Disney and JOLTS — What you need to know in markets on Tuesday

On Tuesday, markets will get to pore over the most anticipated earnings report of the week: Disney (DIS).

Reporting after the market close, the company’s earnings conference call is likely to be flooded with questions about its flagship sports network ESPN, which earlier this month announced layoffs and faces a future that will certainly look very different.

Elsewhere on the calendar, we’ll get first quarter results from Nvidia (NVDA), Yahoo Finance’s company of the year in 2016, as well as Priceline.com (PCLN), and Yelp (YELP).

On the economics side, Tuesday will feature updates on small business optimism as well as the latest job openings and labor turnover survey, or JOLTS report. The JOLTS report has been singled out by Federal Reserve chair Janet Yellen as one of her favorite economic indicators.

This news will follow a Monday in markets that was very ho-hum, with the major U.S. market indexes moving less than 0.2% and crude oil prices rising 0.4% after bouncing off a five-month low on Friday.

Gone, volatility

The big markets story continues to be the lack of volatility in the U.S. markets, with the VIX — an index that tracks implied future volatility in the stock market — falling below 10 on Monday and notching its lowest close since 1993.

For some, of course, this is bad. As we’ve written before, there is a funny kind of markets-only logic wherein high volatility is bad because it means things are unsettled in markets, but so too is low volatility bad because it means people aren’t worried enough about things getting unsettled in markets. Complacency, more or less, is said to be reflected in low volatility and complacency is bad.

In a note to clients published on Friday, however, analysts at Bespoke Investment Group took this logic to task — and levied the ultimate insult in the post-Trump era. Low volatility being bad is simply fake news.

“Whenever the VIX gets to extremely low levels, arguments that it is a sign of complacency and an imminent market top always start to make the rounds,” the firm writes. “Before we go any further, though, this line of reasoning is the ultimate in fake news.”

Bespoke notes that back in 2013, folks were warning that a low VIX was a warning sign for markets. Well, the VIX is a whole lot lower now.

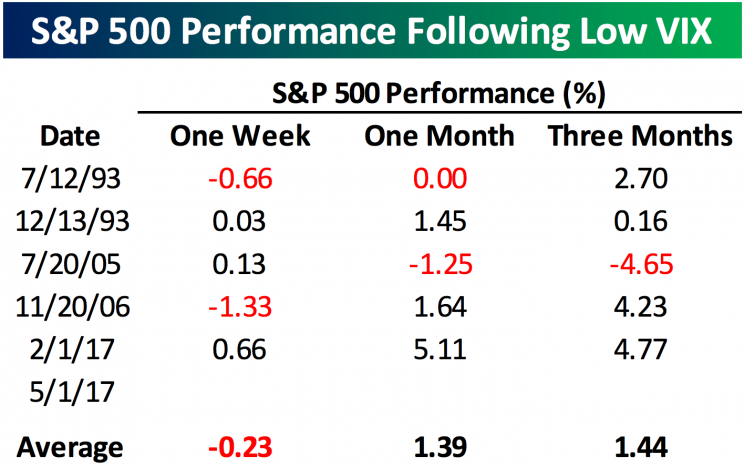

And Bespoke took a look at some simple S&P 500 performance following drops by the VIX into single-digits, and on average, you guessed it, stocks usually go up.

Following Donald Trump’s election, markets were supposed to sell-off. Except they rallied. And then, after the “Trump trades” powering markets petered out, we were supposed to see another rollover in markets as investors realized the legislative promises Trump made during the campaign faced high hurdles to implementation.

And stocks may yet fall.

But at this point, it is clear those who did or have called for lower stocks because of troubles in Washington or mass investor complacency have been too early, at a minimum. Which means they are wrong.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: