Fraud trial: Trump acknowledged penthouse size at 11,000 square feet, not 30,000 he later claimed

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

NEW YORK (AP) — Donald Trump signed a document 30 years ago that gave the true size of his New York penthouse which was later listed as far larger on financial statements, according to evidence Tuesday at the former president's civil business fraud trial.

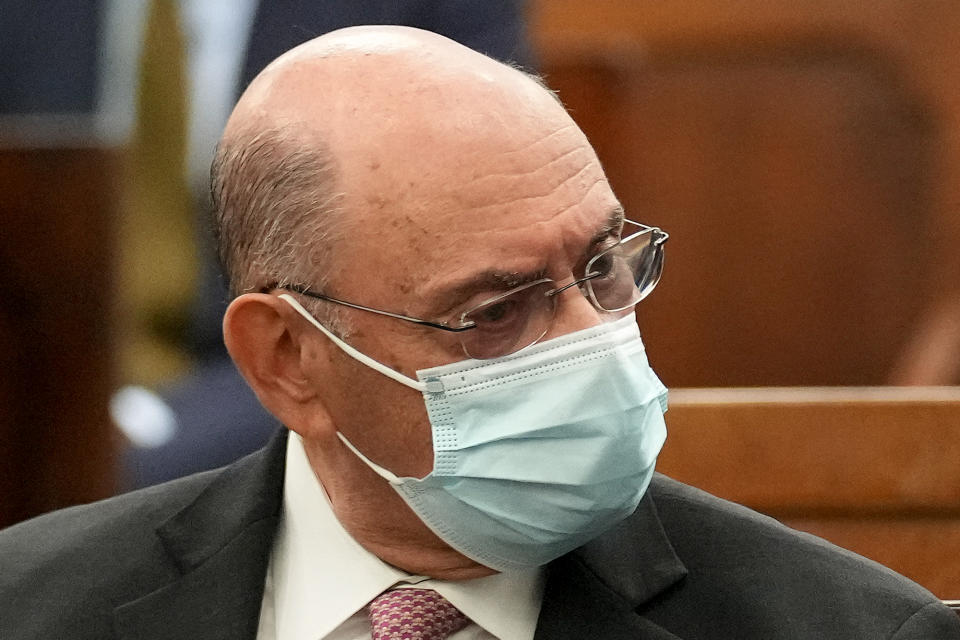

The evidence appeared in an email attachment shown as Allen Weisselberg, the former finance chief of Trump's company, testified in New York Attorney General Letitia James’ fraud lawsuit against Trump and his Trump Organization. Trump denies any wrongdoing.

The attachment was a 1994 document, signed by Trump, that pegged his Trump Tower triplex at 10,996 square feet — not the 30,000 square feet later claimed for years on financial statements that were given to banks, insurers and others to make deals and secure loans.

Weisselberg said he recalled seeing the email but not the attachment, explaining that the attachments were documents he already had on file in the company’s offices. But in any event, he said, he didn’t pay much mind to the apartment's size because its value amounted to a fraction of Trump's wealth.

“I never even thought about the apartment. It was de minimis, in my mind,” Weisselberg said, using a Latin term that means, essentially, too small to care about.

“It was not something that was that important to me when looking at a $6 billion, $5 billion net worth," said Weisselberg, whose questioning will resume after an ex-bank official testifies Wednesday.

Later, Weisselberg was asked about an appraisal that came in $230 million below what Trump’s financial statements showed for his Seven Springs estate north of New York City. Weisselberg said he was aware of the appraisal but didn't think the disparity was worth flagging to the outside accountants who prepared the statements.

Nevertheless, Weisselberg acknowledged signing documents certifying that financial summaries given to banks to meet loan requirements were “true, correct, and completely and fairly” represented Trump's financial condition.

Weisselberg repeatedly said he couldn’t remember whether he discussed the financial statements with Trump while they were being finalized. The ex-CFO said he reviewed drafts “from a 30,000-foot level” (9,100-meter level) but paid special attention to something “very important” to Trump: the descriptions of his properties.

“It was a little bit of a marketing piece for banks to read about our properties, how well they’re taken care of, that they’re first-class properties,” said Weisselberg, who added that Trump scrutinized the language used in such descriptions.

“He might say, ‘Don’t use the word “beautiful” — use the word “magnificent,”’ or something like that,” Weisselberg testified.

Meanwhile, in Trump's election interference case in Washington, prosecutors on Tuesday urged the judge to protect prospective jurors' identities, citing the former president’s “continued use of social media as a weapon of intimidation in court proceedings.” Trump lawyer John Lauro declined to comment.

In that federal criminal case, Trump has pleaded not guilty to illegally plotting to overturn his 2020 election loss to Democrat Joe Biden.

In New York, Weisselberg said Tuesday he learned of the Trump Tower penthouse size discrepancy only when a Forbes magazine reporter pointed it out to him in 2016. He testified that he initially disputed the magazine’s findings but said he couldn’t recall whether he directed anyone to look into the matter.

“You don’t recall if you did anything to confirm who was right?” state lawyer Louis Solomon asked.

Weisselberg said he did not.

As Forbes zeroed in on the apartment size question in 2017, emails show, a company spokesperson told another Trump executive that, per Weisselberg, they weren’t to engage on the issue. A week later, Trump’s 2016 financial statement was released, using the incorrect square footage.

Over the years, Trump Organization executives had greatly boosted their estimate of the apartment's value for reasons ranging from the boss's fame to comparing it to an asking price on another triplex — though that other one ultimately sold for 60% less, another former exec testified last week.

When The Wall Street Journal wrote about the $135 million listing for a property near Trump's Mar-a-Lago club in Florida in 2018, Weisselberg wrote a note telling a staffer to hang onto the article and “see what it ends up selling for.”

Asked Tuesday to explain, Weisselberg testified: “Anybody can ask anything for a dollar amount. That doesn’t mean it’s going to sell.”

Weisselberg, testifying as a prosecution witness, is also a defendant in the lawsuit. He took the stand after a recent jail stint for evading taxes on perks he got while working for Trump.

James' lawsuit alleges that Weisselberg engineered Trump’s financial statements to meet his demands that they show increases in his net worth and signed off on lofty valuations for assets despite appraisals to the contrary.

Trump attended the first three days of the non-jury trial last week but hasn't returned since.

Weisselberg left a New York City jail six months ago after serving 100 days for dodging taxes on $1.7 million in extras that came with his Trump Organization job, including a Manhattan apartment, school tuition for his grandchildren and luxury cars for him and his wife.

During sworn pretrial questioning in May, Weisselberg, 76, testified that he was having trouble sleeping, started seeing a therapist and was taking a generic form of Valium as he tried to “reacclimate myself back to society."

Trump, in a pretrial deposition in April, said his former longtime lieutenant was liked and respected, and “now, he’s gone through hell and back.”

“What’s happened to him is very sad,” Trump said.

In a pretrial ruling last month, Judge Arthur Engoron found that Trump, Weisselberg and other defendants committed years of fraud by exaggerating the value of Trump’s assets and net worth on his financial statements.

As punishment, Engoron ordered that a court-appointed receiver take control of some Trump companies, putting the future oversight of Trump Tower and other marquee properties in doubt. An appeals court on Friday blocked enforcement of that aspect of Engoron’s ruling, at least for now.

The civil trial concerns allegations of conspiracy, insurance fraud and falsifying business records. James is seeking $250 million in penalties and a ban on Trump doing business in New York.

___

Follow Sisak at x.com/mikesisak and send confidential tips by visiting https://www.ap.org/tips