The dollar's getting stronger — and that could be bad news

Reuters/Brendan McDermid

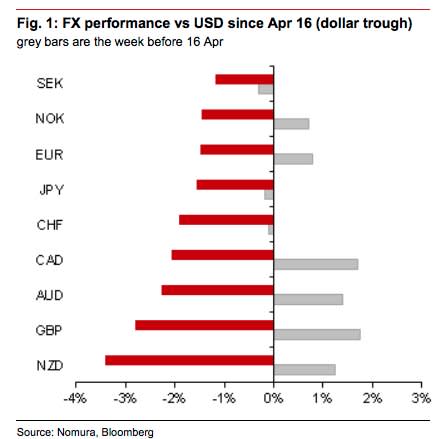

The dollar has been rallying against other major currencies over the past week.

But some think it could be strengthening for negative reasons.

Whether a strong dollar is a good or bad thing remains highly debated among economists. But there is generally one consensus among them — it's important to look at why the dollar is moving.

The greenback has jumped more than 1.5% against the yen and euro since last Monday. And it's made even bigger gains versus other currencies, including the New Zealand dollar and the British pound.

Bilal Hafeez, a foreign exchange strategist at Nomura, thinks the greenback is rising for "bad" reasons.

"US risk markets such as equities and credit have weakened over the same period while the dollar has rallied," he said. "The dollar is rallying in a negative environment."

Hafeez noted the recent commodities rally, which is credited for helping the dollar tick higher, was driven by trade tensions and other geopolitical worries rather than global demand. And those price dynamics may spill over into the rates market, he says.

US government bond yields have been jumping over the past week, with the 10-year Treasury yield hitting the key 3% level for the first time since 2014 on Tuesday. That could signal markets are positioning themselves for a slowdown in growth.

"If anything this suggests rates markets are expecting the Fed to be forced into more hikes to curb these inflationary pressures," he said. "This provides a more negative backdrop for the dollar rally."

Elsewhere, equities have remained relatively sluggish as the dollar climbs. Stocks have been slow to react to a recent series of strong corporate earnings.

"Instead higher US yields could be de-rating stocks, and investor equity longs and fears on tech hardware seem to be weighing on stocks," he said.

NomuraThough the dollar index — a measurement of the greenback versus its major peers — paused Tuesday, some think it will continue strengthening.

The Federal Reserve is on track to raise rates two or three times more this year, which is relatively faster than the other major central banks. That could push rate differentials wider and further boost the dollar, according to FXTM Chief Market Strategist Hussein Sayed.

"Unless President Trump surprises us with a new Tweet, we may see further greenback appreciation," he added.

But that's all the more reason to trade in US dollars for so-called safe haven currencies, according to Hafeez.

"In such an environment, we think the best way of holding onto a core short dollar position would be to sell it against the yen," Hafeez said.

NOW WATCH: Wall Street's biggest bull explains why trade war fears are way overblown

See Also:

SEE ALSO: Bitcoin hits its highest levels in over a month as crypto markets rebound