Daniel Loeb Lags S&P But Top New Stocks Advance

While the returns of Daniel Loeb (Trades, Portfolio)'s hedge fund Third Point have far outpaced the S&P 500 on an annualized basis, this year they fell short. The fund gained 25.2% for the year, compared to the index's 32.4%, and 2.3% for the month of December, versus the index's 2.5%.

By the end of the third quarter, the fund manager was finding a number of investment opportunities in instruments outside of stocks:

"We have continued to find new event-driven ideas and added several significant special situations to the portfolio. We are also finding compelling new pockets of value in both corporate and structured credit," he wrote in his third quarter letter.

Loeb had in fact reduced his equity exposure in July, as several positions reached his price targets, and his concern regarding the global economy - including possible U.S. military conflict in Syria, uncertainty from the Fed and potential government shutdown or default - grew.

Though the fund overall failed to surpass the broader market, two of his top new stock picks jumped in the fourth quarter, and three others have yet to appreciate significantly. The majority of the holdings gained more than half for the year.

Loeb's Stocks

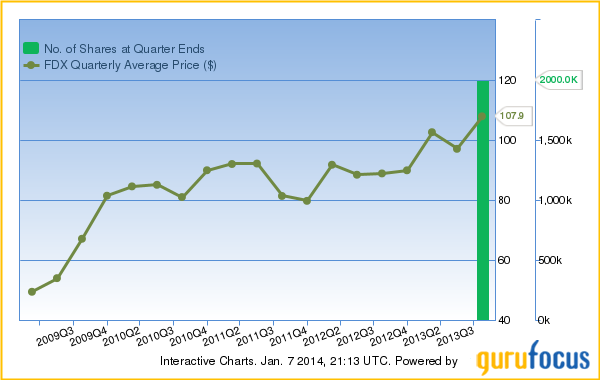

FedEx Corp. (FDX)

FedEx was Loeb's largest new position in the third quarter. He bought 2 million shares of the company, whose share price averaged $108, representing 5.7% of his portfolio.

In the past three months, FedEx shares gained 24%. For the year it gained 48%, and trades around $140.64 on Tuesday.

FedEx is a transportation, e-commerce and business service with a $43.9 billion market cap. In its second fiscal quarter, ended Nov. 30, the company reported a 3% year-over-year increase in revenue to $11.4 billion, and 14% increase in net income to $500 million. Its operating margin also improved to 7.3% from 6.5% the previous year. Much of the increase resulted from the previous year's quarterly results being negatively impacted by hurricane Sandy.

FedEx announced in October a new repurchase program of a maximum 32 million shares, and repurchased 7.2 million shares during the fiscal second quarter.

The company lifted its full-year earnings per share forecast to 8% to 14%, from the previously expected range of 7% to 13% growth, reflecting share repurchases it already made but not those it would make in the future. The growth outlook is also contingent on fuel prices and moderate economic growth continuing.

Mason Hawkins (Trades, Portfolio) commented on the company in his third quarter letter:

"FedEx (FDX) gained 25% over the last nine months after delivering 16% in the third quarter. The stock increase reflects some degree of confidence that management will execute planned cost cuts at the Express air delivery segment to adjust to the migration of more traffic onto ships and trucks due to high oil prices. While the stock has been volatile over the past year, our appraisal of the company has steadily grown, driven by the Ground segment. Subsequent to quarter-end, FedEx announced a share repurchase plan of 11% of the company."

George Soros (Trades, Portfolio) and John Paulson (Trades, Portfolio) also took stakes in the company in the third quarter.

FedEx long-term revenue and earnings history:

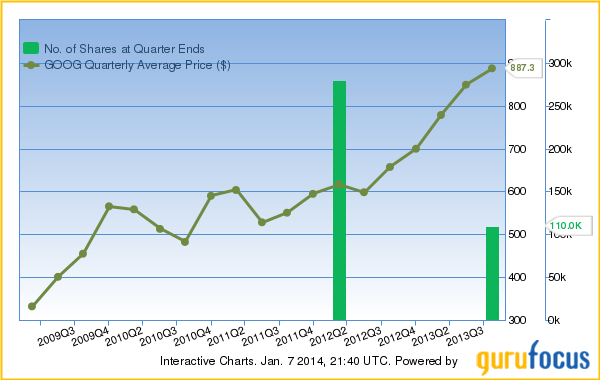

Google (GOOG)

For his second largest position Loeb bought 110,000 shares of Google, equating to 2.4% of his portfolio. The third quarter average share price was $887.

Since the end of the third quarter Google's share price has jumped almost 32%, to trade around $1,138.86 on Tuesday.

The company's share price jumped in October, when it reported third quarter financial results. Google had a 12% year-over-year revenue increase to $14.89 billion, and net income of $2.97 billion, compared to $2.18 billion the previous year. It also announced cash flow of $2.79 billion, and cash holdings totaling $56.52 billion.

The company's financial progress reflected a 26% increase in total paid clicks on its advertisements, compared to an 8% decline in cost-per-click.

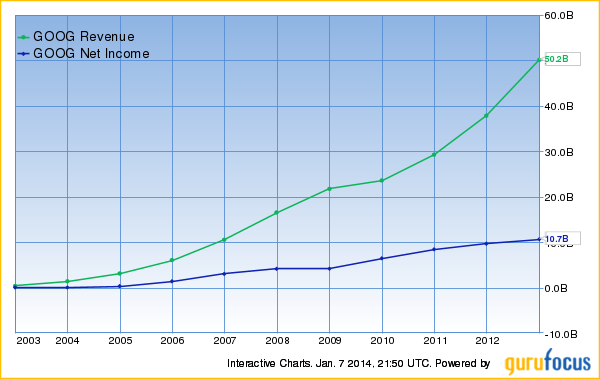

Google's revenue and earnings history:

The company trades with a P/E of 29.8, P/S of 6.38 and P/B of 4.5.

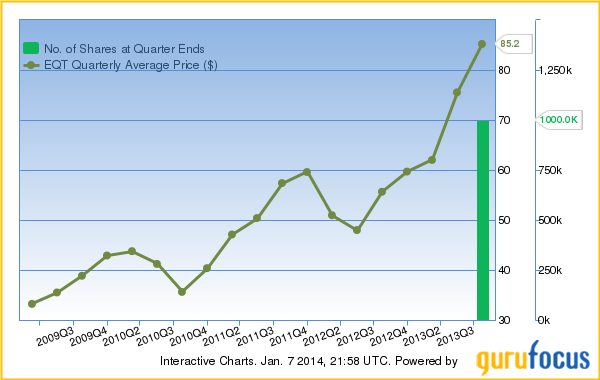

EQT Corp. (EQT)

Loeb bought 1 million shares of EQT Corp., whose price averaged $85 in the third quarter. The holding represents 2.2% of his portfolio.

In the last three months, EQT's price rise 2.14%, below the S&P 500's gain, to trade around $87.85 on Tuesday.

EQT is a natural gas company operating in the Appalachian Basin, with approximately 3.5 million gross acres, 14,000 gross productive wells and 6 trillion cubic feet of proved reserves.

The company's third quarter earnings increased 177% year over year to $88.3 million, and revenue increased to $507 million from $364 million. The results were primarily due to double-digit production growth in each of its segments, higher commodity prices, increased gathered volume and increased firm transmission capacity sales and throughput.

In 2014, EQT plans to increase capital expenditures to $2.4 billion to accelerate development of its Marcellus position and boost volume in 2015. It will also grow its midstream footprint, and re-start drilling in Kentucky.

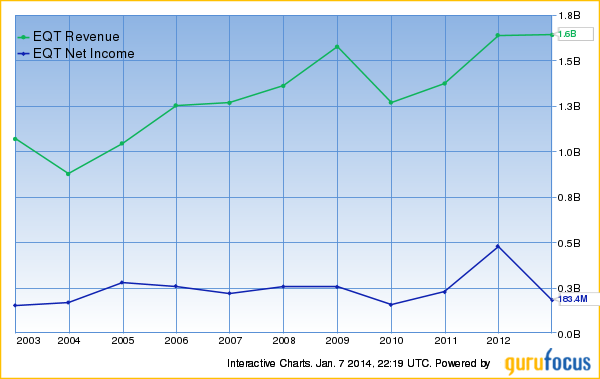

EQT revenue and earnings history:

EQT trades with a P/E of 41.2, P/S near a 10-year high at 5.4 and P/B at 3.4.

Intrexon Corp. (XON)

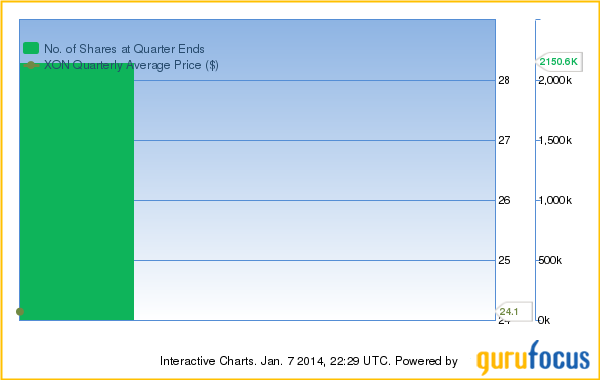

Loeb bought 2,150,592 shares of Intrexon in the third quarter when the price averaged $24, in a holding worth 1.2% of his portfolio space.

Its stock price also moved only slight in the third quarter, up 2.46% to $23.70 on Tuesday.

Intrexon is a synthetic biology company focused on gene program technologies, with a $2.3 billion market cap. The company engineers cells and genomes to produce a number of solutions, including medicines, stress tolerant crops, and improved energy production and industrial and agricultural products.

In the third quarter, the company reported net income of $15.4 million, down from $20.5 million in third quarter 2012. Revenues totaled $6.1 million, compared to $2.9 million for the same periods, largely due to payments from five collaborations over the previous year. The company has entered in 17 collaborative agreements since 2011, with 14 separate counterparties.

Intrexon just began trading on the NYSE after its initial public offering held on Aug. 13, which was priced at $16 per share and raised $168.3 million.

David Einhorn (Trades, Portfolio), T. Boone Pickens and RS Investment Management (Trades, Portfolio) also revealed holdings of the company or bought shares in the IPO in the third quarter.

Intrexon has a P/B of 5.85 and P/S of 80.

To see more Daniel Loeb (Trades, Portfolio) holdings, visit his portfolio here. Not a Premium Member of GuruFocus?Try it free for 7 days here!

This article first appeared on GuruFocus.

Related Articles