Disney, Nvidia, and JOLTS — What you need to know for the week ahead

After one of the busiest weeks of the year, investors this week will face a slower economics calendar and a busy, but more tame, earnings schedule.

The main economics highlights will come on Tuesday and Friday when the latest JOLTS report — which shows job openings in the U.S. — and a check on consumer sentiment are due out, respectively.

Meanwhile, earnings highlights should include results from Disney (DIS), Twenty-First Century Fox (FOXA), Marriott (MAR), MGM (MGM), Macy’s (M), Nordstrom (JWN), and Nvidia (NVDA).

Disney earnings will be closely tracked for an update on the company’s ESPN unit, which has been at the center of political controversies in recent months as well as tried to combat the secular decline in cable subscribers.

This past week, a deluge of news hit markets though the major averages finished the week little-changed, but higher across the board.

President Donald Trump named Jerome Powell to be his nominee to replace Janet Yellen as Chair of the Federal Reserve. Apple (AAPL) reported earnings that crushed expectations and surged to a record high. House Republicans unveiled the first draft of their tax plan.

And the October jobs report showed 261,000 jobs were added to the economy after a disappointing September number with the unemployment rate falling 4.1%, the lowest since December 2000.

Other news to watch into the start of next week were reports late Friday that Broadcom would unveil a bid to acquire Qualcomm, which would create a $200 billion chip giant. Reports late Saturday that Saudi Arabia had arrested 11 princes, current and former ministers, and billionaire Prince Al-Walled bin Talal also bear watching into the new week.

Economic calendar

Monday: No major economic data released.

Tuesday: Job openings and labor turnover survey, September (6.1 million job openings previously); Consumer credit, September ($17.75 billion expected; $13.1 billion previously)

Wednesday: No major economic data released.

Thursday: Initial jobless claims (231,000 expected; 229,000 previously)

Friday: University of Michigan consumer sentiment, November (100.5 expected; 100.7 previously)

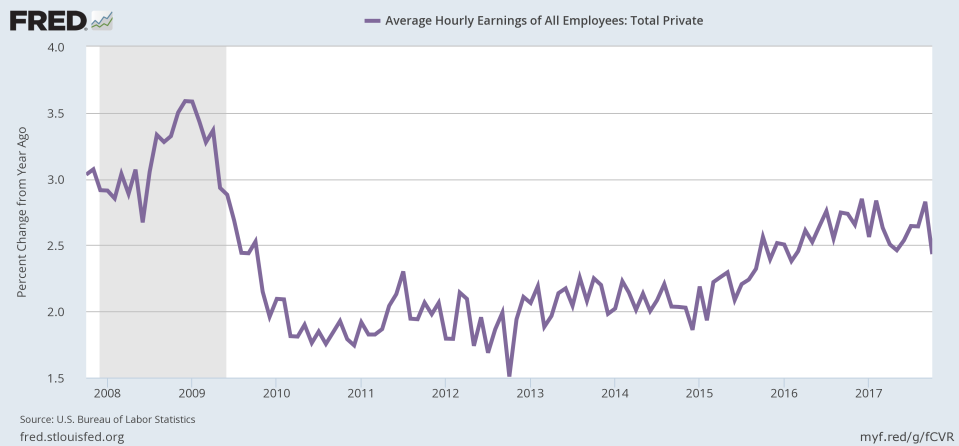

Wage growth continues to disappoint

The October jobs report saw the unemployment rate fall to a nearly 17-year low.

And while the headline job gains — 261,000 vs. an estimated 313,000 — were a slight disappointment relative to expectations, it’s clear that the post-hurricane drop we saw in September was just a blip. The U.S. job-creating machine is still in great shape.

But Friday’s report revealed another area where persistent weakness has and continues to plague the labor market. And that is wage growth.

Wages grew 0% over the prior month in October and just 2.4% over the prior year, the smallest increase since February 2016.

“The story from the October jobs report was the lack of wage growth,” said economists at Bank of America Merrill Lynch. “The reality is that we are still seeing only a gradual move higher in wages on a trend basis. This will continue to present itself as a puzzle for the Fed-with wages failing to accelerate, the natural conclusion will be that NAIRU is lower.” The NAIRU, or non-accelerating inflation rate of unemployment, is the unemployment rate below which economists expect wage gains to inflect higher, thus sending inflation higher as well.

Chris Rupkey, an economist at MUFG, said Friday that, “The only blemish in the [October jobs report] is that wages remain relatively lackluster for this point in the economic cycle with help-wanted signs posted in every shop window on Main Street.”

Rupkey added that, “Part of the subpar wage story is low inflation itself of course as many large corporations index overall annual wage increases to the rate of inflation. 2% inflation last year engenders 2% wages this year.”

Though as we noted at the beginning of 2017, the trend in employment at large companies has decelerated in recent years as smaller businesses take up a larger share of hiring in the economy. And as has tended to be the case with the labor market in recent years, the balance of evidence ultimately leads many economists and experts to simply call the persistent lack of wage growth a puzzle given other dynamics we’re seeing in the economy.

Job openings are near record highs, business activity surveys indicate that labor is in high demand and hard to find, and consumers feel that jobs are widely available. All of these factors point to an environment in which wages should be moving notably higher as competition for workers heats up.

And yet here we are with another disappointment, and another failure to solve the economy’s persistent puzzle.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: