Don’t Overlook The Vident International Equity Fund (VIDI)

At last count, we see 2,021 ETP offerings in the U.S. listed landscape, and we fully recall only several years back when the universe expanded above 1,000 names that some were labeling the industry as being in a bubble.

While it would be unrealistic to assume that all of the current ETPs will survive without any kind of consolidation, the trend of new listings often coming from sponsor companies that are new to the ETF issuer business is clearly intact. One company that has made an impression with its three ETFs that we have covered in this space before is Vident Financial.

The fund with the longest track record in the lineup launched less than four years ago in late October of 2013, VIDI (Vident International Equity, Expense Ratio 0.68%), has accumulated an impressive $727 million in assets under management during this time.

The two other fund offerings from the company, VBND (Vident Core U.S. Bond Strategy, Expense Ratio 0.48%) and VUSE (Vident Core U.S. Equity, Expense Ratio 0.55%), both have more than respectable asset levels at the moment as well, and in even less time traded publicly than VIDI since the funds debuted in October of 2014 and January of 2014 respectively.

Year-to-date, the 4-star Morningstar rated VIDI has reeled in an additional $25 million in new assets via creation while VBND has fared even better with $64 million entering. VUSE on the other hand has seen some position trimming in 2017 in the $20 million range.

If we look at the largest and first to go public fund from Vident, VIDI, we see that fund literature points out the following: “The index seeks to provide investors with a well-diversified set of global equities exposures across countries, regions and stocks, emphasizing countries with more favorable conditions for investment as well as economic and financial market resilience.” When we delve further through fund literature we see that the portfolio management team also seeks countries that specifically meet the following criteria, “Stronger fiscal conditions, More sound monetary policies, More favorable business and legal environment, Higher productivity, More productive demographics, Broader and deeper markets, Cheaper country and company valuations, Better leadership and governance, and More global diversification.”

Currently, the top country weightings in VIDI are: 1) South Korea (8.16%), 2) Japan (6.94%), 3) Singapore (6.83%), 4) Australia (6.70%), and 5) Germany (6.56)%).

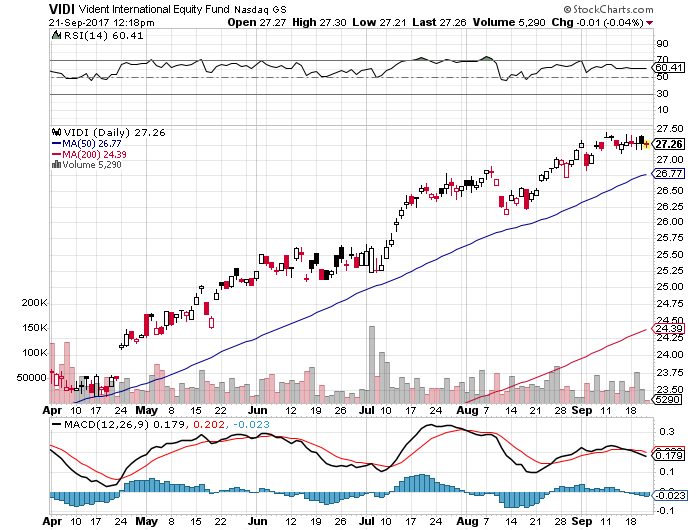

The Vident International Equity Fund (NASDAQ:VIDI) was trading at $27.26 per share on Thursday afternoon, down $0.01 (-0.04%). Year-to-date, VIDI has gained 28.46%, versus a 12.76% rise in the benchmark S&P 500 index during the same period.

VIDI currently has an ETF Daily News SMART Grade of A (Strong Buy), and is ranked #18 of 55 ETFs in the Foreign Large Cap Blend ETFs category.

Disclaimer: The content of this article is excerpted from a daily newsletter from Street One Financial. While ETF Daily News may edit the contents and add a relevant title to the piece, the author, Paul Weisbruch, does not endorse or recommend any issuer or security mentioned herein.

About the Author: Paul Weisbruch

Paul Weisbruch is the VP of ETF/Options Sales and Trading at Street One Financial. Prior to joining the team at Street One, Paul served as the Director of RIA and Institutional ETF Sales at RevenueShares ETFs from December 2007 until November of 2009. Before RevenueShares, Paul was employed by Susquehanna International Group from 2000 until 2007 serving in roles including OTC/NYSE Institutional Block Trading, Nasdaq/OTC Market Making, ETF/Derivatives Intelligence and Strategy, Algorithmic Trading, as well as acting as the PHLX Floor Specialist in the ETFs, SPY and DIA.Paul has been actively involved in the ETF space from both a product and trading standpoint since 2000. Additionally, Paul has well forged relationships with national RIAs, institutional pension fund managers and consultants, mutual fund and hedge fund managers, and also the ETF media. Co-authoring the “S1F ETF Daily” since 2009, the daily piece has become a must for many portfolio managers in the ETF space, with segments regularly appearing in the likes of Barron’s, WSJ, and ETFTrends.com for instance.

He holds his Series 4 (Registered Options Principal), 6, 7, 55 (Equity Trader), 63, and 65 licenses. He graduated from the University of Pittsburgh (B.S. – Economics), graduating magna cum laude, and has an MBA from Villanova University.