The dollar’s days as the world’s most important currency are numbered

For at least 70 years, the US dollar has been the world’s dominant currency. Central banks around the world hold a large portion of their reserves in the US currency, while private companies use it for international transactions. The trade in US Treasury bonds is the world’s deepest, most liquid market. As a result, the American economy benefits from a currency that greases the wheels of the global financial system.

This dominance is historically unusual, according to a new book by Barry Eichengreen, an economics professor at the University of California, Berkeley and expert in global currency systems, and European Central Bank economists Arnaud Mehl and Livia Chițu. In How Global Currencies Work: Past, Present, and Future (Princeton University Press), published this month, they challenge the traditional “winner-take-all” view that there can only be one dominant reserve currency at a time. This became a common view over the decades when the British pound dominated before the US dollar took over. In the future, some believe, the Chinese renminbi is destined to lead.

Using new evidence on central bank reserves from the 1910s to early 1970s, with particularly focus on the interwar period of the 1920s and 1930s, Eichengreen and his co-authors find that reserve currencies can and do coexist. For example, in the period between the wars, it seems the British pound and the US dollar shared reserve currency status more or less equally, depending on the year. Before the First World War, even though sterling was the most important currency, the French franc and German mark were internationally significant, too.

“From this vantage point, it is the second half of the 20th century that is the anomaly, when an absence of alternatives allowed the dollar to come closer to monopolizing this international currency role,” they write.

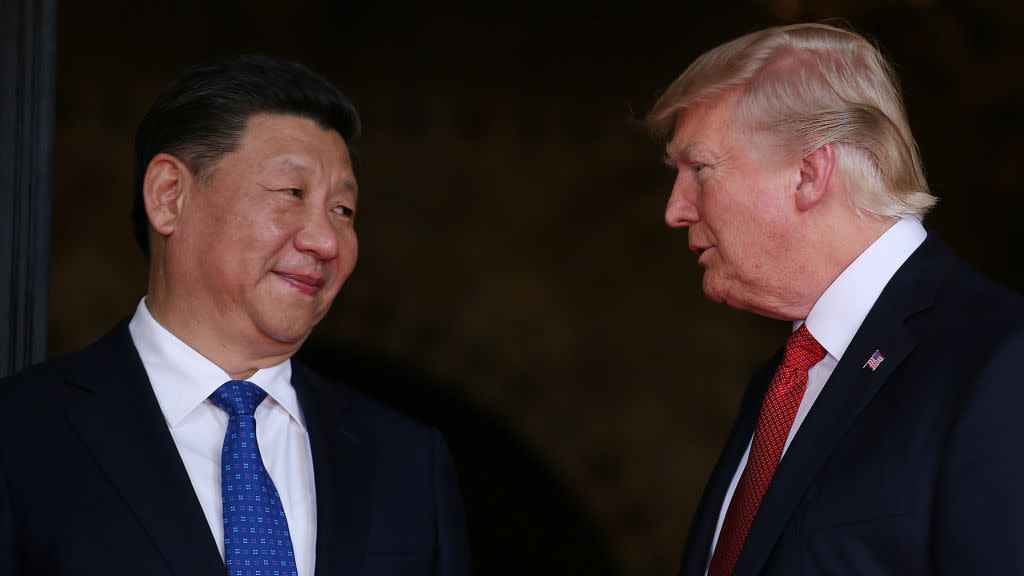

This implies that the dollar’s days as the dominant reserve currency will end “sooner rather than later.” The book suggests we’re heading for a return to the time when currencies coexisted on more equal footing in international markets. In the future, the dollar will be forced to share prominence with the yuan and the euro, in particular. The speed of the shift might depend on the actions of Donald Trump, Eichengreen says.

Quartz spoke to Eichengreen in London on what to expect if the dollar loses its hold over global financial markets. The conversation has been edited and condensed.

Quartz: This book dismantles a long-standing theory about the global currency system. What was wrong with the traditional theory?

Eichengreen: The traditional view is that international currency status is a winner-take-all game, that there’s room on the global stage for only one true international currency. The argument was that network effects are so strong they create a natural monopoly because it pays to use the same currency in cross-border transactions that everybody else has used. The new view is that financial technology has moved on and network effects are no longer so strong. It’s easier to switch between currencies. It’s similar to how operating systems for personal electronics have transformed. Everyone doesn’t have to use Windows anymore.

Since the dollar has been mostly dominant since the 1920s, so it’s all we’ve ever known. What will its loss of status be like?

If the policies of the governments and central banks responsible for these currencies remain sound and stable, this can be a smooth evolution. On the other hand, if there is some kind of policy shock, which could be financial, or it could be the failure of the US Congress to raise the debt ceiling, or it could be a trade war, then I think it’s possible to imagine things suddenly changing. It will depend on whether people view US Treasury bonds as no longer safe assets or they come to view renminbi-denominated securities as unsafe because the rule of law was not reliable in China.

It would be very dramatic for Treasuries to lose their reputation as a haven asset.

That would be severely disruptive to the global economy and the maintenance of globalization as cross-border trade and financial transactions rely on dollars. If liquidity dries up because people don’t want to hold and use dollars, what are they going to use instead? There are only so many Swiss francs and Chinese capital controls make it hard to get your hands on renminbi. There would be a global liquidity shortage. That’s a dire scenario.

What are the chances of this really happening?

If you’d asked me two years ago, I would have attached quite a low probability to that happening. But I think with Trump’s election we have had to consider more seriously the tail events that we might otherwise have neglected. For example, countries that rely on the US for their security umbrella security hold a larger share of their reserves in dollars than countries that don’t. It’s a way of signaling to the United States that we’re on your side but it’s a way of giving the US hostages. Countries that have their own nuclear weapons hold fewer dollars than advanced countries that don’t.

So let’s imagine that South Korea and Japan conclude that the US is not a reliable guarantor of their security and they have to develop their own defense capability; that could significantly diminish their relationship with the of the dollar. I don’t attach a high probability of this happening, but things could fall apart.

What are the benefits of being the dominant reserve currency?

There’s some economic value because it’s convenient for banks and firms to do cross-border business in their own currency, while the government can borrow at lower cost due to additional demand for treasury securities as reserves. Also, if you are the leading international currency, you are also the safe haven. When something goes wrong in the world economy, everybody rushes into your financial markets even if you’re the cause of what went wrong, as in the case of Lehman Brothers and the 2007-2008 financial crisis.

What are the political implications of losing this status?

I’m not sure there are big negatives in an era where the US is trying to play less of an influential geopolitical role.

The UK’s power and standing on the world stage has significantly reduced since its days as the issuer of the leading international currency. Could the US suffer the same fate?

The UK is hopefully a more extreme case. It was a sick economy for an extended period after the Second World War, with tremendous debt and financial problems. For example, the debt to GDP ratio was in excess of 200%, twice and more of what the US has now. Under those circumstances it was simply inconceivable that sterling could remain as important as it had been.

The US is not in that position now but it will depend on how good or bad economic management is. Most people have said, until very recently, that US institutions are strong and irresponsible policies will not be allowed to stand. We will see.

What are the prospects for the renminbi becoming a reserve currency? Is China sufficiently financially open?

Every true global currency in the history of the world has been the currency of a democracy or a political republic, as far back as the republican city-states of Venice, Florence, and Genoa in the 14th and 15th centuries. China knows they need to do political reform to strengthen rule of law and the reliability of contract enforcement. Will that without democratization be enough to support a leading role for the renminbi? We’ve never been there before, but China has done many things other countries have not succeeded in doing before. I wouldn’t rule out they can do this too.

You want a strong and reliable government that implements predictable policies that are investor friendly. Meanwhile, the United States is doing erratic things and there’s no European government but rather a collection of governments trying to cooperate on a capital markets union. Maybe China becomes the attractive issuer.

Would the fragmented nature of Europe’s governance stand in the way of the euro becoming a dominant reserve currency?

There are four things you need in order for your currency to play a global role: size, stability, liquidity, and security. Europe’s economy needs to continue growing and the region needs to move ahead with the Capital Markets Union to become a more liquid market.

But this book is more optimistic about the euro than I had been previously. Europe has made progress in drawing a line under its crisis and the economy is growing again. Markets in euro-denominated assets are growing larger and more liquid.

Stepping back, what’s the most likely future for global currencies?

The optimistic path is where globalization continues at a more measured pace than in the recent past, supported by a global financial system that rests on three pillars—the dollar, the euro, and the renminbi.

The pessimistic scenario is that that progress is too slow and something happens to derail confidence in the dollar. Meanwhile, the euro and the renminbi have not had time to step up and a global liquidity crisis develops that takes globalization down with it. We are more inclined towards the first scenario, but we think it’s worth worrying about the second.

Finally, we have to talk about cryptocurrencies. Where do bitcoin and other digital currencies fit in to this future?

Money has three functions: a means of payment, unit of account, and store of value. Digital currencies are a promising way of reducing transaction costs and could be a more efficient means of payment. But bitcoin is not a good store of value.

It’s almost impossible to keep up with its volatility.

History shows that the reliable store of value has to have a government standing behind it. I think there’s a future for digital currencies, certainly for central-bank issued digital currencies. Then, the question is: Will central bank digital currencies crowd out private digital currencies like bitcoin? Or will central banks try to regulate them out of business because they are used primarily for money laundering, tax evasion, terrorist finance, and drug-related transactions?

If I had to guess, I would say gradually over time we will see central banks and governments occupying this space, proving the really efficient means of payment services that people want. We’ve seen this in history with the evolution from gold coins to token coins to paper money to bank deposits and now to digital currency. But will bitcoin survive? In the casino, but not elsewhere.

Sign up for the Quartz Daily Brief, our free daily newsletter with the world’s most important and interesting news.

More stories from Quartz: