Disney earnings preview: Disney+ anticipation steals spotlight

(Update: Disney 4Q earnings top expectations)

The next big thing in streaming launches on Tuesday when Disney+ hits homes, with analysts predicting huge subscriber numbers in the first few years.

But first, on Thursday, Disney (DIS) will release an earnings report that won’t yet have the benefit of its buzzy new streaming service.

The two biggest pieces of Disney’s business — media networks and parks and resorts — have been lackluster in recent quarters. Waning cable subscribers took a toll on networks, and attendance at Disney’s domestic parks took a hit in part because of timing changes for the openings of Star Wars: Galaxy’s Edge at Disneyland in Anaheim, Calif. and Disney World in Orlando, Fla.

The networks’ weakness in particular is why “they're pivoting to Disney+ and potentially accelerating cord-cutting for the industry by putting out this great service,” said Bernie McTernan, internet and media analyst at Rosenblatt Securities.

Disney’s net income may have dropped as much as 32% last quarter to $1.56 billion, or 96 cents a share, according to a Bloomberg survey of analysts. Revenue likely rose 33% to $19.03 billion. ESPN subscriber losses may have slowed to 2.5% in the fiscal fourth quarter from an estimated 2.7% drop in F3Q, but Disney likely made up for the drop with price increases, according to Dan Salmon, managing director of equity research at BMO Capital Markets.

Disney’s big bet on streaming could help mitigate those areas of weakness, but it will take some time, said McTernan. He predicts Disney+ can reach 10 million subscribers by the end of next year, rising to 90 million in the following four years — but he doesn’t think the service will break even for Disney until 2024.

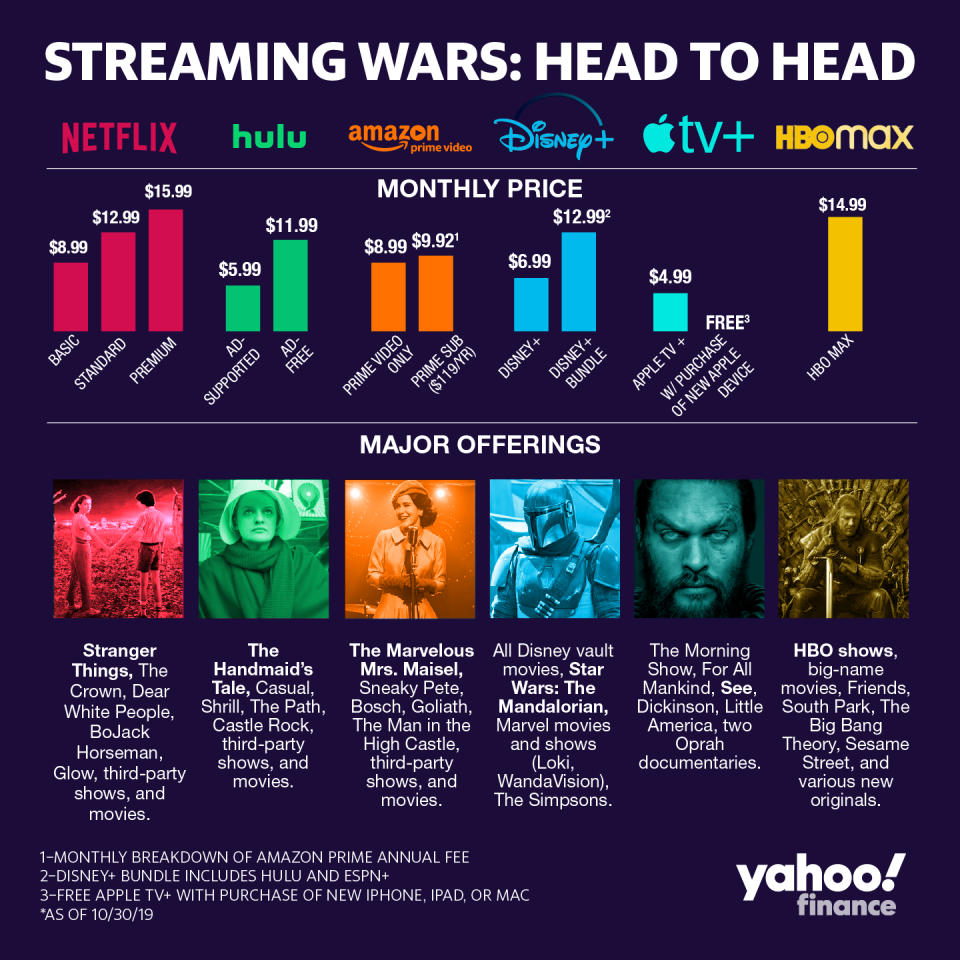

Still, Disney is his top pick among media companies, thanks to its portfolio of legacy content, which will make Disney+ hard to resist. “If you tell people that, ‘Hey, we're launching with a Star Wars show,’ they know what to expect,” McTernan said on Yahoo Finance’s live show On The Move. “That's different with Apple TV+ with shows like ‘See’ and ‘Dickinson’ and ‘The Morning Show.’ Customers aren't used to engaging with those brands and properties, which is why we think there's a much slower ramp there.”

Rosenblatt conducted a survey of streaming customers and found that, two weeks before its launch, 63% were aware of Disney+, 38% were planning to subscribe, and 6% had already pre-ordered the service.

A Bank of America survey found that 27% of respondents planned to subscribe to Disney+.

Last year, media networks constituted the largest part of Disney’s revenue at 41%, followed by parks and resorts at 34%, studio entertainment at 17%, and consumer products and interactive media at 8%. The last category is set to become direct to consumer and international, and will include Disney+. In February, Disney CEO Bob Iger declared that direct-to-consumer is the company’s “number one priority.”

Some investors and analysts are waiting to see subscriber numbers before they dive into the stock.

Disney shares are up about 20% this year, slightly trailing the S&P 500. They reached a record in July before sliding from that level in the late summer and fall. Twenty-seven percent of analysts who track the stock rate it a Hold, according to Bloomberg data, and 3% rate it sell.

Veteran media analyst Michael Nathanson has a Buy rating on Disney stock, but as he lays out in a recent note (titled “Disney — Why So Complicated”): “Rarely has a company willingly created this much financial disruption in strategically pivoting to a new business model.”

Julie Hyman is the co-anchor of On the Move on Yahoo Finance.

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.