discoverIE Group plc (LON:DSCV): Dividend Is Coming In 3 Days, Should You Buy?

Attention dividend hunters! discoverIE Group plc (LSE:DSCV) will be distributing its dividend of £0.03 per share in 3 days time, on the 15 January 2018, and will start trading ex-dividend on the 21 December 2017. So if you want to cash in on the stock’s dividend payment and are not yet a shareholder, you have only few days left! Today I am going to take a look at discoverIE Group’s most recent financial data to examine its dividend characteristics in more detail. View our latest analysis for discoverIE Group

5 checks you should use to assess a dividend stock

When researching a dividend stock, I always follow the following screening criteria:

Is their annual yield among the top 25% of dividend payers?

Has it paid dividend every year without dramatically reducing payout in the past?

Has dividend per share amount increased over the past?

Is its earnings sufficient to payout dividend at the current rate?

Will the company be able to keep paying dividend based on the future earnings growth?

How well does discoverIE Group fit our criteria?

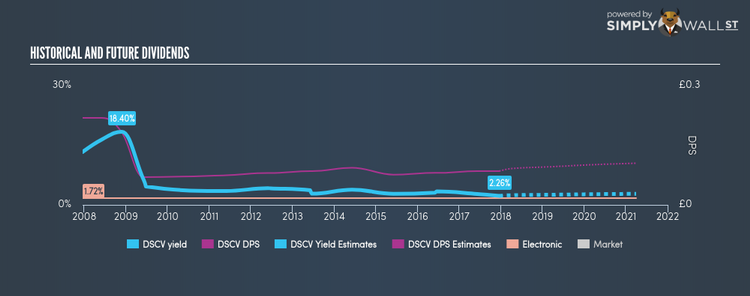

The current payout ratio for the stock is 82.96%, meaning the dividend is sufficiently covered by earnings. In the near future, analysts are predicting lower payout ratio of 38.74%, leading to a dividend yield of around 2.56%. However, EPS should increase to £0.17, meaning that the lower payout ratio does not necessarily implicate a lower dividend payment. If there’s one type of stock you want to be reliable, it’s dividend stocks and their stable income-generating ability. Not only have dividend payouts from discoverIE Group fallen over the past 10 years, it has also been highly volatile during this time, with drops of over 25% in some years. These characteristics do not bode well for income investors seeking reliable stream of dividends. Compared to its peers, discoverIE Group has a yield of 2.26%, which is high for electronic equipment, instruments and components stocks but still below the low risk savings rate.

What this means for you:

Are you a shareholder? You may be wondering why discoverIE Group is paying out dividends at all, instead of re-investing into the business to generate higher cash flows in the future. It may be worth exploring other dividend stocks as alternatives to discoverIE Group or even look at high-growth stocks to supplement your steady income stocks. I encourage you to continue your research by exploring my interactive free list of dividend rockstars as well as high-growth stocks to potentially add to your holdings.

Are you a potential investor? After digging a little deeper into discoverIE Group’s yield, it’s easy to see why you should be cautious investing in the company just for the dividend. On the other hand, if you are not strictly just a dividend investor, the stock could still be offering some interesting investment opportunities. As always, I urge potential investors to try and get a good understanding of the underlying business and its fundamentals before deciding on an investment. Check our latest free fundmental analysis to explore other aspects of discoverIE Group.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.