Disney 4Q earnings glide past expectations ahead of Disney+ launch

Disney (DIS) posted stronger-than-expected results in its final quarterly report before the launch of its new streaming service sets off its direct-to-consumer strategy in earnest.

Here were the main numbers from the report compared to Bloomberg-compiled estimates:

Revenue: $19.1 billion vs. $19.05 billion expected

Adj. earnings: $1.07 per share vs. 95 cents per share expected

Shares of Disney jumped 3.3% to $137.50 each during extended trading after results were released.

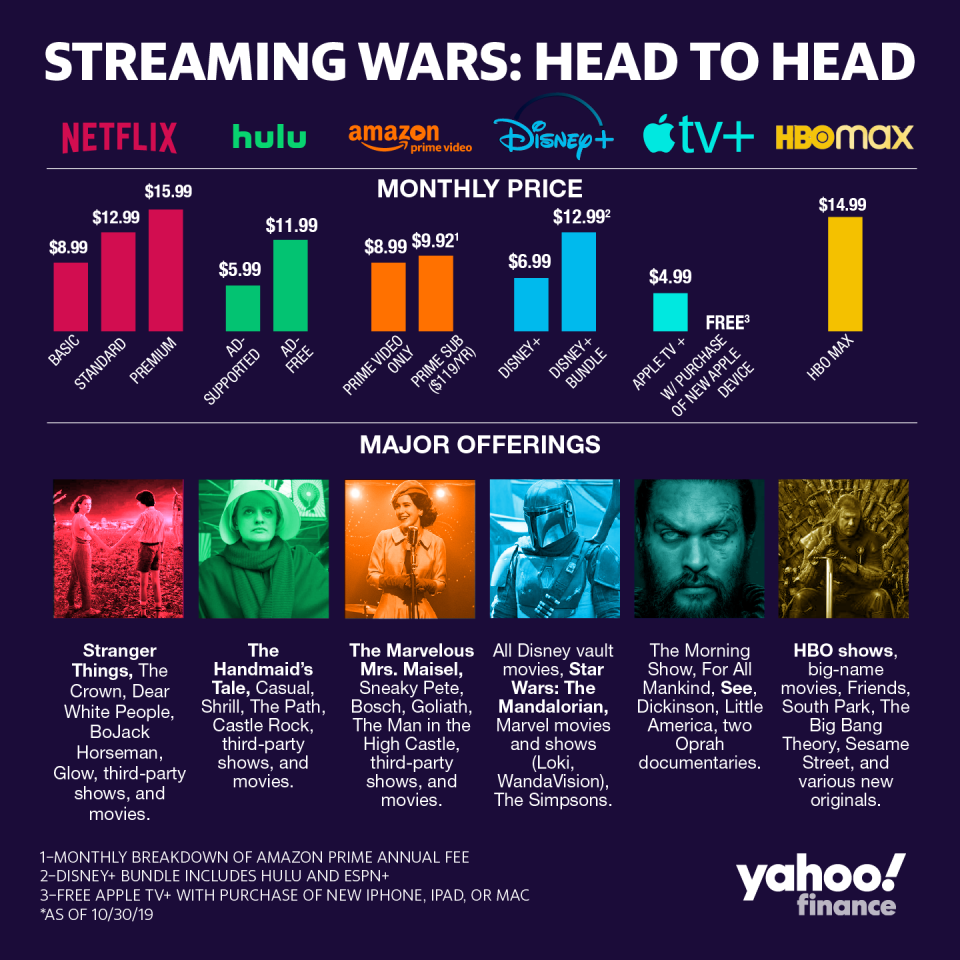

Disney’s fiscal fourth-quarter earnings report come just days before the company’s latest bet, the Disney+ streaming service, launches Tuesday in the U.S. The platform will compete with other over-the-top (OTT) services including Netflix (NFLX), Amazon Prime (AMZN), and Apple TV+ (AAPL), which just launched its own service at the beginning of the month. AT&T (T) WarnerMedia’s HBO Max is set to launch next spring.

“Our solid results in the fourth quarter reflect the ongoing strength of our brands and businesses,” Disney CEO Bob Iger said in a statement. “We’ve spent the last few years completely transforming The Walt Disney Company to focus the resources and immense creativity across the entire company on delivering an extraordinary direct-to-consumer experience, and we’re excited for the launch of Disney+ on November 12.”

The Street has been broadly optimistic about Disney+, a platform which will serve as the home for Marvel, Pixar, Star Wars and other Disney-branded content. Disney’s stock has risen 12.5% since it unveiled its streaming service strategy at its investor day April 11, versus a 6.5% gain in the S&P 500.

“We think the most intriguing period will come in the calendar first half of 2020, as Disney+’s entry, and inevitable comparison with Netflix begins in earnest,” BMO Capital Markets analyst Daniel Salmon wrote in a note ahead of results.

Disney+ has also offered an avenue of integration for 21st Century Fox, an acquisition closed in March that was aimed at helping bulk up Disney’s content library. But the deal has also taken a hit Disney’s bottom line, with CFO Christine McCarthy saying during a call with analysts Thursday that Fox Studio will likely lose $60 million in the fiscal first quarter.

But operating losses in the direct-to-consumer and international segments – which houses the streaming service – were narrower-than-expected for the reported quarter. The quarterly drain was $740 million in the unit, versus the $811.1 million expected. But these losses did more than double over last year, which Disney attributed to consolidation of Hulu, investment in ESPN+ and investments related to Disney+.” The direct-to-consumer unit is expected to lose $800 million in the first quarter, McCarthy said.

Disney also topped expectations in its Media Networks segment, its biggest contributor to profit and second biggest contributor to overall sales. Revenue in this unit, which includes Disney’s various cable networks, rose to $2.27 billion, handily topping the $1.85 billion expected. And operating income of $1.78 billion came in ahead of the $1.64 billion expected.

Studio Entertainment revenues of $3.31 billion matched expectations, and operating income of $1.08 billion was higher than the $827.3 million expected, as strong performances from new releases including The Lion King, Toy Story 4 and Aladdin buoyed results.

Its Parks, Experiences and Products segment also outperformed during the fourth quarter, even as Hurricane Dorian in hit domestic park attendance in the southeastern U.S. and ongoing protests hurt results at Hong Kong Disneyland. The parks segment grew 8% over last year in the fourth quarter to $6.66 billion, topping expectations for $6.56 billion. Operating income of $1.38 billion in the unit was also ahead of consensus, which Disney attributed in part to higher sales from Toy Story and Frozen merchandise.

—

Emily McCormick is a reporter for Yahoo Finance. Follow her on Twitter: @emily_mcck

Read more from Emily:

Jobs report: U.S. economy adds 128,000 jobs in October, smashing expectations

FedEx CEO: ‘Whistling past the graveyard’ on the U.S. consumer belies a broader slowdown

There won’t be ‘billion-dollar beverage brands’ in the future: Iris Nova CEO

Tech companies like Lyft want your money – not ‘your opinion’

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Find live stock market quotes and the latest business and finance news