Dividend Stocks Investors Love

Dividend stocks such as Power Assets Holdings and Link Real Estate Investment Trust can help diversify the constant stream of cash flows from your portfolio. Dividends can be underrated but they form a large part of investment returns, playing an important role in compounding returns in the long run. If you’re a buy and hold investor, these healthy dividend stocks can generously contribute to your monthly portfolio income.

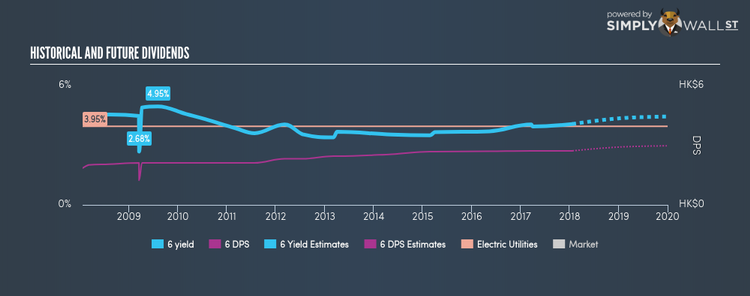

Power Assets Holdings Limited (SEHK:6)

Power Assets Holdings Limited, an investment holding company, engages in the generation, transmission, and distribution of electricity in Hong Kong, the United Kingdom, Australia, Mainland China, and internationally. Established in 1976, and headed by CEO Chao Chung Tsai, the company now has 11 employees and with the stock’s market cap sitting at HKD HK$142.68B, it comes under the large-cap stocks category.

6 has a juicy dividend yield of 4.07% and their current payout ratio is 85.49% . In the case of 6, they have increased their dividend per share from $1.85 to $2.72 so in the past 10 years. The company has been a reliable payer too, not missing a payment during this time. More detail on Power Assets Holdings here.

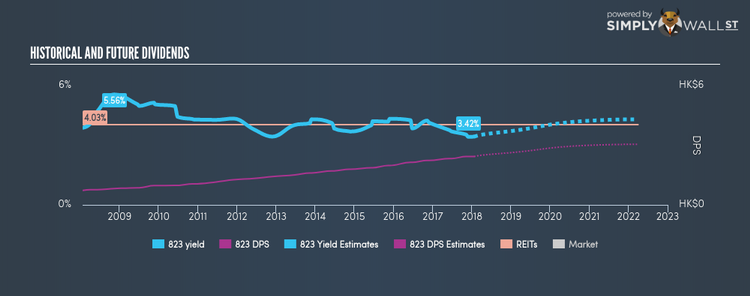

Link Real Estate Investment Trust (SEHK:823)

Link Real Estate Investment Trust (“Link REIT”) is the first real estate investment trust listed in Hong Kong, and currently Asia’s largest REIT and one of the world’s largest retail focused REITs in terms of market capitalisation. Formed in 2005, and currently headed by CEO Kwok Hongchoy, the company size now stands at 907 people and with the company’s market cap sitting at HKD HK$154.59B, it falls under the large-cap category.

823 has a wholesome dividend yield of 3.43% and their current payout ratio is 22.10% , with analysts expecting this ratio in three years to be 107.10%. 823 has increased its dividend from $0.72 to $2.43 over the past 10 years. It should comfort existing and potential future shareholders to know that 823 hasn’t missed a payment during this time. Link Real Estate Investment Trust’s earnings growth over the past 12 months has exceeded the hk reits industry, with the company reporting an EPS growth of 67.78% while the industry totaled 53.47%. Dig deeper into Link Real Estate Investment Trust here.

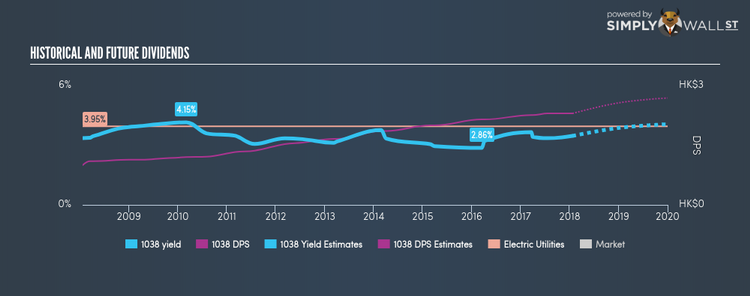

CK Infrastructure Holdings Limited (SEHK:1038)

CK Infrastructure Holdings Limited, an infrastructure company, develops, invests, and operates infrastructure businesses in Hong Kong, Mainland China, the United Kingdom, the Netherlands, Australia, Portugal, New Zealand, and Canada. Established in 1996, and now run by Hing Kam, the company currently employs 2,014 people and with the stock’s market cap sitting at HKD HK$175.74B, it comes under the large-cap stocks category.

1038 has a good-sized dividend yield of 3.47% and the company has a payout ratio of 59.24% . Over the past 10 years, 1038 has increased its dividends from $1 to $2.3. The company has been a reliable payer too, not missing a payment during this time. More on CK Infrastructure Holdings here.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.