americans better off.

Most economists also agree that free trade—like anything that improves efficiency and market performance—produces winners and losers. And the losers usually include people who get the job done slower, at a higher cost than competitors. Protecting underperformers isn’t likely to help the U.S. economy. Helping them perform better would.

Rick Newman’s latest book is Liberty for All: A Manifesto for Reclaiming Financial and Political Freedom. Follow him on Twitter: @rickjnewman.