Don't Laugh, but After Horrible Holiday, Sears Says Profitability Is Still on the Table for 2018

As today's kids might say -- lolz! Because laughing is the only appropriate response to Sears Holdings' (NASDAQ: SHLD) declaration that it remains committed to becoming profitable in 2018.

After a Christmas holiday where it saw its decline in comparable-store sales actually worsen from where they had been, even as much of the rest of the retail industry was seeing strong gains, there seems little hope Sears will survive the coming year, let alone report profits.

Image source: Getty Images.

A lump of coal

If Sears was to make good on its turnaround ambitions, it needed Christmas to be at least not too bad, if not very good. While always a slim possibility at best, the worst that it could have experienced is a rapid acceleration of its downfall, and that's exactly what it got.

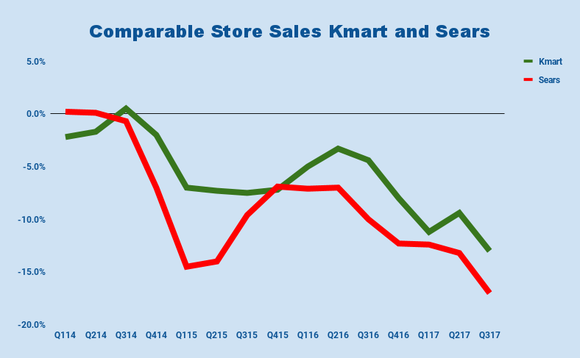

Over the two-month November-to-December holiday season, comparable-store sales at Sears and Kmart tumbled in the range of 16% to 17%, worse than the 15% decline in the third quarter, and down significantly from the 12% to 13% range it reported for the Christmas holiday a year ago.

Data source: Sears Holdings quarterly SEC filings. Chart by author.

For a company that has finally started making a lot of smart business decisions, it seemed to revert to form by choosing not to advertise at all for the holidays. According to The Wall Street Journal, the retailer suspended all advertising after the Thanksgiving weekend. Sure it needs to conserve cash, but for a company that's already witnessed a mass exodus of customers, not luring more in during the most important part of the year is stunningly short-sighted.

The move conjures up images of chairman and CEO Eddie Lampert eschewing remodeling Sears and Kmart stores because he believed customers didn't care about such things. Not running ads seems to have undermined whatever good works he might have achieved this year. It certainly doesn't instill any confidence that Sears can become profitable -- certainly not before it goes under.

The first rule of holes

More disturbing are the financial moves Lampert is making. Once again, he is digging into his own deep pockets to prop the retailer up by extending to Sears a $100 million term loan through one of the affiliates of his ESL Investments hedge fund, JPP, a lender that is often involved in these kinds of transactions. Sears said it will try to drum up an additional $200 million from other sources.

Further, it renegotiated some terms with an existing lender so that in the event of a default, the lender will recover 75% of the value of Sears' inventory rather than 65%, but it also pushed further out into 2018 terms related to collateral tied to other loans, while also trying to renegotiate other terms on as much as $1 billion worth of loans as a means of reducing its costs.

It's obviously not a good sign that the company is once again seeking financing at the end of the holiday season, a period when most retailers are typically flush with cash.

Shrinking its footprint

Sears just announced it was closing at least 100 more stores, and we'll probably hear about many more in the future. That should help it reduce its costs, but it's also going to cause sales to fall further still.

And now Land's End (NASDAQ: LE), which Sears spun out two years ago, said it was looking forward to the day that its reliance upon its former parent comes to an end, saying it expects its relationship with Sears to "go away." The retailer, which has only 11 stores of its own while still residing inside some 180 Sears stores, just turned a small profit last month of $200,000 on a 4.5% increase in sales.

There should theoretically become a point where Sears Holdings reduces its size to such a degree that it could be profitable, but it still has thousands of stores in its portfolio. The retailer also remains billions of dollars in debt, which, despite narrowing its losses in recent quarters, it is very much in the red.

Sadly, the probability the retailer goes bankrupt before it ever has a chance to achieve profitability, whether in 2018 or beyond, is very real, and that's no laughing matter.

More From The Motley Fool

Rich Duprey has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.